Region:Central and South America

Author(s):Dev

Product Code:KRAB3020

Pages:95

Published On:October 2025

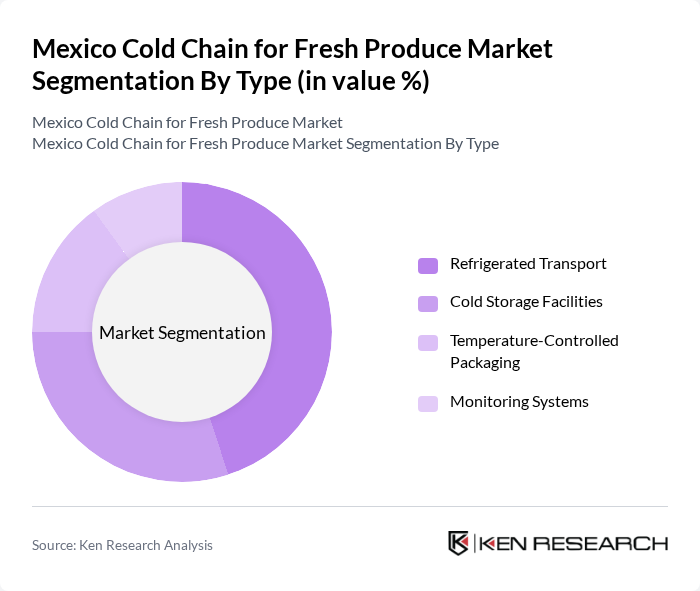

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Monitoring Systems. Each of these segments plays a crucial role in maintaining the quality and safety of fresh produce throughout the supply chain. The Refrigerated Transport segment is particularly dominant due to the increasing demand for efficient logistics solutions that ensure timely delivery of perishable goods.

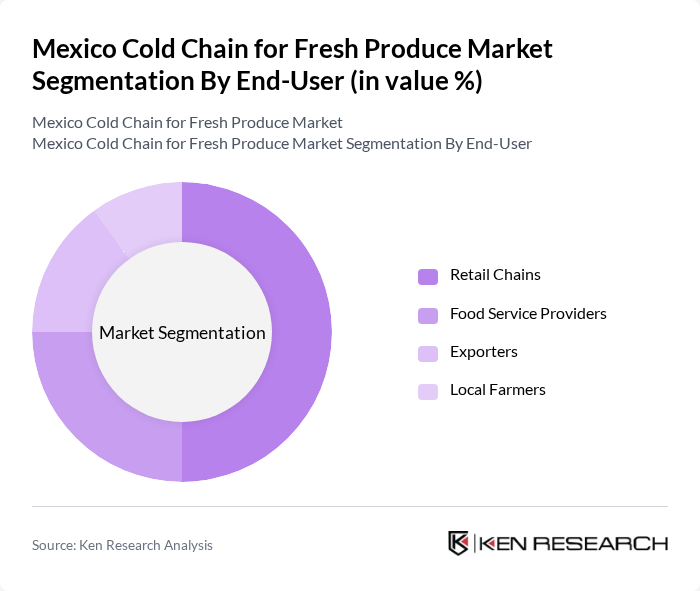

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Exporters, and Local Farmers. Retail Chains are the leading end-users, driven by the growing consumer preference for fresh produce and the need for efficient supply chain management. The increasing number of supermarkets and grocery stores has significantly contributed to the demand for cold chain solutions.

The Mexico Cold Chain for Fresh Produce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bimbo, Sigma Alimentos, Nestlé Mexico, Walmart de México y Centroamérica, Chedraui, Soriana, Alsea, Grupo Lala, Jalisco Fresh, Frutas y Verduras de México, Agropecuaria de México, Fresh Produce Logistics, Transportes Frigoríficos, Distribuidora de Alimentos, Frío y Fresco contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for fresh produce in Mexico appears promising, driven by increasing consumer demand for quality and safety. As e-commerce continues to grow, particularly in urban areas, the need for efficient cold chain solutions will become even more critical. Additionally, government initiatives aimed at improving infrastructure and supporting local farmers will likely enhance market dynamics. The integration of smart technologies will further streamline operations, ensuring that fresh produce reaches consumers in optimal condition.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems |

| By End-User | Retail Chains Food Service Providers Exporters Local Farmers |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Wholesale Markets |

| By Application | Fruits Vegetables Dairy Products Meat and Seafood |

| By Sales Channel | Online Sales Offline Sales B2B Sales B2C Sales |

| By Price Range | Budget Mid-Range Premium |

| By Others | Niche Products Specialty Produce Organic Options |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Fresh Produce Distributors | 80 | Supply Chain Managers, Logistics Coordinators |

| Agricultural Producers | 70 | Farm Owners, Production Managers |

| Retail Sector Cold Chain Users | 90 | Retail Managers, Procurement Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Compliance Officers |

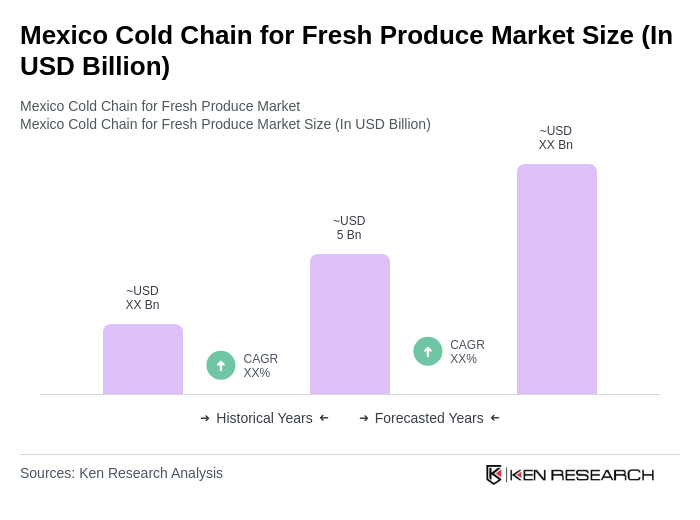

The Mexico Cold Chain for Fresh Produce Market is valued at approximately USD 5 billion, driven by increasing demand for fresh produce and heightened consumer awareness regarding food safety and quality.