Region:Middle East

Author(s):Shubham

Product Code:KRAA8471

Pages:84

Published On:November 2025

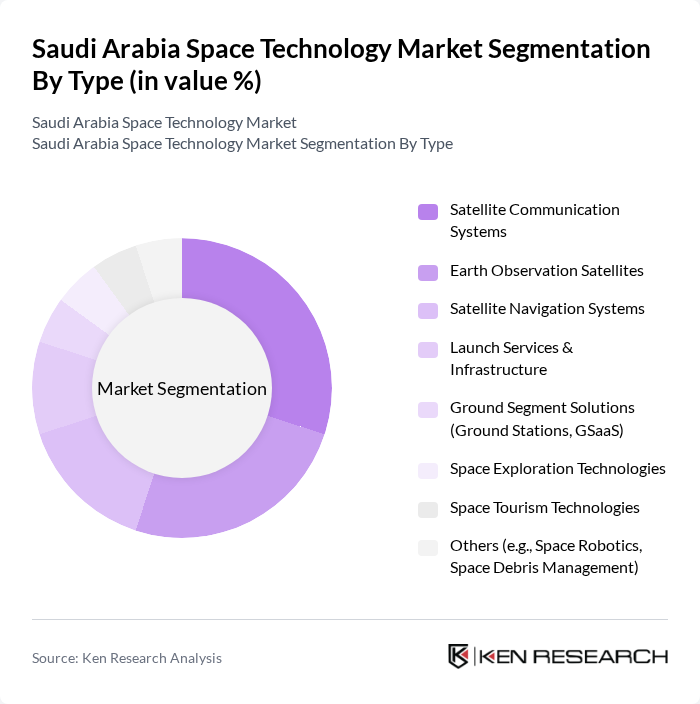

By Type:The segmentation of the market by type includes various subsegments such as Satellite Communication Systems, Earth Observation Satellites, Satellite Navigation Systems, Launch Services & Infrastructure, Ground Segment Solutions, Space Exploration Technologies, Space Tourism Technologies, and Others. Each of these subsegments plays a crucial role in the overall market dynamics, with specific applications and technological advancements driving their growth. Satellite Communication Systems lead the market, driven by demand for broadband connectivity and enterprise data services. Earth Observation Satellites are increasingly used for urban planning, environmental monitoring, and disaster response. Satellite Navigation Systems support logistics and autonomous mobility, while Launch Services & Infrastructure are expanding through international partnerships and local investments in ground stations and GSaaS platforms .

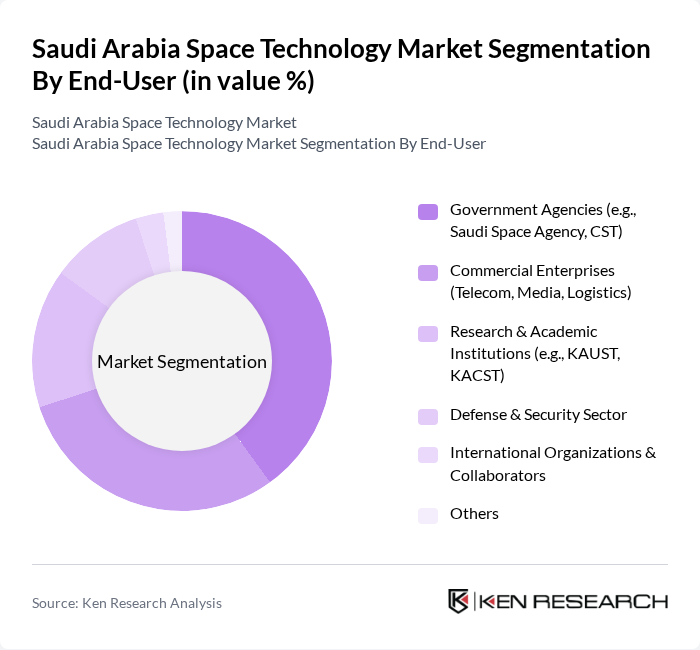

By End-User:The market is segmented by end-user into Government Agencies, Commercial Enterprises, Research & Academic Institutions, Defense & Security Sector, International Organizations, and Others. Each end-user category has distinct requirements and applications for space technology, influencing the overall market landscape. Government Agencies drive the majority of demand through national programs and regulatory oversight. Commercial Enterprises leverage satellite services for telecom, media, and logistics, while Research & Academic Institutions focus on innovation and talent development. The Defense & Security Sector utilizes satellite and Earth observation for surveillance and operational planning. International Organizations and Collaborators contribute through joint missions and technology transfer .

