Region:Asia

Author(s):Shubham

Product Code:KRAA1912

Pages:81

Published On:August 2025

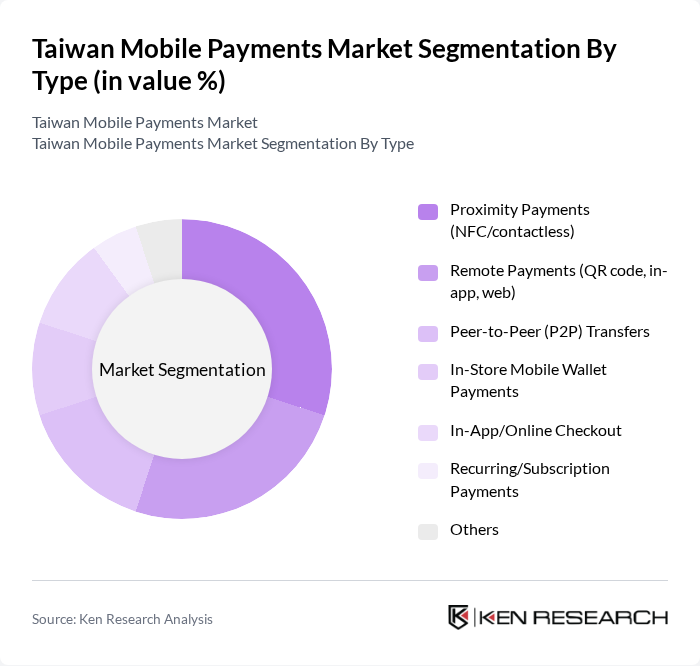

By Type:The mobile payments market can be segmented into various types, including Proximity Payments (NFC/contactless), Remote Payments (QR code, in-app, web), Peer-to-Peer (P2P) Transfers, In-Store Mobile Wallet Payments, In-App/Online Checkout, Recurring/Subscription Payments, and Others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall growth of the market. In Taiwan, QR-code and wallet-based remote payments are widely used for retail, e-commerce, and bill payments, while NFC/contactless is supported through schemes like Apple Pay and Google Pay and by contactless cards in-store; public transit and convenience retail are important proximity use cases.

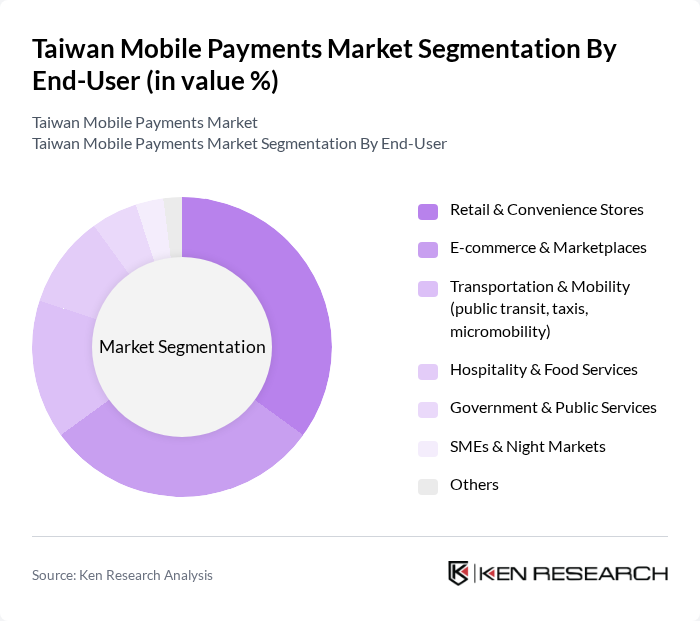

By End-User:The end-user segmentation includes Retail & Convenience Stores, E-commerce & Marketplaces, Transportation & Mobility (public transit, taxis, micromobility), Hospitality & Food Services, Government & Public Services, SMEs & Night Markets, and Others. Each segment reflects the diverse applications of mobile payments across various industries, highlighting the versatility and growing acceptance of mobile payment solutions. Retail, convenience chains, and e-commerce are leading adopters, supported by high contactless acceptance, wallet promotions, and integration with transport and bill-pay services.

