Region:Europe

Author(s):Geetanshi

Product Code:KRAA6016

Pages:95

Published On:September 2025

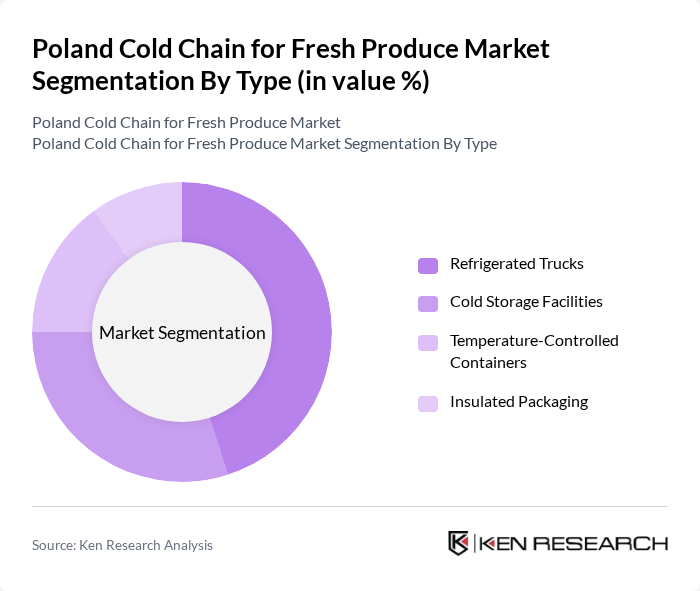

By Type:The cold chain market is segmented into various types, including Refrigerated Trucks, Cold Storage Facilities, Temperature-Controlled Containers, and Insulated Packaging. Each of these segments plays a vital role in ensuring the safe transportation and storage of fresh produce. Among these, Refrigerated Trucks are particularly dominant due to their flexibility and efficiency in transporting goods over long distances.

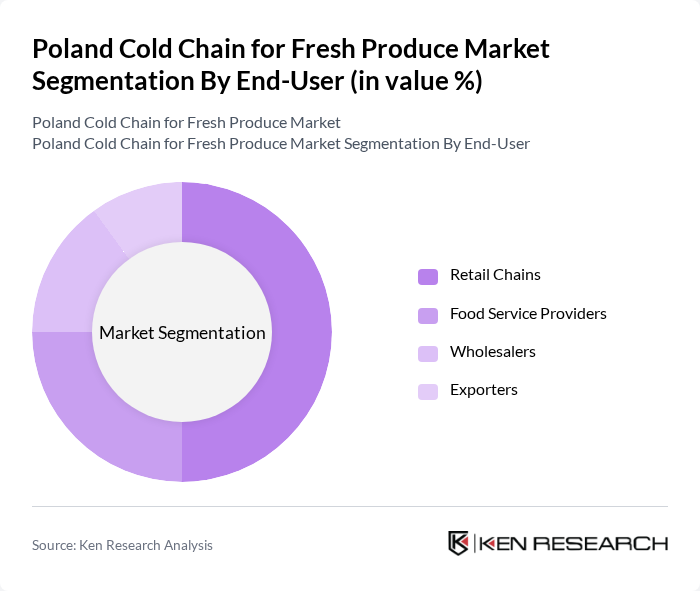

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Wholesalers, and Exporters. Retail Chains are the leading segment, driven by the increasing demand for fresh produce in supermarkets and grocery stores. The growing trend of health-conscious consumers has led to a surge in the demand for fresh fruits and vegetables, further solidifying the position of retail chains in the market.

The Poland Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as DSV Panalpina A/S, Kuehne + Nagel International AG, DB Schenker, XPO Logistics, Inc., Lineage Logistics Holdings LLC, Americold Realty Trust, Nichirei Logistics Group, Agility Logistics, DHL Supply Chain, CEVA Logistics, Raben Group, Transcom, Kuehne + Nagel, GEFCO, TSL Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for fresh produce in Poland appears promising, driven by increasing consumer awareness of food safety and sustainability. As the market adapts to technological advancements, the integration of IoT and energy-efficient solutions will enhance operational efficiency. Additionally, the growing trend towards organic produce will likely stimulate demand for specialized cold chain services. With government support and investment in infrastructure, the sector is poised for significant growth, addressing both domestic and export market needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Trucks Cold Storage Facilities Temperature-Controlled Containers Insulated Packaging |

| By End-User | Retail Chains Food Service Providers Wholesalers Exporters |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Farmers' Markets |

| By Product Category | Fruits Vegetables Herbs Others |

| By Packaging Type | Plastic Containers Cardboard Boxes Vacuum-Sealed Bags Others |

| By Sales Channel | Online Sales Offline Sales Wholesale Markets Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Fresh Produce Distributors | 80 | Supply Chain Managers, Logistics Coordinators |

| Retail Grocery Chains | 90 | Procurement Managers, Category Managers |

| Transport Service Providers | 70 | Fleet Managers, Business Development Executives |

| Agricultural Producers | 60 | Farm Owners, Operations Managers |

The Poland Cold Chain for Fresh Produce Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for fresh produce and heightened consumer awareness regarding food safety and quality.