Region:Middle East

Author(s):Dev

Product Code:KRAD7725

Pages:84

Published On:December 2025

By Route of Administration:The market is segmented into various routes of administration, including Oral Medical Foods, Enteral (Tube-Feeding) Medical Foods, Parenteral-Adjunct Medical Nutrition for Orphan Diseases, and Others. Among these, Oral Medical Foods are the most widely used due to their ease of administration and patient preference. Enteral medical foods are also gaining traction, particularly for patients with severe malabsorption issues. The growing trend towards home healthcare is further driving the demand for these products.

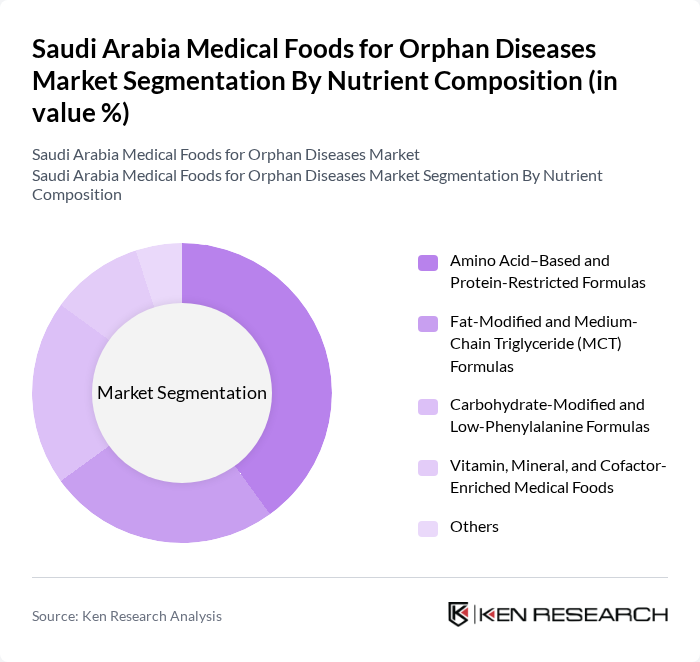

By Nutrient Composition:The market is also segmented based on nutrient composition, including Amino Acid–Based and Protein-Restricted Formulas, Fat-Modified and Medium-Chain Triglyceride (MCT) Formulas, Carbohydrate-Modified and Low-Phenylalanine Formulas, Vitamin, Mineral, and Cofactor-Enriched Medical Foods, and Others. Amino Acid–Based and Protein-Restricted Formulas dominate the market due to their critical role in managing metabolic disorders. The increasing prevalence of conditions requiring specialized dietary management is driving the demand for these formulations.

The Saudi Arabia Medical Foods for Orphan Diseases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories (Abbott Nutrition), Nestlé Health Science (including Vitaflo International Ltd.), Danone Nutricia (Nutricia Advanced Medical Nutrition), Mead Johnson Nutrition (Reckitt Benckiser Group plc), Fresenius Kabi, Baxter International Inc., B. Braun Melsungen AG, Solace Nutrition, Alcresta Therapeutics Inc., Medtrition Inc., Hero Group (Hero Baby & Medical Nutrition), Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, Tamer Group (Healthcare & Nutrition Division) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia medical foods for orphan diseases market appears promising, driven by increasing government support and rising healthcare investments. As awareness of orphan diseases grows, healthcare providers are likely to prioritize specialized nutrition, leading to enhanced product development. Additionally, advancements in technology and personalized nutrition are expected to play a crucial role in shaping the market landscape, fostering innovation and improving patient outcomes in the future.

| Segment | Sub-Segments |

|---|---|

| By Route of Administration | Oral Medical Foods Enteral (Tube-Feeding) Medical Foods Parenteral-Adjunct Medical Nutrition for Orphan Diseases Others |

| By Nutrient Composition | Amino Acid–Based and Protein-Restricted Formulas Fat-Modified and Medium-Chain Triglyceride (MCT) Formulas Carbohydrate-Modified and Low-Phenylalanine Formulas Vitamin, Mineral, and Cofactor-Enriched Medical Foods Others |

| By Orphan Disease Category | Inborn Errors of Metabolism (e.g., PKU, MSUD, Urea Cycle Disorders) Rare Gastrointestinal and Malabsorption Disorders Rare Neurological and Neurodegenerative Disorders Rare Oncology and Cachexia-Related Conditions Others |

| By End-User | Tertiary Hospitals and Specialized Centers Specialty Clinics and Rare Disease Centers Homecare and Patient Support Programs Retail and Hospital Pharmacies Others |

| By Distribution Channel | Hospital and Clinic-Based Distribution Specialty and Retail Pharmacies E-Pharmacy and Online Rare-Disease Platforms Direct-to-Patient and Managed Access Programs Others |

| By Age Group | Neonatal and Infant Pediatric Adult Geriatric Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Doctors, Specialists in Orphan Diseases |

| Patients and Caregivers | 100 | Patients with Orphan Diseases, Family Members |

| Dietitians and Nutritionists | 80 | Clinical Dietitians, Nutrition Consultants |

| Pharmaceutical Representatives | 70 | Sales Representatives, Product Managers |

| Regulatory Experts | 50 | Health Policy Analysts, Regulatory Affairs Managers |

The Saudi Arabia Medical Foods for Orphan Diseases Market is valued at approximately USD 4 million, driven by the increasing prevalence of orphan diseases and advancements in medical nutrition and diagnostic tools.