Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7318

Pages:91

Published On:October 2025

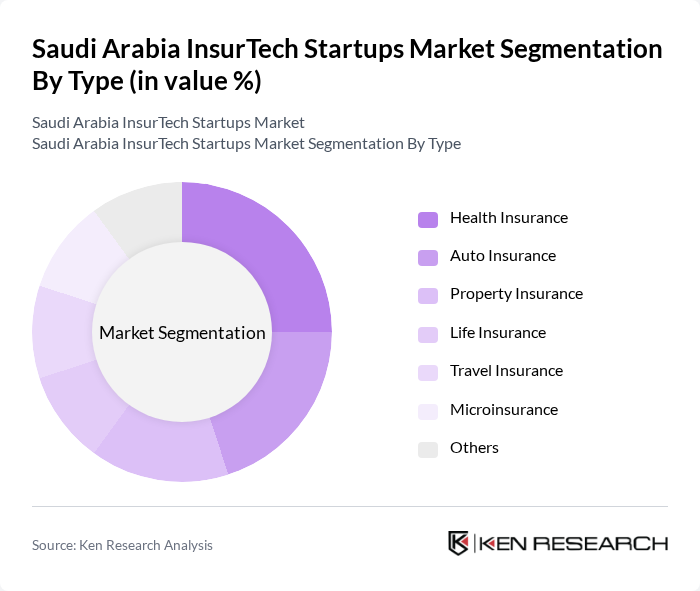

By Type:The InsurTech market can be segmented into various types, including Health Insurance, Auto Insurance, Property Insurance, Life Insurance, Travel Insurance, Microinsurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of insurance products available in the market.

The Health Insurance segment is currently dominating the market, driven by an increasing focus on health and wellness among consumers, coupled with the rising costs of healthcare. The demand for comprehensive health coverage has surged, particularly in the wake of the COVID-19 pandemic, leading to a greater emphasis on preventive care and personalized health solutions. This trend is further supported by technological advancements that enable insurers to offer tailored health plans and improve customer engagement.

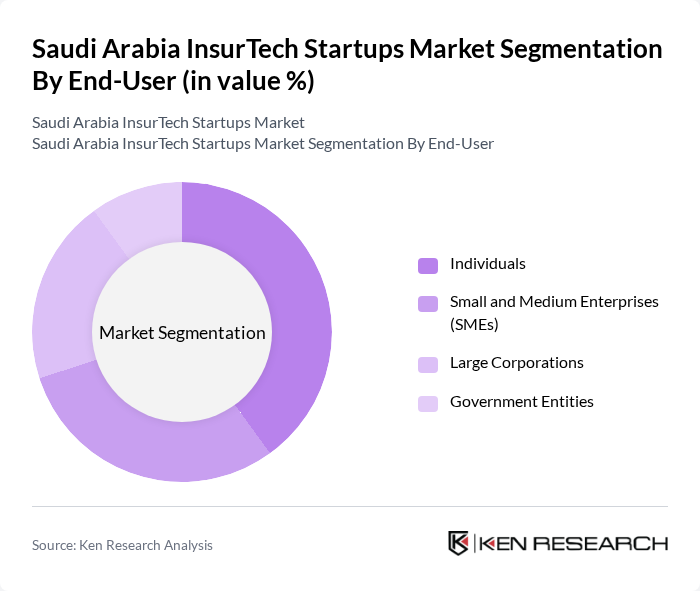

By End-User:The market can be segmented based on end-users, including Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has unique insurance needs and purchasing behaviors, influencing the types of products offered by InsurTech startups.

The Individuals segment is the largest in the market, driven by a growing awareness of the importance of personal insurance coverage. As more consumers seek protection against unforeseen events, the demand for tailored insurance products has increased. This trend is further supported by the rise of digital platforms that facilitate easy access to insurance services, making it more convenient for individuals to purchase and manage their policies.

The Saudi Arabia InsurTech Startups Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group, AXA Cooperative Insurance, MetLife Alico, Alinma Tokio Marine, Al Ahli Takaful, Walaa Cooperative Insurance, Aljazira Takaful, United Cooperative Assurance, SABB Takaful, Al Sagr Cooperative Insurance, Al-Etihad Cooperative Insurance, Al-Masane Al-Khobari Holding Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the InsurTech market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, startups are likely to innovate further, focusing on user-friendly platforms and personalized services. Additionally, the integration of AI and blockchain technologies is expected to enhance operational efficiency and customer trust. With ongoing regulatory support, the market is poised for significant growth, attracting both local and international investments, thereby solidifying its position in the regional landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Auto Insurance Property Insurance Life Insurance Travel Insurance Microinsurance Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Brokers and Agents Partnerships with Financial Institutions |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Insurance Packages |

| By Technology Utilization | AI and Machine Learning Blockchain Technology Big Data Analytics |

| By Policy Duration | Short-Term Policies Long-Term Policies Pay-As-You-Go Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance InsurTech Solutions | 100 | Health Insurance Executives, Product Managers |

| Property and Casualty Insurance Startups | 80 | Founders, Business Development Managers |

| Life Insurance Digital Platforms | 70 | Marketing Directors, Customer Experience Managers |

| Regulatory Compliance in InsurTech | 60 | Compliance Officers, Legal Advisors |

| Consumer Adoption of InsurTech Services | 90 | End-users, Insurance Policyholders |

The Saudi Arabia InsurTech Startups Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digital technology adoption, personalized insurance demand, and increased consumer awareness regarding insurance products.