Spain FinTech Lending & Online Loans Market Overview

- The Spain FinTech Lending & Online Loans Market is valued at approximately USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the expansion of alternative lending platforms that cater to diverse customer needs. Key drivers include the rapid uptake of mobile and online payments, the proliferation of peer-to-peer lending, and the integration of AI-driven credit assessment tools, which enhance both speed and personalization in lending decisions .

- Key cities such as Madrid and Barcelona dominate the market due to their robust financial ecosystems, high population density, and a strong presence of technology-driven startups. These urban centers foster innovation and attract investment, making them pivotal in the growth of the FinTech lending landscape. Government initiatives to improve digital infrastructure and financial literacy further reinforce their leadership in the sector .

- In 2023, the Spanish government implemented the “Law 5/2015 on the Promotion of Business Financing,” as amended by Law 18/2022, which regulates crowdfunding and online lending platforms. This law, issued by the Spanish Parliament, mandates that all lending platforms register with the National Securities Market Commission (CNMV), comply with operational transparency requirements, and adhere to investor protection standards, including disclosure obligations, investment limits for non-professional investors, and ongoing reporting to the CNMV .

Spain FinTech Lending & Online Loans Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Buy Now Pay Later (BNPL), Peer-to-Peer (P2P) Loans, Crowdfunding Loans, and Others. Personal Loans are currently the most dominant segment, driven by consumer preferences for unsecured borrowing options that offer flexibility and quick access to funds. The rise of digital onboarding and instant credit decisioning has further accelerated the demand for personal loans, while BNPL and P2P lending are also growing rapidly due to their appeal among younger and digitally savvy consumers .

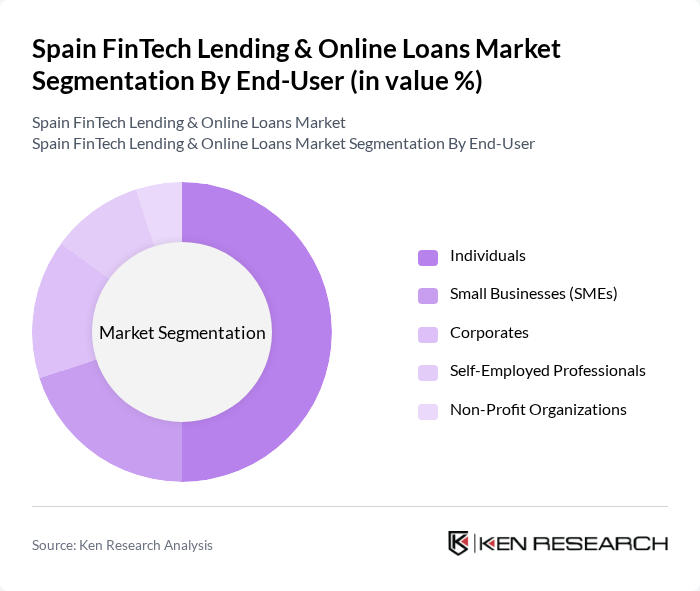

By End-User:The end-user segmentation includes Individuals, Small Businesses (SMEs), Corporates, Self-Employed Professionals, and Non-Profit Organizations. Individuals represent the largest segment, as they increasingly seek personal loans for various purposes, including debt consolidation, home improvements, and unexpected expenses. SMEs are also a significant end-user group, leveraging online lending platforms for working capital and business expansion, supported by streamlined digital onboarding and faster approval processes .

Spain FinTech Lending & Online Loans Market Competitive Landscape

The Spain FinTech Lending & Online Loans Market is characterized by a dynamic mix of regional and international players. Leading participants such as BBVA, Banco Sabadell, CaixaBank, ING España, Creditea, Aplazame, SeQura, Cofidis España, October, MytripleA, Lendmarket, Zank, Housers, Spotcap, Finzmo contribute to innovation, geographic expansion, and service delivery in this space.

Spain FinTech Lending & Online Loans Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital adoption rate in Spain has surged, with over94%of the population using the internet in future. This shift has facilitated the growth of online lending platforms, allowing consumers to access loans conveniently. The number of mobile banking users reachedover 25 million, indicating a strong preference for digital financial services. This trend is supported by the Spanish government's initiatives to enhance digital infrastructure, which is expected to further boost online loan accessibility.

- Demand for Quick Loan Processing:The average loan processing time in Spain for digital lenders is typicallywithin 24 to 48 hours, driven by advancements in technology and streamlined operations. This rapid processing meets the increasing consumer demand for immediate financial solutions, particularly among millennials and Gen Z, who prioritize speed and convenience. The total volume of online loans issued in Spain was reported atover €4.5 billionin recent periods, reflecting a growing preference for quick access to funds.

- Rise of Alternative Lending Platforms:The alternative lending sector in Spain has expanded, withover 150 active platformsin recent periods. These platforms cater to underserved markets, including small businesses and individuals with limited credit histories. The total amount lent through peer-to-peer platforms reachedover €1 billionin recent periods, showcasing a shift from traditional banking. This growth is supported by increasing consumer awareness and acceptance of non-traditional lending solutions, enhancing market competition.

Market Challenges

- High Competition Among Lenders:The Spanish FinTech lending market is characterized by intense competition, withover 200 lendersvying for market share in recent periods. This saturation leads to aggressive pricing strategies, which can erode profit margins. Additionally, the influx of new entrants complicates customer acquisition efforts, as established players must continuously innovate to retain their client base. The competitive landscape necessitates significant marketing investments to differentiate services and attract borrowers.

- Regulatory Compliance Costs:Compliance with evolving regulations poses a significant challenge for FinTech lenders in Spain. The average cost of compliance for a mid-sized lender is estimated at€400,000 to €500,000 annually. This includes expenses related to data protection, consumer rights, and anti-money laundering measures. As regulations tighten, particularly with the implementation of the PSD2 directive, lenders must allocate substantial resources to ensure adherence, impacting their operational efficiency and profitability.

Spain FinTech Lending & Online Loans Market Future Outlook

The future of the Spain FinTech lending market appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, lenders are expected to enhance their offerings through innovative solutions, such as AI-driven credit assessments. Additionally, the focus on financial inclusion will likely lead to the development of tailored products for underserved demographics, fostering a more diverse lending ecosystem. Overall, the market is poised for sustained growth, adapting to changing economic conditions and consumer needs.

Market Opportunities

- Expansion of Peer-to-Peer Lending:The peer-to-peer lending segment presents a significant opportunity, with a projected growth rate of15%annually. This model allows individuals to lend directly to borrowers, bypassing traditional banks. As consumer trust in these platforms increases, the total volume of peer-to-peer loans could reachover €1.5 billion in future, providing a lucrative avenue for investors and borrowers alike.

- Integration of AI in Loan Processing:The integration of artificial intelligence in loan processing is set to revolutionize the industry. AI technologies are expected to reduce loan approval times by up to50%, enhancing customer satisfaction. This technological shift will enable lenders to offer personalized loan products, improving risk assessment and decision-making processes, ultimately driving growth in the sector.