Region:Middle East

Author(s):Dev

Product Code:KRAD6321

Pages:93

Published On:December 2025

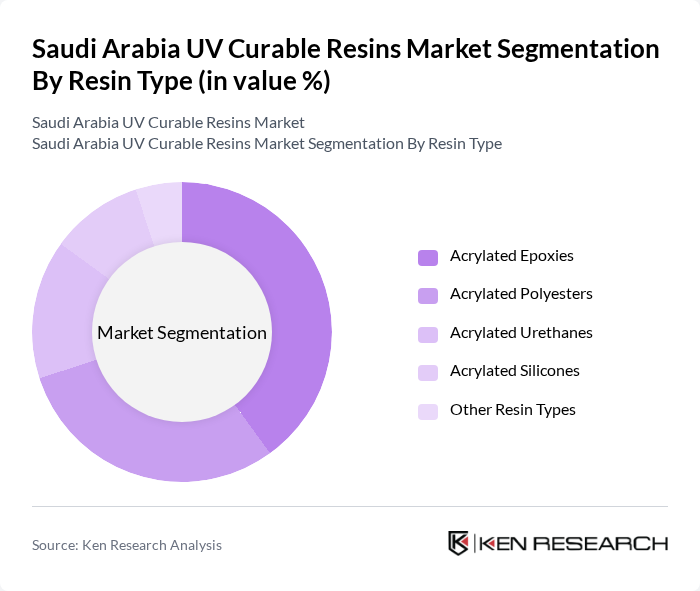

By Resin Type:The market is segmented into various resin types, including Acrylated Epoxies, Acrylated Polyesters, Acrylated Urethanes, Acrylated Silicones, and Other Resin Types, consistent with global UV-curable resin classifications covering oligomer backbones and specialty systems. Among these, Acrylated Epoxies are leading due to their excellent adhesion properties, chemical resistance, and versatility in applications such as printing inks, wood coatings, and protective industrial finishes. The demand for Acrylated Polyesters is also significant, driven by their use in flexible and rigid packaging inks, metal and plastic coatings, and overprint varnishes, while Acrylated Urethanes are gaining traction in the automotive, electronics, and high-performance industrial sectors for their durability, abrasion resistance, and flexibility.

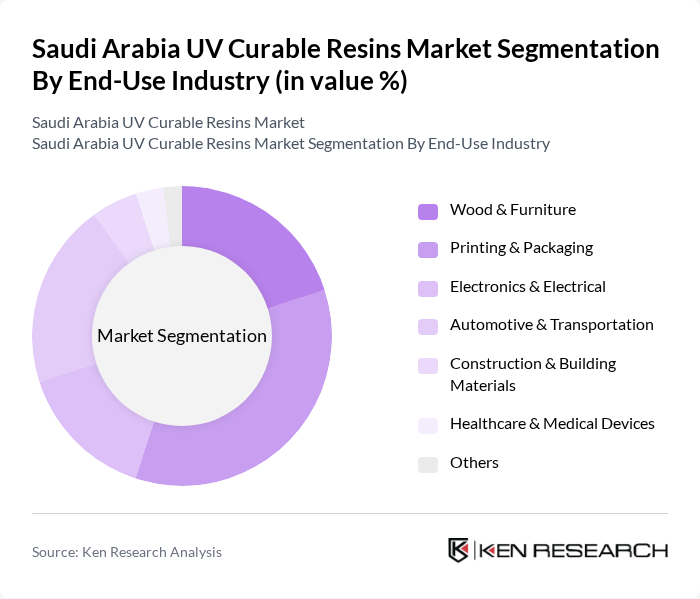

By End-Use Industry:The end-use industries for UV curable resins include Wood & Furniture, Printing & Packaging, Electronics & Electrical, Automotive & Transportation, Construction & Building Materials, Healthcare & Medical Devices, and Others, aligning with the major global UV-curable application clusters of wood and paper coatings, graphic arts, industrial, automotive, and electronics. The Printing & Packaging sector is the largest consumer, driven by the need for high-quality, high?speed UV printing, low?migration inks, and overprint varnishes for labels, flexible packaging, folding cartons, and commercial print. The Automotive & Transportation industry is also a significant contributor, utilizing UV curable resins for coatings, clearcoats, plastic component finishing, and adhesives and sealants due to their durability, chemical resistance, and quick curing times, while electronics and wood & furniture segments increasingly adopt UV-curable systems for PCB coatings, conformal coatings, flooring, and furniture finishes.

The Saudi Arabia UV Curable Resins Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Allnex Netherlands B.V., Arkema Group (Sartomer), Covestro AG, DSM Coating Resins (part of Covestro), IGM Resins B.V., Nippon Gohsei (Japan Polychem Corporation), Miwon Commercial Co., Ltd., Eternal Materials Co., Ltd., Toagosei Co., Ltd., DIC Corporation, Saudi Basic Industries Corporation (SABIC), Jotun Saudi Arabia Co. Ltd. (UV-curable coatings user/formulator), National Paints Factories Co. Ltd. (Saudi Operations), Asian Paints Berger – Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UV curable resins market in Saudi Arabia appears promising, driven by increasing environmental regulations and a shift towards sustainable manufacturing practices. As industries adapt to these changes, the demand for innovative, eco-friendly resin solutions is expected to rise. Furthermore, the integration of smart technologies in UV curing processes will enhance efficiency and product quality, positioning the market for substantial growth. Companies that invest in research and development will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Acrylated Epoxies Acrylated Polyesters Acrylated Urethanes Acrylated Silicones Other Resin Types |

| By End-Use Industry | Wood & Furniture Printing & Packaging Electronics & Electrical Automotive & Transportation Construction & Building Materials Healthcare & Medical Devices Others |

| By Application | Coatings Inks Adhesives & Sealants D Printing & Additive Manufacturing Others |

| By Curing Technology | UV LED Curing Conventional UV (Mercury Lamp) Curing Electron Beam (EB) Curing Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail) Western Region (including Jeddah, Makkah, Madinah) Southern Region Northern Region |

| By Product Formulation | Oligomers Monomers/Reactive Diluents Photoinitiators Additives & Others |

| By Sales Channel | Direct Sales to End Users Local Distributors/Traders International Distributors Online / E-commerce Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 100 | Production Managers, Quality Control Supervisors |

| Electronics Encapsulation | 80 | R&D Engineers, Product Managers |

| Packaging Adhesives | 90 | Procurement Managers, Operations Directors |

| Industrial Inks | 70 | Marketing Managers, Technical Sales Representatives |

| Construction Sealants | 60 | Project Managers, Product Development Specialists |

The Saudi Arabia UV Curable Resins Market is valued at approximately USD 230 million, reflecting a significant growth trajectory influenced by increasing demand for eco-friendly and efficient coating solutions across various industries.