Region:Africa

Author(s):Shubham

Product Code:KRAA1721

Pages:98

Published On:August 2025

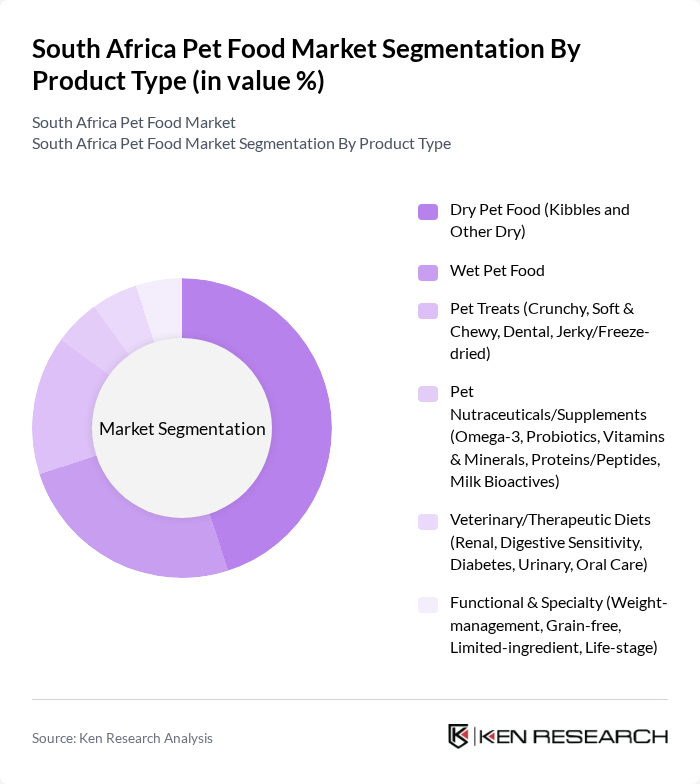

By Product Type:The product type segmentation includes various categories such as Dry Pet Food, Wet Pet Food, Pet Treats, Pet Nutraceuticals/Supplements, Veterinary/Therapeutic Diets, and Functional & Specialty products. Among these, Dry Pet Food is the most dominant segment due to its convenience, longer shelf life, and cost-effectiveness, appealing to a wide range of pet owners. Wet Pet Food is also gaining traction as consumers seek more palatable options for their pets. The increasing trend towards health-conscious pet ownership is driving the demand for Pet Nutraceuticals and Veterinary Diets, reflecting a shift in consumer preferences towards specialized nutrition.

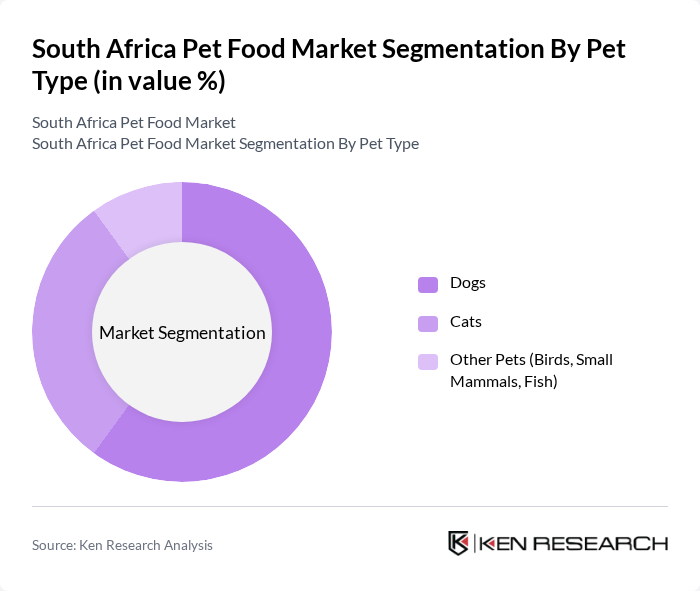

By Pet Type:The pet type segmentation includes Dogs, Cats, and Other Pets (Birds, Small Mammals, Fish). Dogs represent the largest segment due to their popularity as pets and the increasing trend of pet humanization, where owners are willing to spend more on high-quality food for their canine companions. Cats are also a significant segment, with a growing number of households adopting cats as pets. The Other Pets category, while smaller, is gaining attention as more consumers explore diverse pet ownership.

The South Africa Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare South Africa, Mars Petcare South Africa (including Royal Canin South Africa), Hill’s Pet Nutrition South Africa, Montego Pet Nutrition (South Africa), RCL Foods Pet Food (Malcolm, Bobtail, Catmor), AVI Limited – National Brands Limited (I&J Pet Food, Lucky Pet), Promeal (Pty) Ltd, Premier FMCG – Pet Care (Petley’s), Pack Leader Pet Products (Distributor of Acana/Orijen and others), Pet Heaven (E?commerce retailer), Ultra Pet (Foodcorp/RCL brand), JOCK Dog Food (Montego Brand), Vondis Holistic Pet Nutrition, Olympic Professional (Pet Treats), Marltons (Pet accessories and consumables distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The South African pet food market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The trend towards premiumization will likely continue, with consumers increasingly seeking high-quality, nutritious options for their pets. Additionally, the rise of e-commerce platforms is expected to enhance accessibility, allowing consumers to purchase pet food conveniently. Innovations in product formulations and sustainable practices will further shape the market landscape, fostering growth and attracting new entrants in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dry Pet Food (Kibbles and Other Dry) Wet Pet Food Pet Treats (Crunchy, Soft & Chewy, Dental, Jerky/Freeze?dried) Pet Nutraceuticals/Supplements (Omega?3, Probiotics, Vitamins & Minerals, Proteins/Peptides, Milk Bioactives) Veterinary/Therapeutic Diets (Renal, Digestive Sensitivity, Diabetes, Urinary, Oral Care) Functional & Specialty (Weight?management, Grain?free, Limited?ingredient, Life?stage) |

| By Pet Type | Dogs Cats Other Pets (Birds, Small Mammals, Fish) |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Pet Stores Online Channel/E?commerce Platforms Convenience Stores Other Channels (Breeders, Veterinary Clinics, Direct) |

| By Price Tier | Economy Mid?Range Premium Super Premium |

| By Ingredient Source | Animal Protein Plant?based Ingredients Additives & Supplements Alternative Proteins (Insect, Novel) |

| By Packaging Type | Bags Cans Pouches Tubs/Trays and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 120 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 90 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Pet Supply Distributors | 70 | Logistics Managers, Sales Representatives |

The South Africa pet food market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and a shift towards premium pet food products.