Region:Africa

Author(s):Shubham

Product Code:KRAB5029

Pages:87

Published On:October 2025

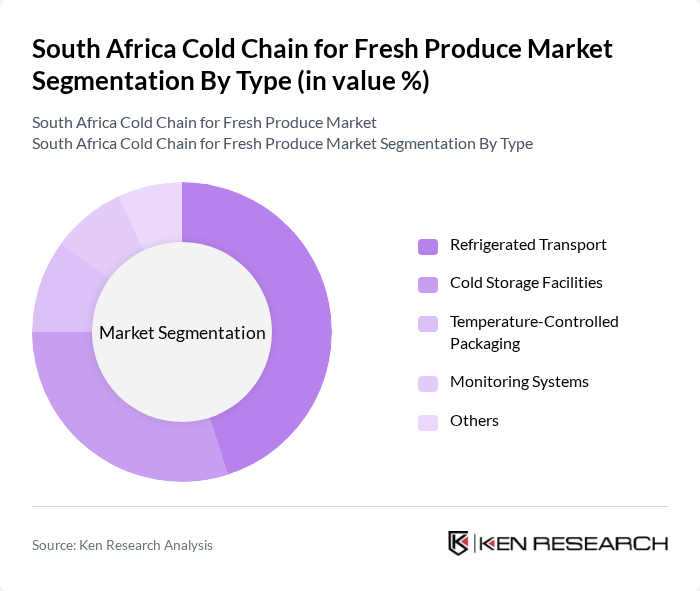

By Type:The cold chain market is segmented into Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Among these, Refrigerated Transport is the leading segment, driven by the need for timely and temperature-controlled delivery of fresh produce to urban centers and export terminals. The rise of e-commerce and online grocery platforms has further increased demand for reliable refrigerated transport, making it a critical component of the cold chain. Cold Storage Facilities also represent a significant share, reflecting ongoing investments in large-scale, multi-temperature storage infrastructure .

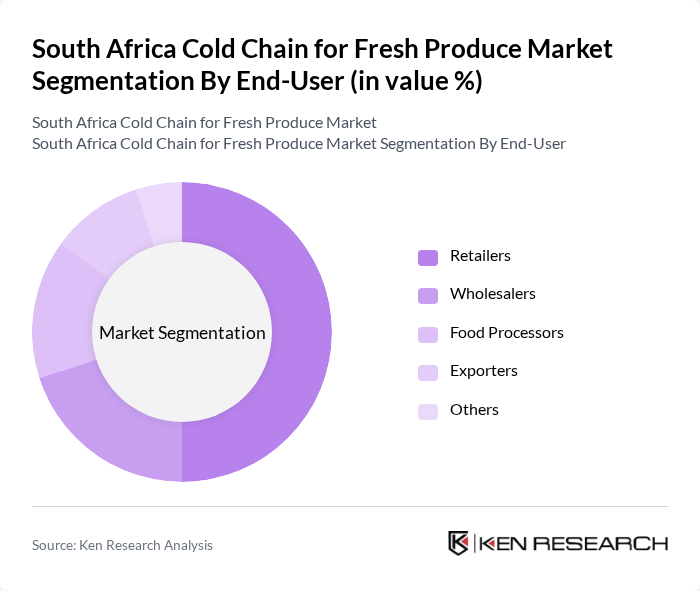

By End-User:The market is further segmented by end-users, including Retailers, Wholesalers, Food Processors, Exporters, and Others. Retailers represent the largest segment, driven by the proliferation of supermarkets and grocery stores, as well as consumer demand for high-quality, fresh fruits and vegetables. Investments in advanced cold chain solutions by retailers ensure product quality and safety, while wholesalers and food processors also contribute significantly to market demand through their role in aggregation, processing, and distribution .

The South Africa Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Group Limited, Imperial Logistics Limited, Cold Chain Solutions, Africold Logistics, Kuehne + Nagel South Africa, DSV Panalpina South Africa, Transnet Freight Rail, RCL Foods Limited, A.P. Moller - Maersk South Africa, Bidvest Waltons, SAA Cargo, Unitrans Supply Chain Solutions, DHL Supply Chain South Africa, Safmarine, Seaboard Marine contribute to innovation, geographic expansion, and service delivery in this space .

The South African cold chain for fresh produce market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As the demand for fresh and organic produce continues to rise, businesses are likely to invest in advanced cold chain solutions to enhance efficiency and reduce waste. Additionally, the government's focus on improving infrastructure and food safety regulations will create a more robust framework for the industry, fostering growth and sustainability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Retailers Wholesalers Food Processors Exporters Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Others |

| By Product Type | Fresh Fruits Fresh Vegetables Processed Fruits & Vegetables Others |

| By Temperature Range | Chilled (0-5°C) Frozen (-18°C and below) Ambient (5-20°C) Others |

| By Service Type | Transportation Services Storage Services Packaging Services Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Distributors | 60 | Logistics Managers, Supply Chain Coordinators |

| Cold Storage Facility Operators | 50 | Facility Managers, Operations Supervisors |

| Agricultural Cooperatives | 40 | Farm Managers, Cooperative Leaders |

| Retail Sector Fresh Produce Buyers | 55 | Procurement Officers, Category Managers |

| Transport Service Providers | 45 | Fleet Managers, Logistics Directors |

The South Africa Cold Chain for Fresh Produce Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for fresh produce, consumer awareness of food safety, and investments in cold storage infrastructure.