Region:Asia

Author(s):Geetanshi

Product Code:KRAA1294

Pages:90

Published On:August 2025

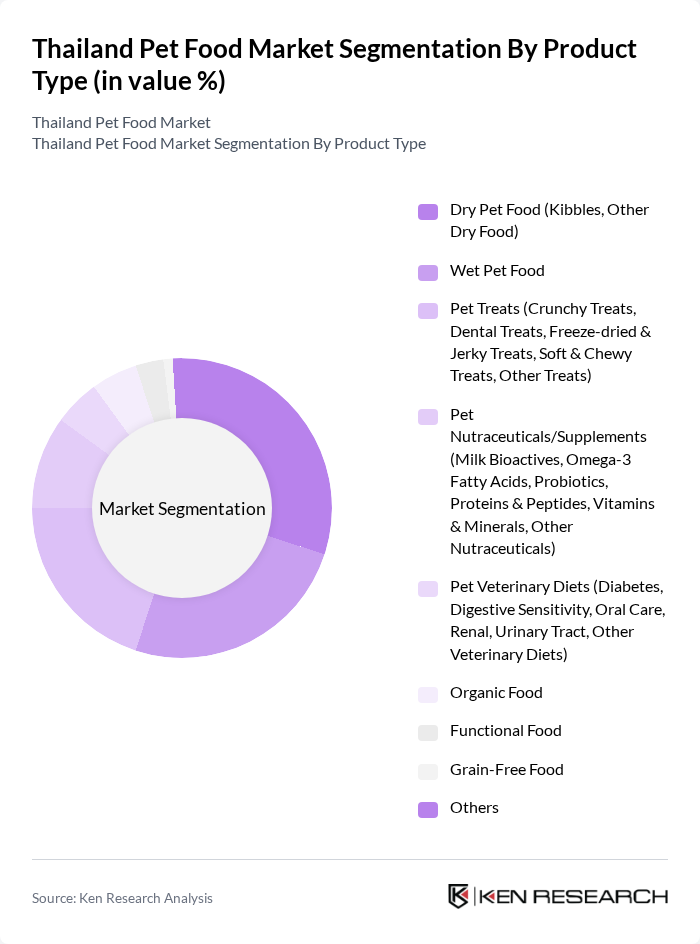

By Product Type:The product type segmentation includes various categories such as dry pet food, wet pet food, pet treats, nutraceuticals, veterinary diets, organic food, functional food, grain-free food, and others. Each of these subsegments caters to different consumer preferences and dietary needs for pets. Dry pet food remains the largest segment, followed by wet food and treats, with increasing demand for functional, organic, and grain-free products reflecting a shift toward specialized nutrition and premiumization .

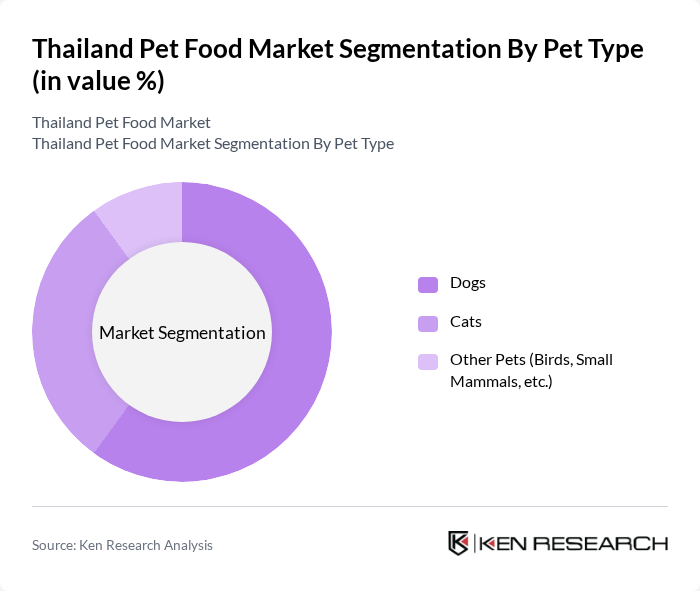

By Pet Type:The pet type segmentation includes dogs, cats, and other pets such as birds and small mammals. Each category reflects the varying preferences of pet owners and the specific dietary needs of different pet species. Dogs account for the majority of pet food sales, followed by cats, with birds and small mammals representing a smaller but growing segment .

The Thailand Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charoen Pokphand Foods Public Company Limited (CPF), Betagro Public Company Limited, Unicharm Corporation, Nestlé Purina PetCare (Thailand) Ltd., Mars Petcare (Thailand) Co., Ltd., Thai Union Group Public Company Limited, Perfect Companion Group Co., Ltd., Royal Canin (Thailand) Co., Ltd., Jerhigh (International Pet Food Co., Ltd.), SmartHeart (Perfect Companion Group Co., Ltd.), Pet Lover Centre (Thailand) Co., Ltd., Me-O (Perfect Companion Group Co., Ltd.), Mongkut Pet Food Co., Ltd., Thai Agri Foods Public Company Limited, Prima Pet Foods Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand pet food market is poised for continued growth, driven by increasing pet ownership and a shift towards premium products. As consumer preferences evolve, brands that focus on natural ingredients and sustainable practices are likely to gain a competitive edge. Additionally, the rise of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Overall, the market is expected to adapt to changing consumer demands while navigating challenges related to competition and raw material costs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dry Pet Food (Kibbles, Other Dry Food) Wet Pet Food Pet Treats (Crunchy Treats, Dental Treats, Freeze-dried & Jerky Treats, Soft & Chewy Treats, Other Treats) Pet Nutraceuticals/Supplements (Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins & Peptides, Vitamins & Minerals, Other Nutraceuticals) Pet Veterinary Diets (Diabetes, Digestive Sensitivity, Oral Care, Renal, Urinary Tract, Other Veterinary Diets) Organic Food Functional Food Grain-Free Food Others |

| By Pet Type | Dogs Cats Other Pets (Birds, Small Mammals, etc.) |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Pet Shops Convenience Stores E-commerce/Online Channel Direct Sales Other Channels |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | International Brands Local Brands |

| By Packaging Type | Bags Cans Pouches |

| By Nutritional Content | High Protein Low Carb Balanced Nutrition |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 60 | Product Development Managers, Marketing Directors |

| E-commerce Platforms | 40 | eCommerce Managers, Logistics Coordinators |

The Thailand pet food market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and a shift towards premium and organic pet food products.