Region:North America

Author(s):Geetanshi

Product Code:KRAA6050

Pages:91

Published On:September 2025

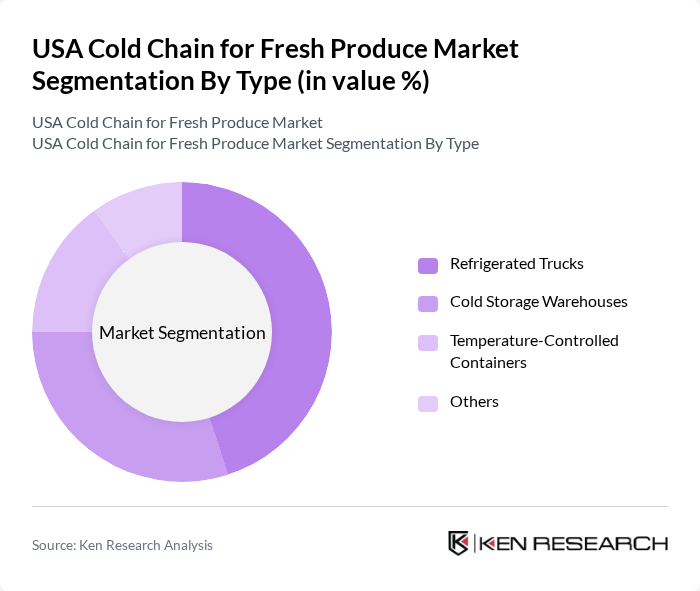

By Type:The cold chain logistics market for fresh produce can be segmented into four main types: Refrigerated Trucks, Cold Storage Warehouses, Temperature-Controlled Containers, and Others. Among these, Refrigerated Trucks are the most dominant segment due to their essential role in transporting perishable goods over long distances while maintaining the required temperature. The increasing demand for fresh produce and the expansion of e-commerce have further solidified the importance of refrigerated transportation in the supply chain.

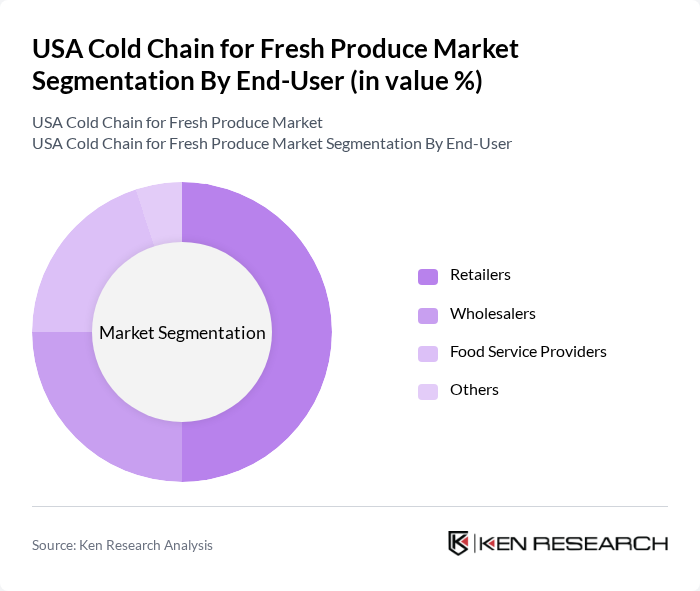

By End-User:The end-user segmentation includes Retailers, Wholesalers, Food Service Providers, and Others. Retailers represent the largest segment, driven by the growing consumer demand for fresh produce in supermarkets and grocery stores. The trend towards healthier eating habits and the increasing popularity of organic products have led retailers to invest in efficient cold chain solutions to ensure product quality and safety.

The USA Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Logistics LLC, Lineage Logistics Holdings LLC, United States Cold Storage Inc., Preferred Freezer Services, Cold Chain Technologies, VersaCold Logistics Services, XPO Logistics Inc., DHL Supply Chain, C.H. Robinson Worldwide Inc., Sysco Corporation, Martin Brower, A.P. Moller - Maersk, Kuehne + Nagel International AG, DB Schenker, J.B. Hunt Transport Services Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA cold chain for fresh produce market appears promising, driven by technological innovations and evolving consumer preferences. As the demand for organic produce continues to rise, companies are likely to invest in advanced cold chain solutions to ensure product integrity. Additionally, the increasing focus on sustainability will push businesses to adopt eco-friendly practices, enhancing their competitive edge while meeting regulatory requirements. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Trucks Cold Storage Warehouses Temperature-Controlled Containers Others |

| By End-User | Retailers Wholesalers Food Service Providers Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Product Category | Fruits Vegetables Herbs Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Sales Channel | Online Sales Offline Sales Distributors Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Distributors | 100 | Logistics Managers, Supply Chain Coordinators |

| Cold Storage Facility Operators | 80 | Facility Managers, Operations Supervisors |

| Agricultural Cooperatives | 70 | Farm Managers, Cooperative Directors |

| Retail Grocery Chains | 90 | Procurement Officers, Fresh Produce Buyers |

| Food Safety Regulators | 50 | Compliance Officers, Regulatory Affairs Managers |

The USA Cold Chain for Fresh Produce Market is valued at approximately USD 20 billion, driven by increasing demand for fresh produce and consumer preferences for organic and locally sourced foods, alongside the growth of e-commerce and logistics solutions to reduce food spoilage.