Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7708

Pages:81

Published On:October 2025

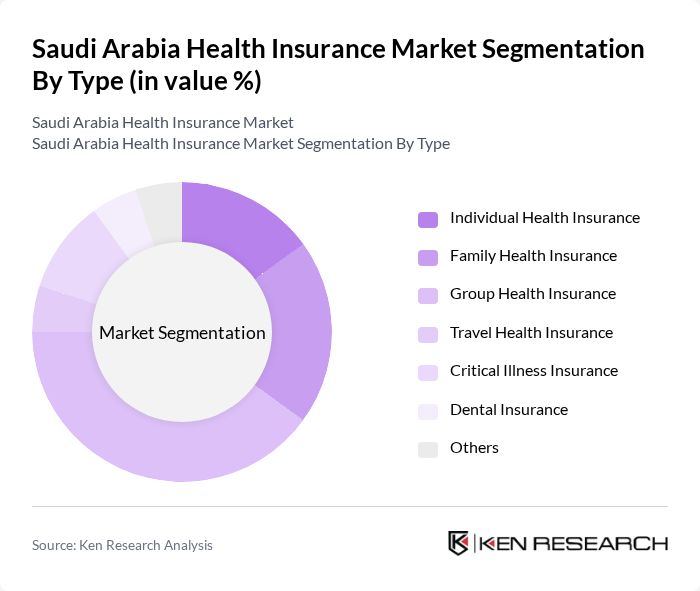

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Among these, Group Health Insurance is currently the leading sub-segment due to its popularity among employers who provide coverage for their employees as part of benefits packages. This trend is driven by the increasing focus on employee welfare and retention strategies.

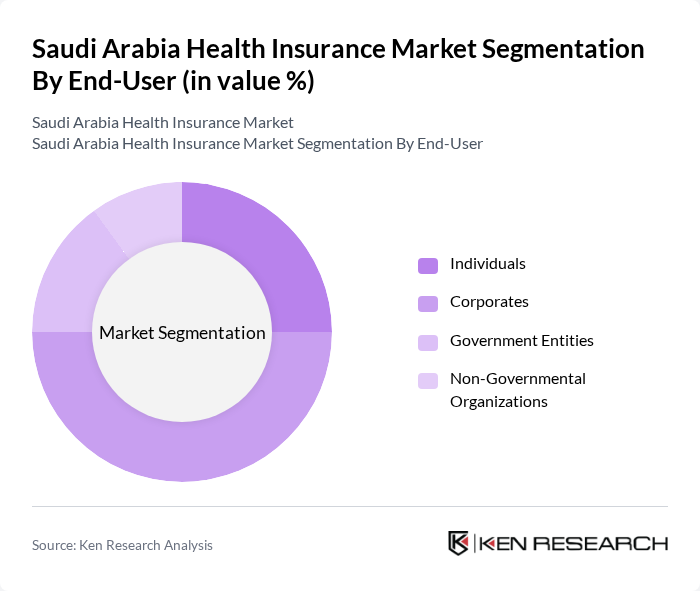

By End-User:The end-user segmentation includes Individuals, Corporates, Government Entities, and Non-Governmental Organizations. Corporates are the dominant end-user segment, as many companies offer health insurance as part of their employee benefits. This trend is fueled by the competitive job market and the need for businesses to attract and retain talent through comprehensive health coverage.

The Saudi Arabia Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Medgulf, Al Rajhi Takaful, Gulf Insurance Group, Allianz Saudi Fransi, United Cooperative Assurance, Alinma Tokio Marine, Al-Ahlia Insurance Company, Al-Etihad Cooperative Insurance, Al-Jazira Company for Insurance, Al-Sagr Cooperative Insurance, Al-Bilad Insurance, Al-Mawared Insurance, Al-Faisal Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi health insurance market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As digital health solutions gain traction, insurers are likely to adopt innovative platforms for policy management and claims processing. Additionally, the increasing focus on personalized health plans will cater to diverse consumer needs, enhancing customer satisfaction. These trends, coupled with government support for health coverage, will create a dynamic environment for growth and innovation in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Maternity Coverage Emergency Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 150 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Buyers | 100 | HR Managers, Benefits Coordinators from SMEs and large corporations |

| Healthcare Providers | 80 | Hospital Administrators, Clinic Managers |

| Insurance Brokers | 70 | Insurance Agents, Brokers specializing in health insurance |

| Regulatory Bodies | 50 | Officials from the Ministry of Health and SAMA |

The Saudi Arabia Health Insurance Market is valued at approximately USD 10 billion, reflecting significant growth driven by increased healthcare demand, government initiatives, and rising awareness of health insurance benefits among the population.