Region:Europe

Author(s):Geetanshi

Product Code:KRAB1462

Pages:99

Published On:October 2025

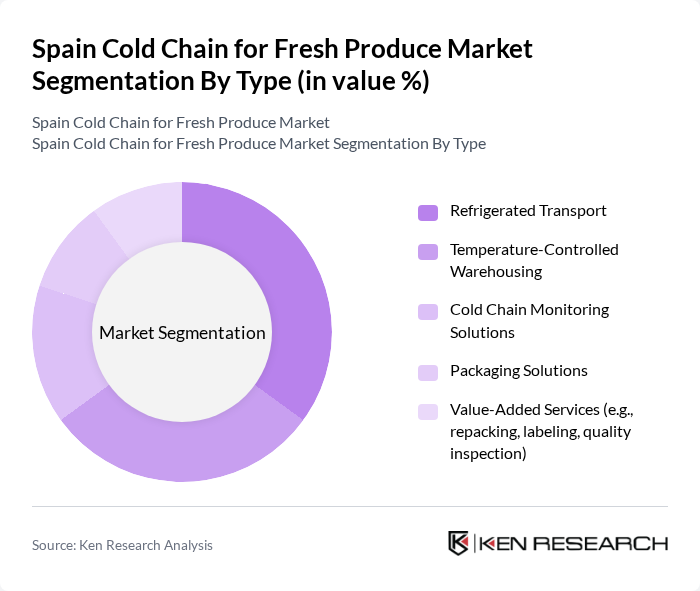

By Type:The cold chain logistics market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Value-Added Services. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for fresh produce across various distribution channels. The need for efficient transportation methods to maintain the quality and safety of perishable goods has made this segment crucial in the cold chain logistics landscape. The adoption of advanced refrigerated vehicles and integration of real-time tracking systems are further enhancing the reliability and efficiency of this segment .

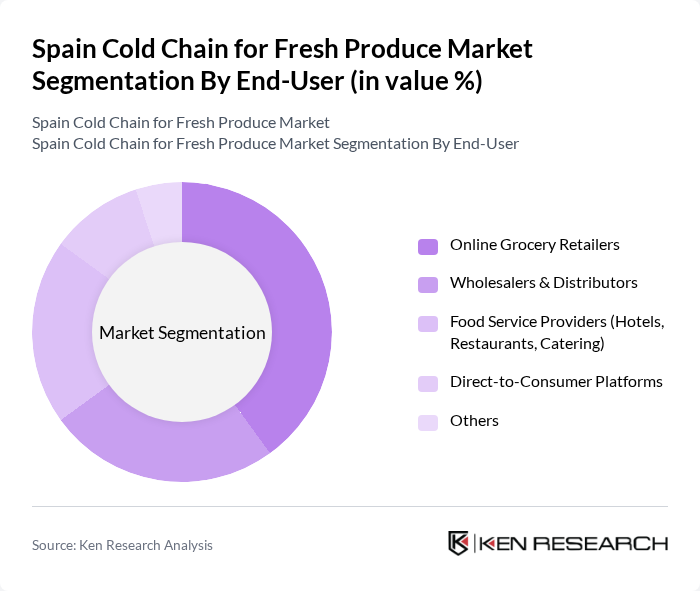

By End-User:The end-user segmentation includes Online Grocery Retailers, Wholesalers & Distributors, Food Service Providers (Hotels, Restaurants, Catering), and Direct-to-Consumer Platforms. The Online Grocery Retailers segment is currently dominating the market, fueled by the surge in online shopping and the growing consumer preference for home delivery of fresh produce. This trend has necessitated the establishment of robust cold chain logistics to ensure timely and safe delivery of perishable items. The increasing integration of digital platforms and last-mile delivery solutions is further strengthening this segment's market position .

The Spain Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo CTC, Transcoma Grupo Logístico, Frio Almacenaje S.A., Logista, Eurocruz, XPO Logistics, DHL Supply Chain, Kuehne + Nagel, SEUR, Stef Iberia, Ferro-Montajes Albacete, Frigoríficos SOLY, Primafrio, APM Terminals, Cargill España contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for fresh produce in Spain appears promising, driven by technological advancements and increasing consumer demand for quality and safety. As e-commerce continues to expand, the need for efficient logistics solutions will grow, prompting investments in infrastructure and technology. Additionally, sustainability initiatives will likely shape operational practices, with a focus on reducing carbon footprints. Overall, the market is poised for transformation, aligning with global trends towards healthier eating and environmentally responsible practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Value-Added Services (e.g., repacking, labeling, quality inspection) |

| By End-User | Online Grocery Retailers Wholesalers & Distributors Food Service Providers (Hotels, Restaurants, Catering) Direct-to-Consumer Platforms |

| By Distribution Channel | E-Commerce Platforms Direct Sales (B2B/B2C) Third-Party Logistics (3PL) Providers Marketplace Aggregators |

| By Product Category | Fruits Vegetables Fresh Herbs & Leafy Greens Exotic Produce & Berries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Distributors | 100 | Logistics Managers, Supply Chain Coordinators |

| Cold Storage Facility Operators | 70 | Facility Managers, Operations Supervisors |

| Agricultural Producers | 60 | Farm Owners, Production Managers |

| Retail Sector Cold Chain Managers | 80 | Retail Operations Managers, Inventory Managers |

| Logistics Service Providers | 50 | Business Development Managers, Sales Managers |

The Spain Cold Chain for Fresh Produce Market is valued at approximately USD 4.7 billion, driven by increasing demand for fresh produce, dairy, meat, seafood, and pharmaceuticals, alongside a consumer preference for high-quality food products.