The Taiwan Mobile Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as LINE Pay (LINE Pay Taiwan Limited), Apple Pay, Google Pay, JKOPAY (JKO Payment Co., Ltd.), Pi Wallet (Pi ???, Pi Mobile Technology Inc.), Taiwan Pay (Financial Information Service Co. – FISC), Alipay (Ant Group), WeChat Pay (Tencent), PayPal, ShopeePay, EasyCard Corporation (???), TapPay (WooXin Co., Ltd.), O’Pay Electronic Payment Co., Ltd. (???), momo Wallet (????????????), 17Pay (17LIVE Pay) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile payments market in Taiwan appears promising, driven by technological advancements and changing consumer preferences. As contactless payment methods gain traction, the integration of biometric authentication and AI-driven fraud detection will enhance security and user experience. Additionally, the rise of fintech companies is expected to foster innovation, leading to the development of new payment solutions. These trends indicate a robust growth trajectory for mobile payments, positioning Taiwan as a leader in the digital payment landscape in the Asia-Pacific region.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity Payments (NFC/contactless) Remote Payments (QR code, in-app, web) Peer-to-Peer (P2P) Transfers In-Store Mobile Wallet Payments In-App/Online Checkout Recurring/Subscription Payments Others |

| By End-User | Retail & Convenience Stores E-commerce & Marketplaces Transportation & Mobility (public transit, taxis, micromobility) Hospitality & Food Services Government & Public Services SMEs & Night Markets Others |

| By Payment Method | Card-on-File (credit/debit via tokenization) Bank Account/ACH Transfers Stored-Value Wallet/Prepaid Balance QR Code Scheme (e.g., Taiwan Pay QR) Others |

| By Transaction Size | Micro (? TWD 100) Small (TWD 101–500) Medium (TWD 501–2,000) Large (? TWD 2,001) Others |

| By User Demographics | Age Groups Income Levels Urban vs Rural Tech Savviness Others |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption & Tokenization Fraud & Risk Scoring Others |

| By Distribution Channel | Super Apps & Mobile Wallets Bank Mobile Apps Merchant POS/QR Acceptance Payment Gateways & PSPs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 150 | General Consumers, Tech-Savvy Users |

| Merchant Acceptance of Mobile Payments | 120 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 80 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 60 | Policy Makers, Financial Regulators |

| Consumer Attitudes Towards Security | 120 | General Consumers, Security-Conscious Users |

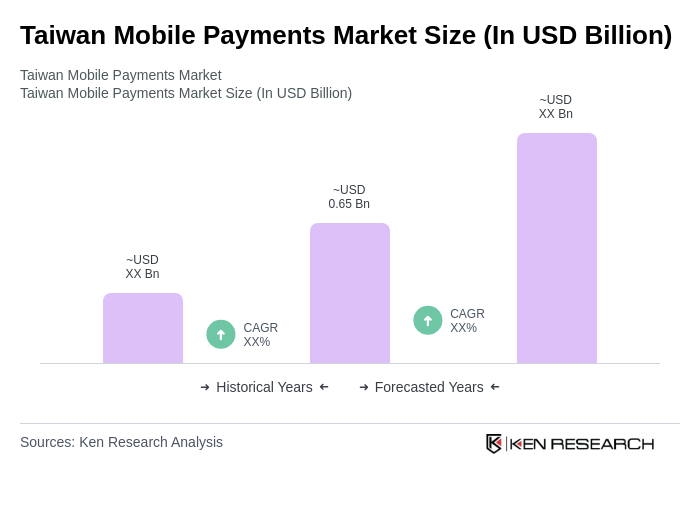

The Taiwan Mobile Payments Market is valued at approximately USD 0.65 billion, reflecting a significant growth trajectory. This value is based on a five-year historical analysis, indicating rapid adoption but still smaller than the overall cards and payments market.