Region:Europe

Author(s):Geetanshi

Product Code:KRAA8160

Pages:84

Published On:September 2025

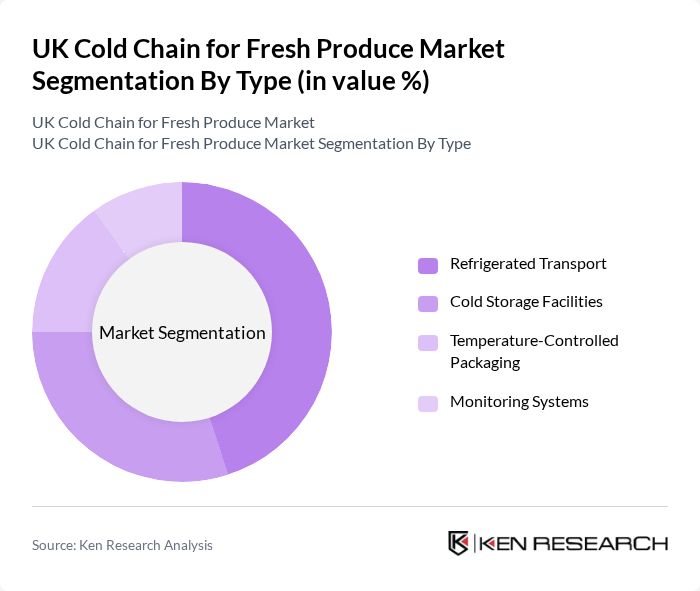

By Type:The market is segmented into four main types: Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Monitoring Systems. Each of these segments plays a crucial role in maintaining the quality and safety of fresh produce throughout the supply chain. Refrigerated transport is particularly dominant due to the increasing reliance on logistics for timely delivery, while cold storage facilities are essential for preserving produce before it reaches retailers.

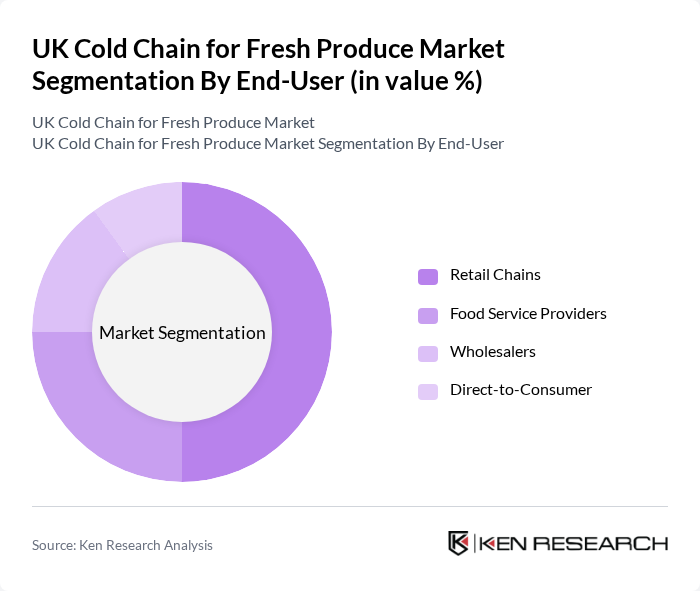

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Wholesalers, and Direct-to-Consumer. Retail chains are the leading segment, driven by the growing trend of supermarkets and grocery stores that require efficient cold chain solutions to maintain the freshness of their produce. Food service providers also contribute significantly, as they demand reliable logistics for timely deliveries.

The UK Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lineage Logistics, XPO Logistics, DHL Supply Chain, Norbert Dentressangle, Cold Chain Technologies, United States Cold Storage, Americold Logistics, Kuehne + Nagel, DB Schenker, Agility Logistics, Gist Limited, A.P. Moller - Maersk, CEVA Logistics, J.B. Hunt Transport Services, Preferred Freezer Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK cold chain for fresh produce market appears promising, driven by technological advancements and evolving consumer preferences. The integration of IoT and automation in logistics is expected to enhance operational efficiency and reduce costs. Additionally, the increasing focus on sustainability will likely lead to the adoption of energy-efficient practices and eco-friendly refrigerants, aligning with government initiatives aimed at reducing carbon emissions and promoting environmental responsibility in the food supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems |

| By End-User | Retail Chains Food Service Providers Wholesalers Direct-to-Consumer |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Application | Fruits and Vegetables Dairy Products Meat and Seafood Processed Foods |

| By Sales Channel | Online Sales Offline Sales Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Others | Niche Products Specialty Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facility Operations | 100 | Facility Managers, Operations Directors |

| Fresh Produce Supply Chain | 80 | Supply Chain Managers, Procurement Officers |

| Retail Distribution Channels | 70 | Logistics Coordinators, Retail Managers |

| Food Safety Compliance | 60 | Quality Assurance Managers, Compliance Officers |

| Technology Adoption in Cold Chain | 90 | IT Managers, Innovation Leads |

The UK Cold Chain for Fresh Produce Market is valued at approximately USD 15 billion, reflecting a significant growth driven by increasing demand for fresh produce and advancements in cold chain technologies that enhance logistics efficiency.