Region:Europe

Author(s):Geetanshi

Product Code:KRAB2786

Pages:98

Published On:October 2025

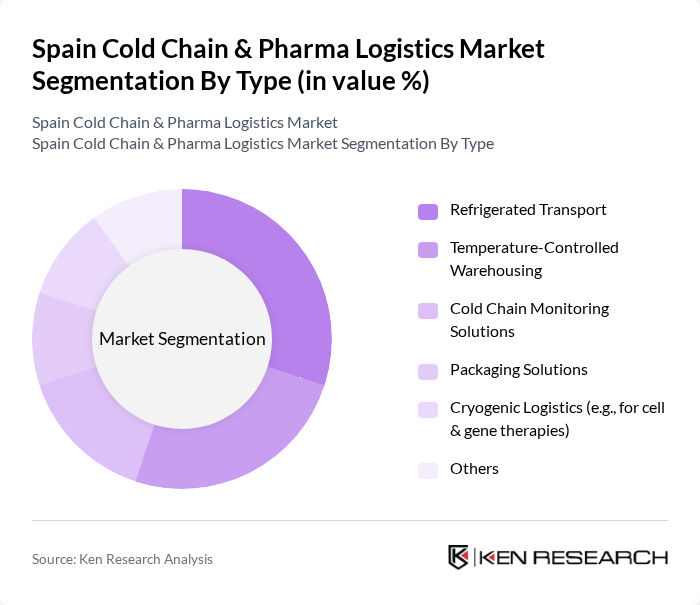

By Type:The market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, Cryogenic Logistics, and Others. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain.

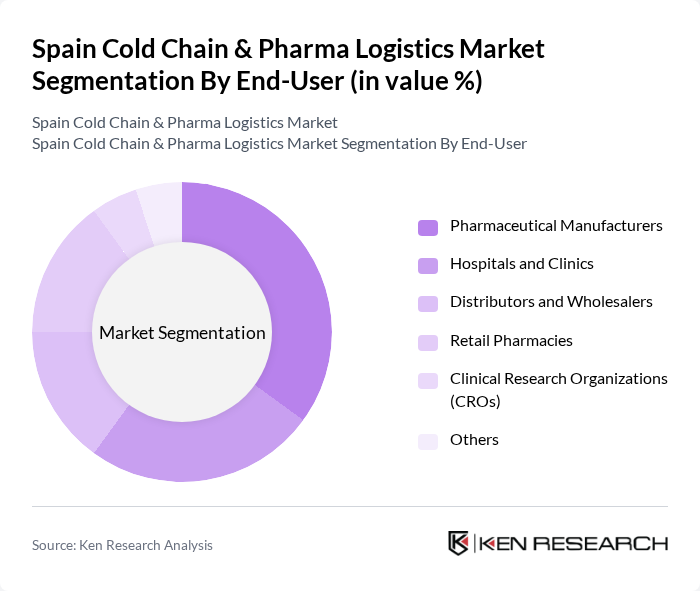

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Hospitals and Clinics, Distributors and Wholesalers, Retail Pharmacies, Clinical Research Organizations (CROs), and Others. Each segment has unique requirements and contributes differently to the overall market dynamics.

The Spain Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Iberia, Kuehne + Nagel Spain, DB Schenker Spain, XPO Logistics Spain, UPS Healthcare Spain, GEODIS Spain, Grupo Sesé, Logista Pharma, Alliance Healthcare España, Stef Iberia, Transfesa Logistics, Grupo Carreras, Movianto Spain, Eurotranspharma Spain, Thermo Fisher Scientific contribute to innovation, geographic expansion, and service delivery in this space.

The future of Spain's cold chain and pharma logistics market appears promising, driven by technological advancements and increasing demand for biopharmaceuticals. The integration of IoT and AI technologies is expected to enhance monitoring and predictive analytics, improving operational efficiency. Additionally, the growing focus on sustainability practices will likely shape logistics strategies, as companies seek to reduce their carbon footprint while maintaining compliance with evolving regulations. These trends will create a dynamic environment for innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Cryogenic Logistics (e.g., for cell & gene therapies) Others |

| By End-User | Pharmaceutical Manufacturers Hospitals and Clinics Distributors and Wholesalers Retail Pharmacies Clinical Research Organizations (CROs) Others |

| By Application | Vaccines Biologics Clinical Trials Blood and Blood Products Cell & Gene Therapies Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Distribution Home Delivery (e.g., for chronic care) Others |

| By Packaging Type | Insulated Containers Refrigerated Trucks Temperature-Controlled Pallets Phase-Change Materials Packaging Others |

| By Service Type | Transportation Services Warehousing Services Monitoring & Traceability Services Packaging Services Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships EU Grants & Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Cold Chain Service Providers | 80 | Operations Managers, Business Development Heads |

| Regulatory Compliance in Pharma Logistics | 60 | Compliance Officers, Quality Assurance Managers |

| Temperature-Controlled Storage Solutions | 50 | Facility Managers, Warehouse Supervisors |

| Emerging Biopharmaceutical Logistics | 40 | Product Managers, R&D Directors |

The Spain Cold Chain & Pharma Logistics Market is valued at approximately USD 4.7 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, the rise of e-commerce, and stringent regulatory standards for medical goods storage and transportation.