Region:Asia

Author(s):Rebecca

Product Code:KRAD0272

Pages:92

Published On:August 2025

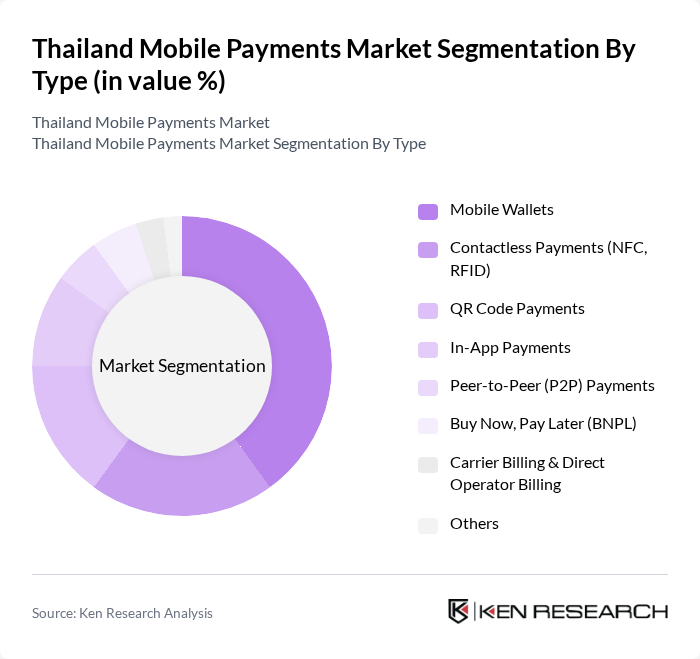

By Type:The mobile payments market is segmented into Mobile Wallets, Contactless Payments (NFC, RFID), QR Code Payments, In-App Payments, Peer-to-Peer (P2P) Payments, Buy Now, Pay Later (BNPL), Carrier Billing & Direct Operator Billing, and Others. Mobile Wallets have emerged as the leading segment, driven by their convenience, widespread adoption, and integration with retail and e-commerce platforms. Strategic partnerships between mobile wallet providers and merchants have further accelerated their use, making them the preferred choice for everyday transactions.

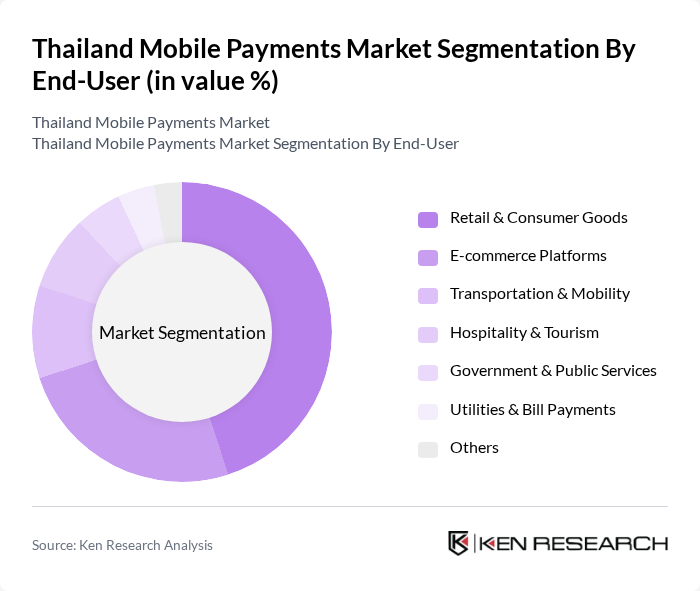

By End-User:The end-user segmentation of the mobile payments market includes Retail & Consumer Goods, E-commerce Platforms, Transportation & Mobility, Hospitality & Tourism, Government & Public Services, Utilities & Bill Payments, and Others. The Retail & Consumer Goods segment is the largest contributor, fueled by rapid adoption of mobile payment solutions in retail stores and supermarkets. The convenience and speed of mobile payments have led to increased consumer spending and higher transaction frequencies in this sector, making it a focal point for mobile payment providers.

The Thailand Mobile Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as TrueMoney, Rabbit LINE Pay, PromptPay, AirPay (now ShopeePay), K PLUS (Kasikornbank), SCB Easy (Siam Commercial Bank), Bangkok Bank Mobile Banking, Krungsri Mobile App (Bank of Ayudhya), TMB Touch (TMBThanachart Bank), UOB Mighty (United Overseas Bank), GrabPay, DeeMoney, DeepPocket, Paysolutions, DIGIO (THAILAND) CO., LTD. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand mobile payments market is poised for significant growth, driven by technological advancements and evolving consumer preferences. As digital literacy improves and more users become comfortable with mobile technology, the adoption of mobile payment solutions is expected to rise. Additionally, the integration of AI and blockchain technology will enhance security and efficiency, further encouraging consumer trust. The government’s continued support for cashless initiatives will also play a crucial role in shaping the future landscape of mobile payments in Thailand.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Contactless Payments (NFC, RFID) QR Code Payments In-App Payments Peer-to-Peer (P2P) Payments Buy Now, Pay Later (BNPL) Carrier Billing & Direct Operator Billing Others |

| By End-User | Retail & Consumer Goods E-commerce Platforms Transportation & Mobility Hospitality & Tourism Government & Public Services Utilities & Bill Payments Others |

| By Payment Method | PromptPay (Real-Time Bank Transfers) Credit Cards Debit Cards E-wallets Bank Transfers Mobile Network Operator Billing Cryptocurrency Others |

| By Demographics | Gen Z Millennials Generation X Baby Boomers Others |

| By Transaction Size | Micro Transactions ( |

| By Geographic Distribution | Urban Areas Rural Areas Tourist Areas Special Economic Zones Others |

| By Industry Vertical | Retail Healthcare Education Entertainment & Media Financial Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 120 | Regular Mobile Payment Users, Age 18-45 |

| Merchant Acceptance of Mobile Payments | 90 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 60 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Financial Regulators |

| Consumer Attitudes Towards Security | 70 | General Consumers, Age 25-55 |

The Thailand Mobile Payments Market is valued at approximately USD 31.8 billion, driven by factors such as increasing smartphone penetration, robust digital infrastructure, and a growing preference for cashless transactions among consumers and businesses.