Switzerland Hospitality Industry Market Overview

- The Switzerland Hospitality Industry Market is valued at USD 10 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing influx of international tourists, a robust business travel sector, and a growing demand for luxury accommodations. The market has seen a resurgence post-pandemic, with a notable rise in both domestic and international travel, contributing to the overall economic recovery.

- Key cities such as Zurich, Geneva, and Lucerne dominate the hospitality market due to their status as major financial hubs and tourist destinations. Zurich, with its vibrant cultural scene and business opportunities, attracts a significant number of travelers. Geneva, known for its international organizations and luxury hotels, and Lucerne, famous for its picturesque landscapes, further enhance Switzerland's appeal in the hospitality sector.

- In 2023, the Swiss government expanded sustainable tourism initiatives, encouraging hotels to adopt eco-friendly practices such as energy efficiency and waste reduction. Participation in programs like EarthCheck's Sustainable Destinations has become a benchmark for qualifying for government incentives, positioning Switzerland as a leader in sustainable tourism and enhancing its global competitiveness.

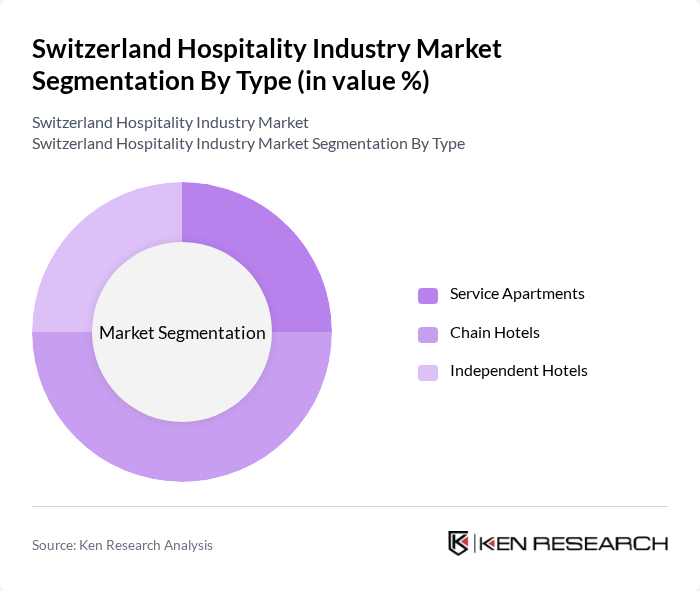

Switzerland Hospitality Industry Market Segmentation

By Type:The hospitality market in Switzerland is segmented into three main types: Service Apartments, Chain Hotels, and Independent Hotels. Service apartments cater to long-term stays, offering home-like amenities and flexibility for both business and leisure travelers. Chain hotels provide standardized services and brand reliability across various locations, appealing to both business and group travelers. Independent hotels focus on unique experiences, personalized services, and local authenticity, attracting tourists seeking distinctive accommodations.

By Segment:The market is further divided into Budget and Economy, Mid and Upper Mid-scale, and Luxury segments. Budget and Economy hotels cater to cost-conscious travelers, offering essential amenities and competitive pricing. Mid and Upper Mid-scale hotels provide a balance of comfort, quality, and affordability, appealing to families and business travelers. Luxury hotels deliver high-end services, exclusive amenities, and premium experiences, attracting affluent tourists and executives.

Switzerland Hospitality Industry Market Competitive Landscape

The Switzerland Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accor SA, Hilton Worldwide Holdings Inc., Marriott International, Inc., InterContinental Hotels Group PLC, Swissôtel Hotels & Resorts, Badrutt's Palace Hotel, The Dolder Grand, Kempinski Hotels S.A., Mövenpick Hotels & Resorts, Radisson Hotel Group, Sorell Hotels Switzerland, Tschuggen Hotel Group AG, Hotelplan Group, Zermatt Bergbahnen AG, Hotel Baur au Lac contribute to innovation, geographic expansion, and service delivery in this space.

Switzerland Hospitality Industry Market Industry Analysis

Growth Drivers

- Increase in Tourism:Switzerland welcomed approximately 11.4 million international tourists in future, a significant increase from 10.5 million in the previous period. This surge is attributed to the country's reputation for stunning landscapes and cultural heritage. The Swiss Federal Statistical Office reported that tourism contributed CHF 23.7 billion to the economy in future, highlighting the sector's vital role in driving hospitality growth. The anticipated rise in global travel post-pandemic further supports this upward trend, positioning Switzerland as a prime destination.

- Rise in Business Travel:Business travel in Switzerland is projected to reach CHF 7.8 billion in future, reflecting a robust recovery as companies resume in-person meetings and conferences. The Swiss Business Travel Association noted a 14% increase in corporate travel bookings in future compared to the previous period. This growth is driven by the country's strategic location in Europe and its reputation for hosting international events, which enhances demand for hotels and related services in the hospitality sector.

- Growth of Online Booking Platforms:The online travel agency market in Switzerland is expected to generate CHF 3.4 billion in revenue in future, up from CHF 3 billion in the previous period. The rise of platforms like Booking.com and Airbnb has transformed how travelers book accommodations, with approximately 68% of bookings now made online. This shift not only increases accessibility for consumers but also drives competition among hospitality providers, encouraging improvements in service quality and customer experience.

Market Challenges

- High Operational Costs:The hospitality sector in Switzerland faces operational costs averaging CHF 195 per room per night, significantly higher than in neighboring countries. Factors contributing to these costs include high labor expenses, with the average salary for hospitality workers reaching CHF 4,400 monthly. Additionally, energy costs have surged by approximately 28% in the past period, further straining profit margins for hotels and restaurants, making it challenging to maintain competitive pricing.

- Seasonal Fluctuations:The Swiss hospitality industry experiences significant seasonal fluctuations, with peak tourist seasons in summer and winter. For instance, hotel occupancy rates can drop to 42% during off-peak months, compared to 83% during peak seasons. This variability complicates revenue management and staffing, leading to potential overstaffing in low seasons and undercapacity during high demand periods, ultimately affecting profitability and operational efficiency.

Switzerland Hospitality Industry Market Future Outlook

The Switzerland hospitality industry is poised for a dynamic future, driven by increasing tourism and evolving consumer preferences. The integration of technology, such as AI-driven customer service and contactless check-ins, is expected to enhance guest experiences. Additionally, the focus on sustainability will likely shape operational practices, with more hotels adopting eco-friendly initiatives. As domestic tourism continues to grow, local experiences will become a key differentiator, allowing businesses to cater to a diverse range of travelers seeking unique offerings.

Market Opportunities

- Expansion of Luxury Segment:The luxury hospitality segment in Switzerland is projected to grow, with an estimated increase in high-end hotel openings by approximately 18% in future. This growth is driven by affluent travelers seeking exclusive experiences, such as personalized services and unique accommodations. The demand for luxury wellness retreats is also rising, presenting opportunities for hotels to cater to this niche market.

- Development of Wellness Tourism:Wellness tourism in Switzerland is expected to reach CHF 1.1 billion in future, driven by increasing consumer interest in health and well-being. The rise of spa resorts and wellness retreats, particularly in scenic locations, offers significant growth potential. Hotels that incorporate wellness programs and holistic experiences can attract health-conscious travelers, enhancing their competitive edge in the market.