Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9007

Pages:99

Published On:November 2025

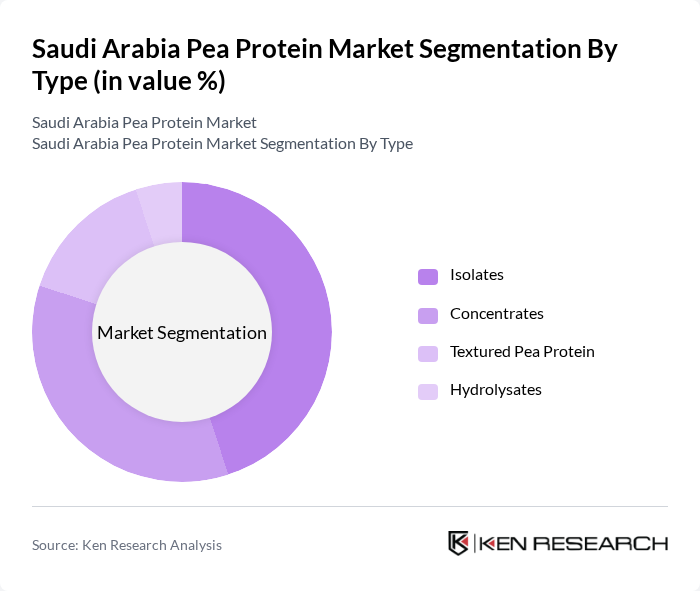

By Type:The pea protein market can be segmented into four main types: Isolates, Concentrates, Textured Pea Protein, and Hydrolysates. Among these, pea protein isolates are gaining significant traction due to their high protein content, clean-label appeal, and versatility in applications such as meat analogues, dairy alternatives, and nutritional supplements. Concentrates are also popular, especially in the food and beverage sector for bakery and snack products, while textured pea protein is increasingly used in meat alternatives and ready meals. Hydrolysates, although less common, are utilized in specialized nutritional and clinical nutrition products for their enhanced digestibility.

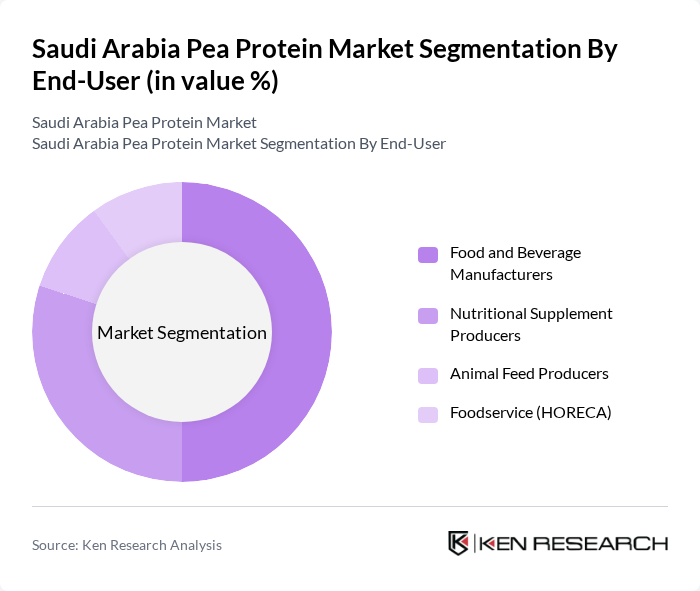

By End-User:The end-user segmentation includes Food and Beverage Manufacturers, Nutritional Supplement Producers, Animal Feed Producers, and Foodservice (HORECA). Food and Beverage Manufacturers dominate the market as they increasingly incorporate pea protein into a wide range of products, driven by consumer demand for healthier, allergen-free, and sustainable options. Nutritional supplement producers are significant users, particularly in the sports nutrition and wellness segments, while the foodservice sector is gradually adopting pea protein in menu offerings to cater to vegan and flexitarian consumers. Animal feed producers utilize pea protein for its nutritional value in specialty feed formulations.

The Saudi Arabia Pea Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Frères, Cargill, Incorporated, Ingredion Incorporated, AGT Food and Ingredients Inc., DuPont Nutrition & Health (now part of IFF), Axiom Foods, Inc., The Green Labs LLC, Nutra Food Ingredients, Emsland Group, Shandong Jianyuan Group, Burcon NutraScience Corporation, Vestkorn Milling AS, Puris Foods, Beyond Meat, Inc., Sunwarrior contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pea protein market in Saudi Arabia appears promising, driven by increasing health consciousness and government support for sustainable food sources. As consumer preferences shift towards plant-based diets, the market is expected to see innovations in product formulations, enhancing the appeal of pea protein. Additionally, the rise of e-commerce platforms is likely to facilitate greater accessibility, allowing consumers to explore and purchase pea protein products more conveniently, thus expanding market reach and growth potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Isolates Concentrates Textured Pea Protein Hydrolysates |

| By End-User | Food and Beverage Manufacturers Nutritional Supplement Producers Animal Feed Producers Foodservice (HORECA) |

| By Application | Meat Alternatives Dairy Alternatives Bakery and Confectionery Sports and Performance Nutrition Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Direct-to-Business (B2B) |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Powder Liquid Granules Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Dietary Preferences (e.g., Vegan, Vegetarian, Flexitarian) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Health and Wellness Retailers | 60 | Store Managers, Nutrition Consultants |

| Dietary Supplement Producers | 50 | R&D Managers, Marketing Directors |

| Consumer Focus Groups | 40 | Health-Conscious Consumers, Fitness Enthusiasts |

| Food Service Industry Stakeholders | 70 | Chefs, Menu Planners, Restaurant Owners |

The Saudi Arabia Pea Protein Market is valued at approximately USD 186 million, reflecting a significant growth trend driven by increasing demand for plant-based protein sources and rising health consciousness among consumers.