Region:Middle East

Author(s):Rebecca

Product Code:KRAD2749

Pages:98

Published On:November 2025

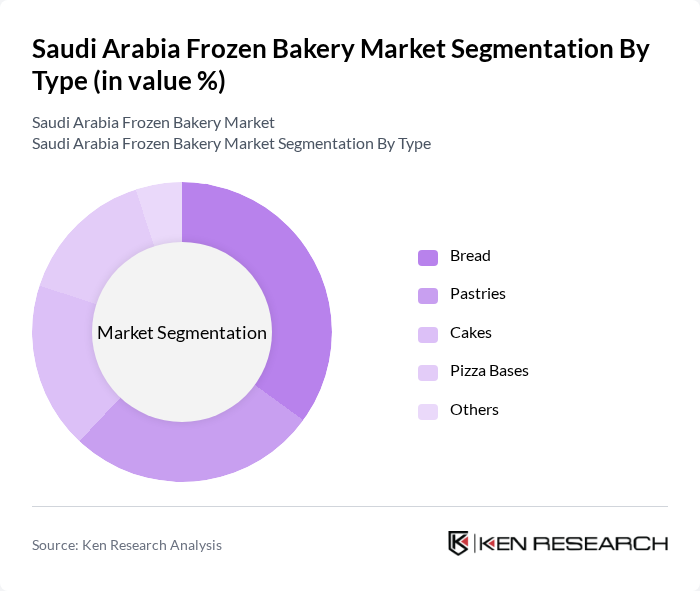

By Type:The market is segmented into various types, including Bread, Pastries, Cakes, Pizza Bases, and Others. Among these, Bread is the leading sub-segment due to its widespread consumption and versatility in various culinary applications. The increasing trend of health-conscious consumers has also led to a rise in demand for whole grain and specialty breads, further solidifying its dominance in the market.

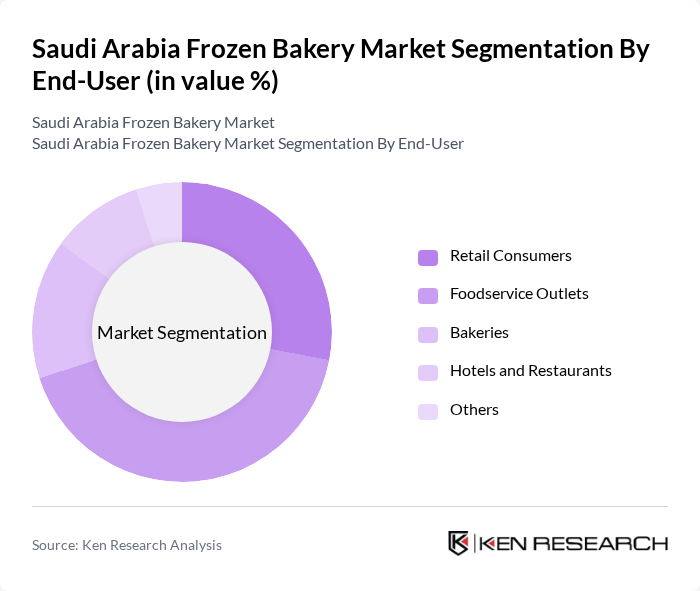

By End-User:The end-user segmentation includes Retail Consumers, Foodservice Outlets, Bakeries, Hotels and Restaurants, and Others. The Foodservice Outlets segment is currently leading the market, driven by the growing trend of dining out and the increasing number of cafes and restaurants. This segment benefits from the convenience and efficiency that frozen bakery products offer, allowing foodservice providers to serve high-quality items quickly.

The Saudi Arabia Frozen Bakery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al-Faisal Bakery, Al-Othaim Foods, Saudi Frozen Foods, Al-Muhaidib Group, Al-Jazira Foods, Al-Baik, Al-Masah Bakery, Al-Safi Danone, Al-Hokair Group, Al-Mansour Group, Al-Salam Bakery, Al-Watania Poultry, Americana Group, Tanmiah Food Group, The Savola Group, Sunbulah Group, Halwani Bros, McCain Foods Limited, The Unilever Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia frozen bakery market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness rises, manufacturers are likely to innovate with healthier options, including gluten-free and organic products. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to frozen bakery items, allowing consumers to purchase products conveniently. This shift towards online sales is expected to reshape the market landscape, providing new avenues for growth and customer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Pizza Bases Others |

| By End-User | Retail Consumers Foodservice Outlets Bakeries Hotels and Restaurants Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Direct Sales Others |

| By Packaging Type | Plastic Packaging Paper Packaging Glass Packaging Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Frozen Dough Fully Baked Partially Baked Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Bakery Sales | 120 | Store Managers, Category Buyers |

| Food Service Sector Insights | 85 | Restaurant Owners, Catering Managers |

| Consumer Preferences Survey | 150 | Household Consumers, Food Enthusiasts |

| Distribution Channel Analysis | 65 | Logistics Managers, Supply Chain Coordinators |

| Market Trend Evaluation | 95 | Industry Analysts, Market Researchers |

The Saudi Arabia Frozen Bakery Market is valued at approximately USD 405 million, reflecting a significant growth trend driven by increasing demand for convenient ready-to-eat products and the expansion of the foodservice sector.