Region:Africa

Author(s):Geetanshi

Product Code:KRAA0284

Pages:81

Published On:August 2025

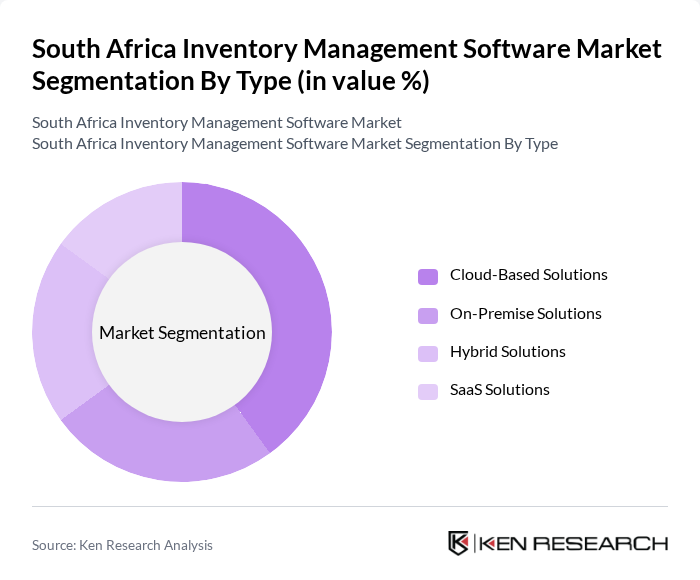

By Type:The market is segmented into Cloud-Based Solutions, On-Premise Solutions, Hybrid Solutions, and SaaS Solutions. Cloud-based solutions are gaining significant traction due to their flexibility, lower upfront costs, and ease of integration with other business systems. On-premise solutions remain relevant for organizations with strict data control requirements, while hybrid and SaaS models are increasingly adopted by businesses seeking a balance between control and scalability .

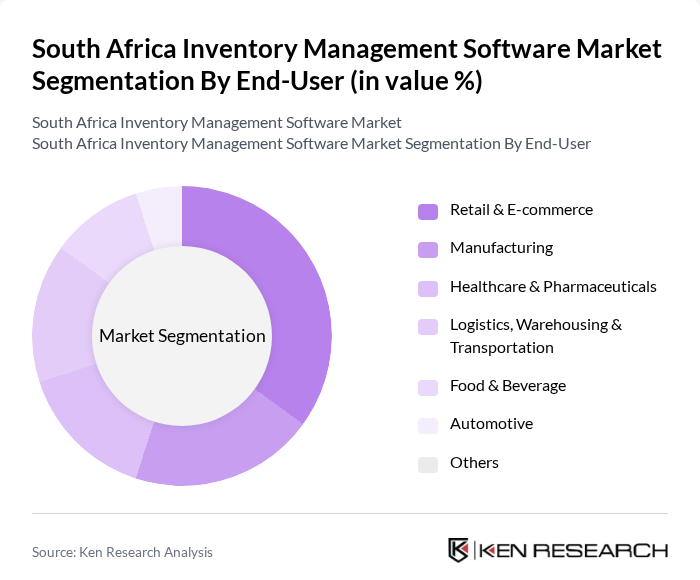

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics, Warehousing & Transportation, Food & Beverage, Automotive, and Others. Retail & E-commerce is the leading segment, driven by the rapid growth of online shopping and the need for efficient inventory management to meet consumer demands. Manufacturing and logistics are also significant users, leveraging inventory software to optimize production and distribution processes .

The South Africa Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP South Africa, Oracle South Africa, Syspro, Sage South Africa, IQ Retail, Pilot Software, NetSuite South Africa, Kerridge Commercial Systems (KCS) South Africa, Acumatica, QuickBooks South Africa, Zoho Inventory, Unleashed Software, Vend (Lightspeed), Odoo, and Cin7 contribute to innovation, geographic expansion, and service delivery in this space.

The South African inventory management software market is poised for significant transformation as businesses increasingly recognize the importance of digital solutions. With the anticipated growth of e-commerce and the push for operational efficiency, companies are likely to invest more in advanced inventory systems. Additionally, the integration of artificial intelligence and machine learning will enhance predictive analytics, enabling businesses to optimize stock levels and reduce waste. This evolution will create a more agile and responsive supply chain landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions SaaS Solutions |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics, Warehousing & Transportation Food & Beverage Automotive Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premise |

| By Industry Vertical | Retail Manufacturing Healthcare Logistics Food and Beverage Automotive Others |

| By Functionality | Inventory Tracking & Visibility Order & Fulfillment Management Demand Forecasting & Analytics Integration with ERP/POS Reporting and Analytics Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Geographic Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 120 | Inventory Managers, IT Directors |

| Manufacturing Supply Chain Solutions | 90 | Operations Managers, Supply Chain Analysts |

| Logistics and Distribution Software | 60 | Logistics Coordinators, Warehouse Supervisors |

| Food and Beverage Inventory Control | 50 | Quality Assurance Managers, Procurement Officers |

| Pharmaceutical Inventory Systems | 40 | Regulatory Affairs Managers, Supply Chain Managers |

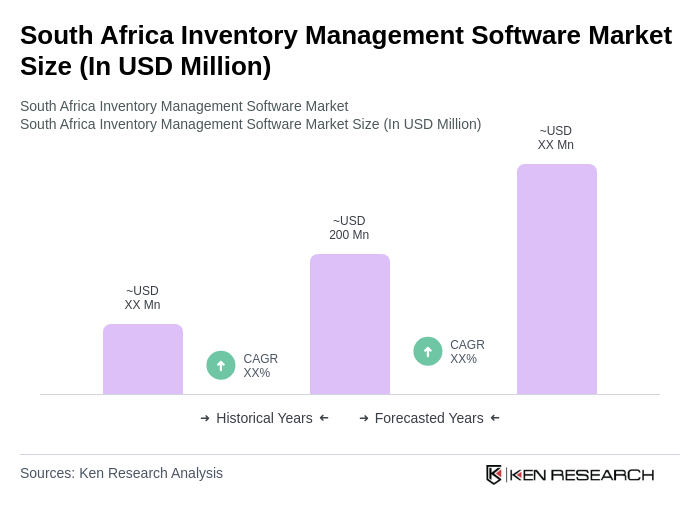

The South Africa Inventory Management Software Market is valued at approximately USD 200 million, driven by the increasing demand for efficient supply chain management and the rapid growth of e-commerce in the region.