The Saudi Arabia Space Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Space Agency (SSA), Communications, Space & Technology Commission (CST), King Abdulaziz City for Science and Technology (KACST), Saudi Arabian Oil Company (Aramco) – Space & Geospatial Division, NEOM Tech & Digital Company, National Satellite Company (NASCOM), SARsat Arabia, Taqnia Space, Axiom Space, OneWeb (Eutelsat OneWeb), Airbus Defence and Space, Thales Alenia Space, Lockheed Martin, Boeing, Northrop Grumman, SpaceX, Inmarsat, SES S.A., Iridium Communications Inc., Planet Labs, Maxar Technologies, Rocket Lab contribute to innovation, geographic expansion, and service delivery in this space. These organizations are driving advancements in satellite manufacturing, Earth observation, launch services, and ground infrastructure, supported by significant public and private investment and a robust regulatory environment .

The Saudi Arabia space technology market is poised for transformative growth, driven by increased government investment and strategic international partnerships. As the nation enhances its capabilities in satellite communication and space exploration, the focus on developing a skilled workforce and fostering innovation will be paramount. The integration of private sector collaboration and advancements in satellite technology will further propel the market, positioning Saudi Arabia as a key player in the global space landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Satellite Communication Systems Earth Observation Satellites Satellite Navigation Systems Launch Services & Infrastructure Ground Segment Solutions (Ground Stations, GSaaS) Space Exploration Technologies Space Tourism Technologies Others (e.g., Space Robotics, Space Debris Management) |

| By End-User | Government Agencies (e.g., Saudi Space Agency, CST) Commercial Enterprises (Telecom, Media, Logistics) Research & Academic Institutions (e.g., KAUST, KACST) Defense & Security Sector International Organizations & Collaborators Others |

| By Application | Satellite Communication (Broadband, IoT, NTN) Earth Observation & Remote Sensing (Agriculture, Urban Planning, Disaster Response) Navigation & Positioning (GNSS, SatNav) Scientific Research & Space Exploration Space Tourism Others |

| By Technology | Satellite Manufacturing (LEO, GEO, MEO) Launch Vehicle Technology Ground Control & Operations Systems Space Robotics & Automation Advanced Sensing & Imaging Systems Others |

| By Investment Source | Government Funding (e.g., National Programs, CST, SSA) Private Investments (Venture Capital, Corporate) International Collaborations & Joint Ventures Public-Private Partnerships Academic & Research Grants Others |

| By Policy Support | Subsidies for Space Startups & SMEs Tax Incentives for R&D and Investment Grants for Space Exploration & Innovation Regulatory Support for Launch & Satellite Services Special Economic Zone Incentives Others |

| By Market Segment | Downstream (Satcom, EO, Navigation, Data Services) Upstream (Satellite Manufacturing, Launch, Infrastructure) Commercial Space Activities Government Space Programs International Collaborations Educational and Research Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Space Initiatives | 50 | Policy Makers, Program Directors |

| Commercial Satellite Operations | 40 | Business Development Managers, Operations Directors |

| Aerospace Research Institutions | 40 | Research Scientists, Academic Professors |

| Space Technology Startups | 40 | Founders, Chief Technology Officers |

| International Space Collaborations | 40 | Project Managers, Partnership Coordinators |

The Saudi Arabia Space Technology Market is valued at approximately USD 1.9 billion, driven by government investments, advancements in satellite technology, and increasing demand for satellite-based services across various sectors, including telecommunications and defense.