Region:Asia

Author(s):Dev

Product Code:KRAB0526

Pages:87

Published On:August 2025

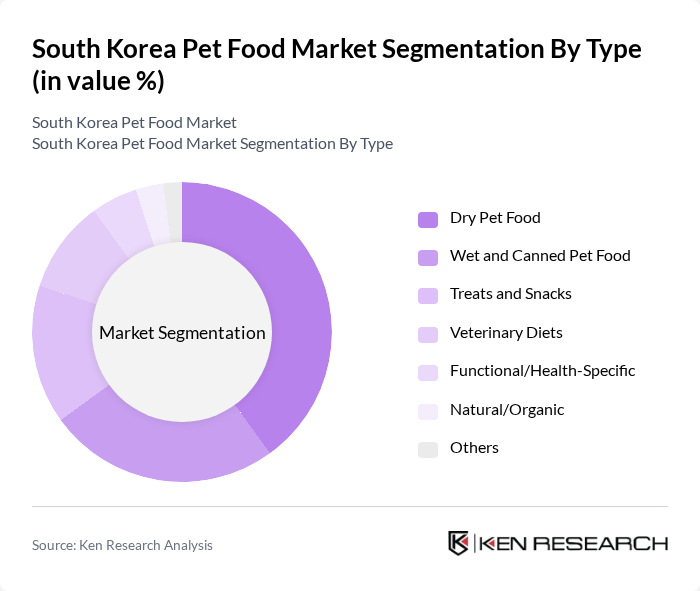

By Type:The pet food market can be segmented into various types, including Dry Pet Food, Wet and Canned Pet Food, Treats and Snacks, Veterinary Diets, Functional/Health-Specific, Natural/Organic, and Others. Among these, Dry Pet Food is the most popular due to its convenience and longer shelf life, while Wet and Canned Pet Food is gaining traction for its palatability and moisture content. Treats and Snacks are also increasingly favored as pet owners look for ways to reward their pets.

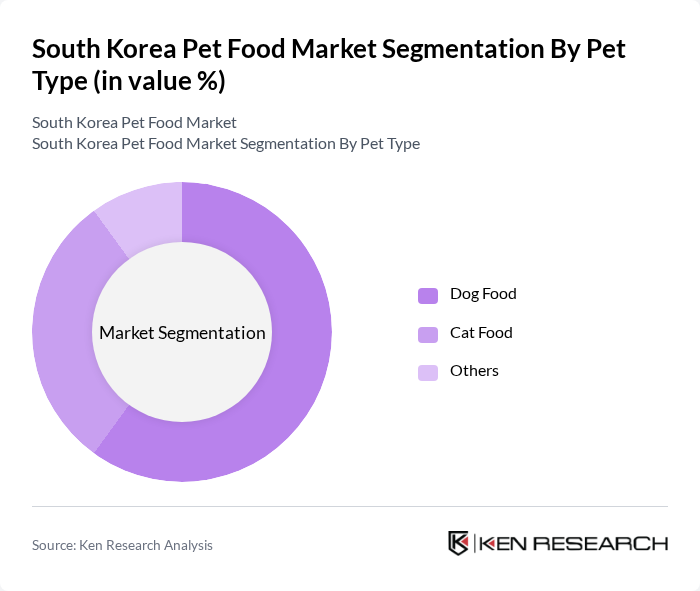

By Pet Type:The market can also be segmented by pet type, primarily focusing on Dog Food, Cat Food, and Others. Dog Food dominates the market due to the higher number of dog owners compared to cat owners in South Korea. The increasing trend of pet humanization has led to a rise in demand for specialized dog food products, while Cat Food is also witnessing growth as more households adopt cats; industry trackers note particularly strong momentum for cat food within ecommerce channels.

The South Korea Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Petcare (including Royal Canin), Nestlé Purina PetCare, Hill’s Pet Nutrition, Unicharm Corporation (Petcare), Cargill, Incorporated (Provimi, pet nutrition), Bowwow Korea Co., Ltd., Happy Dream Company Co., Ltd., ATBIO Co., Ltd., Lotte Pet Food (Lotte Wellfood Co., Ltd.), CJ CheilJedang (Pet food ingredients/brands), Dongwon F&B (Pet food lines), E-Mart/SSG.COM (own-brand pet food retail), Blue Buffalo (General Mills), WellPet LLC (Wellness, CORE), Spectrum Brands (Tetra, pet supplies) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean pet food market is poised for continued growth, driven by increasing pet ownership and a shift towards premium products. Innovations in pet food formulations, including organic and natural ingredients, are expected to gain traction as consumers become more health-conscious. Additionally, the rise of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer convenience and driving sales. Overall, the market is set to evolve significantly, reflecting changing consumer preferences and lifestyle trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Pet Food Wet and Canned Pet Food Treats and Snacks Veterinary Diets Functional/Health-Specific (e.g., digestive, skin & coat) Natural/Organic Others |

| By Pet Type | Dog Food Cat Food Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Pet Stores Online Channels Others |

| By Price Range | Mass Premium |

| By Ingredient Source | Animal-Derived Plant-Derived |

| By Packaging Type | Bags Cans Pouches |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 150 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Pet Nutrition Experts | 50 | Nutritionists, Animal Dieticians |

The South Korea pet food market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing pet ownership, premiumization, and health-focused formulations. This market is evolving with a notable shift towards natural and organic options.