Germany Cold Chain for Fresh Produce Market Overview

- The Germany Cold Chain for Fresh Produce Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for fresh produce, coupled with the rising consumer awareness regarding food safety and quality. The expansion of e-commerce and the need for efficient logistics solutions have further propelled the market, as businesses seek to minimize spoilage and ensure product freshness during transportation.

- Key players in this market include major cities such as Berlin, Hamburg, and Munich, which dominate due to their strategic locations and advanced infrastructure. These cities serve as logistical hubs, facilitating efficient distribution networks for fresh produce. Additionally, the presence of leading cold chain service providers and a robust retail sector in these areas contribute to their market dominance.

- In 2023, the German government implemented regulations mandating stricter temperature control standards for the transportation and storage of perishable goods. This regulation aims to enhance food safety and reduce waste, requiring all cold chain operators to comply with specific temperature monitoring and reporting protocols to ensure the integrity of fresh produce throughout the supply chain.

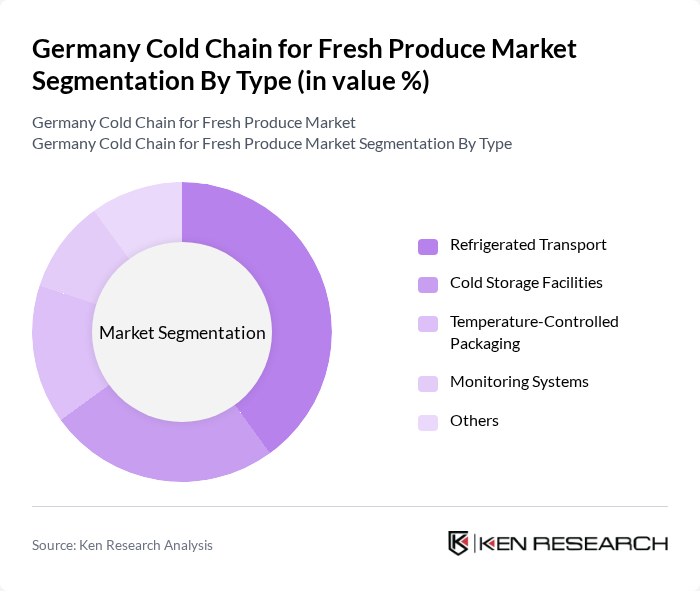

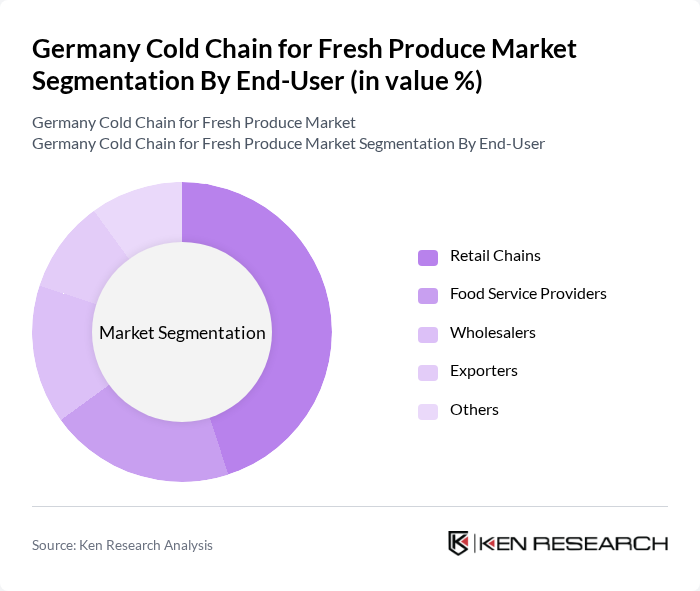

Germany Cold Chain for Fresh Produce Market Segmentation

By Type:The cold chain market can be segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Each of these sub-segments plays a crucial role in maintaining the quality and safety of fresh produce during transportation and storage. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for efficient logistics solutions and the need to minimize spoilage during transit.

