Region:Middle East

Author(s):Rebecca

Product Code:KRAE2922

Pages:96

Published On:February 2026

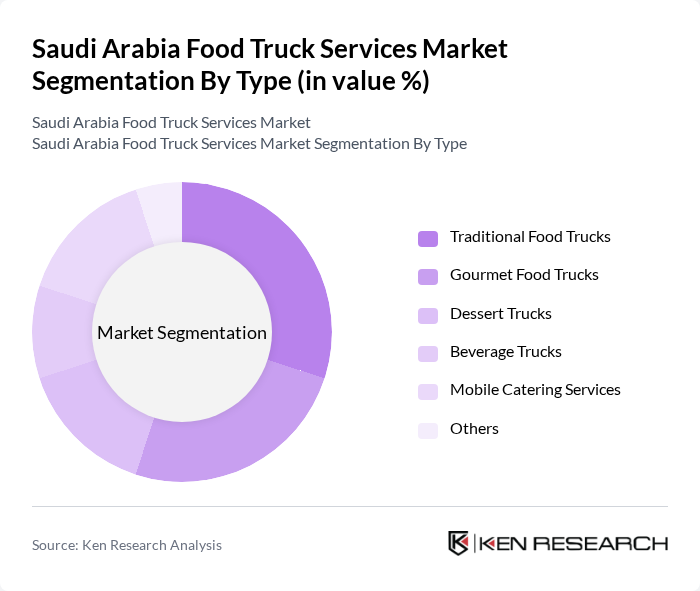

By Type:The food truck services market can be segmented into various types, including Traditional Food Trucks, Gourmet Food Trucks, Dessert Trucks, Beverage Trucks, Mobile Catering Services, and Others. Each type caters to different consumer preferences and occasions, contributing to the overall market dynamics.

The Traditional Food Trucks segment leads the market, driven by their affordability and familiarity among consumers. These trucks often serve classic street food items that resonate with local tastes, making them a popular choice for quick meals. Gourmet Food Trucks are also gaining traction, appealing to consumers seeking unique and high-quality dining experiences. The Dessert Trucks and Beverage Trucks segments cater to niche markets, providing specialized offerings that enhance the overall food truck experience.

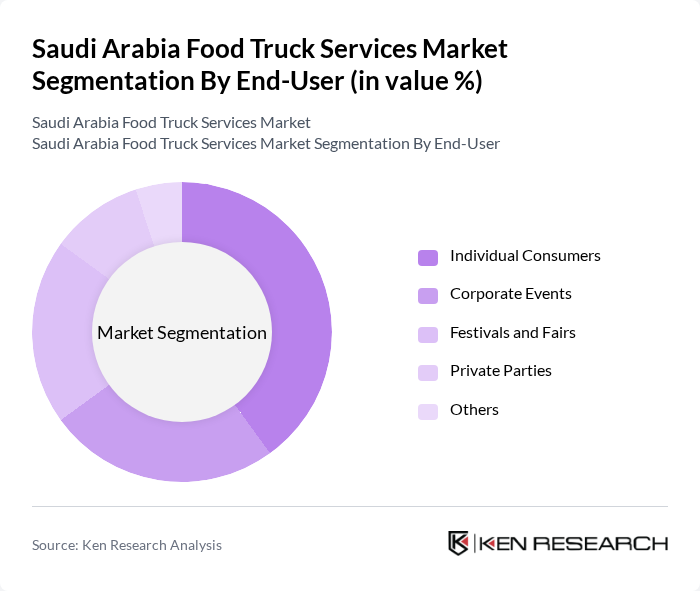

By End-User:The market can also be segmented based on end-users, including Individual Consumers, Corporate Events, Festivals and Fairs, Private Parties, and Others. Each segment reflects different consumer needs and preferences, influencing the overall market landscape.

The Individual Consumers segment dominates the market, driven by the growing trend of casual dining and the convenience offered by food trucks. Corporate Events and Festivals and Fairs also represent significant opportunities, as these venues often attract large crowds seeking diverse food options. The Private Parties segment is smaller but growing, as more people opt for food trucks to cater their events, providing a unique dining experience.

The Saudi Arabia Food Truck Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Food Truck Saudi, The Food Truck Company, Street Food Saudi, Gourmet Food Trucks KSA, Al-Masah Food Trucks, Foodie on Wheels, Taste of Arabia, The Rolling Kitchen, Saudi Street Eats, Urban Bites, Food Truck Revolution, The Snack Shack, Mobile Munchies, Arabian Delights on Wheels, The Food Cart contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food truck services market in Saudi Arabia appears promising, driven by evolving consumer preferences and supportive government policies. As urbanization continues, food trucks are likely to become integral to the culinary landscape, offering diverse and convenient dining options. Additionally, the integration of technology for ordering and payment solutions will enhance customer experiences. The market is expected to see innovative concepts, including health-focused menus and collaborations with local events, further solidifying the food truck's role in the food service industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Food Trucks Gourmet Food Trucks Dessert Trucks Beverage Trucks Mobile Catering Services Others |

| By End-User | Individual Consumers Corporate Events Festivals and Fairs Private Parties Others |

| By Location | Urban Areas Suburban Areas Tourist Attractions Event Venues Others |

| By Cuisine Type | Middle Eastern Cuisine Asian Cuisine Western Cuisine Fusion Cuisine Others |

| By Service Model | On-Site Service Pre-Order and Delivery Catering Services Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Others |

| By Marketing Channel | Social Media Marketing Event Sponsorships Influencer Collaborations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Truck Operators | 100 | Owners, Managers |

| Consumer Preferences | 150 | Food Enthusiasts, Regular Customers |

| Regulatory Insights | 30 | Local Government Officials, Licensing Authorities |

| Supply Chain Stakeholders | 50 | Food Suppliers, Distributors |

| Market Trends Analysts | 40 | Industry Experts, Market Researchers |

The Saudi Arabia Food Truck Services Market is valued at approximately USD 1.2 billion, reflecting a growing trend towards street food culture and convenient dining options, particularly in urban areas like Riyadh, Jeddah, and Dammam.