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Wholesalers, Exporters, and Others. Retail Chains are the dominant end-user segment, driven by the increasing consumer demand for fresh produce and the need for efficient supply chain management. The growth of supermarkets and hypermarkets has further fueled the demand for cold chain solutions to ensure product freshness and safety.

Germany Cold Chain for Fresh Produce Market Competitive Landscape

The Germany Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Post AG, Kühne + Nagel International AG, DB Schenker, XPO Logistics, Inc., DSV Panalpina A/S, Lineage Logistics, Agility Logistics, C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., Nippon Express Co., Ltd., CEVA Logistics, Americold Realty Trust, Sysco Corporation, FreshDirect, Tesco PLC contribute to innovation, geographic expansion, and service delivery in this space.

Germany Cold Chain for Fresh Produce Market Industry Analysis

Growth Drivers

- Increasing Demand for Fresh Produce:The demand for fresh produce in Germany is projected to reach approximately 5.5 million tons in future, driven by a growing population and health-conscious consumers. The per capita consumption of fruits and vegetables is expected to rise to 150 kg annually, reflecting a shift towards healthier diets. This surge in demand necessitates efficient cold chain logistics to ensure product freshness and minimize spoilage, thereby propelling market growth.

- Technological Advancements in Refrigeration:The cold chain sector is witnessing significant technological advancements, with investments in energy-efficient refrigeration systems expected to exceed €1 billion in future. Innovations such as smart temperature monitoring and automated storage solutions enhance operational efficiency and reduce energy consumption. These advancements not only improve product quality but also lower operational costs, making cold chain logistics more attractive to stakeholders in the fresh produce market.

- Rising Consumer Awareness of Food Safety:In future, approximately 70% of German consumers prioritize food safety, leading to increased demand for traceable and safe food products. This heightened awareness drives retailers and suppliers to invest in robust cold chain solutions to maintain product integrity. The implementation of stringent food safety regulations further compels businesses to adopt advanced cold chain practices, ensuring compliance and fostering consumer trust in fresh produce.

Market Challenges

- High Operational Costs:The operational costs associated with cold chain logistics in Germany are projected to reach €3.2 billion in future. Factors such as energy expenses, maintenance of refrigeration equipment, and labor costs contribute to these high expenditures. As companies strive to maintain profitability while ensuring product quality, managing these costs becomes a significant challenge, potentially hindering market growth in the fresh produce sector.

- Regulatory Compliance Complexity:The cold chain industry faces complex regulatory requirements, with over 200 regulations impacting food safety and transportation of perishables in Germany. Compliance with these regulations demands significant resources and expertise, posing a challenge for smaller operators. The need for continuous training and adaptation to evolving standards can strain operational capabilities, affecting overall market efficiency and competitiveness.

Germany Cold Chain for Fresh Produce Market Future Outlook

The future of the cold chain for fresh produce in Germany appears promising, driven by technological innovations and increasing consumer demand for quality and safety. As the market adapts to evolving consumer preferences, investments in sustainable practices and infrastructure will likely enhance operational efficiency. Additionally, the integration of digital solutions, such as IoT and AI, will optimize supply chain management, ensuring timely delivery and reducing waste. This dynamic environment presents opportunities for growth and collaboration among stakeholders.

Market Opportunities

- Growth in Organic Produce Demand:The organic produce market in Germany is expected to grow to €2.5 billion in future, driven by increasing consumer preference for organic products. This trend presents an opportunity for cold chain operators to specialize in organic logistics, ensuring the freshness and quality of these products while meeting consumer expectations for sustainability and safety.

- Investment in Cold Chain Infrastructure:With the German government allocating €500 million for cold chain infrastructure improvements in future, there is a significant opportunity for businesses to enhance their logistics capabilities. This investment will facilitate the development of modern facilities and technologies, enabling companies to meet the rising demand for fresh produce while improving efficiency and reducing waste.