Region:Europe

Author(s):Geetanshi

Product Code:KRAB2838

Pages:85

Published On:October 2025

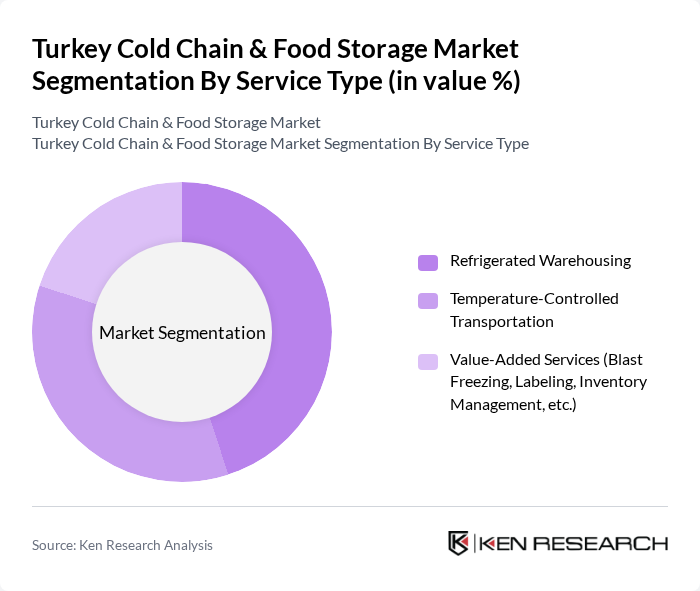

By Service Type:The service type segmentation includes various subsegments such as Refrigerated Warehousing, Temperature-Controlled Transportation, and Value-Added Services (Blast Freezing, Labeling, Inventory Management, etc.). Each of these subsegments plays a crucial role in ensuring the integrity of the cold chain process. Refrigerated warehousing is essential for storing perishable goods, while temperature-controlled transportation ensures that products remain at the required temperatures during transit. Value-added services enhance operational efficiency and customer satisfaction.

By Temperature Type:The temperature type segmentation consists of Chilled and Frozen categories. Chilled products are typically used for dairy, fruits, and vegetables, while frozen products are essential for meat, seafood, and certain processed foods. The demand for chilled storage is increasing due to the rising consumption of fresh produce and dairy products, while frozen storage remains critical for long-term preservation of various food items.

The Turkey Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tiryaki Agro, Aydinlar Group, TCDD Ta??mac?l?k A.?., Ekol Logistics, MNG Kargo, Netlog Logistics Group, Reysa? Logistics, Borusan Lojistik, Mars Logistics, Sutas Süt Ürünleri A.?., P?nar Süt, Y?ld?z Holding, Unilever Turkey, Nestle Turkey, Cold Chain Logistics Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The Turkey cold chain and food storage market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of IoT technologies is expected to enhance operational efficiency, while sustainability initiatives will shape future practices. As the demand for organic and locally sourced products rises, businesses will need to adapt their cold chain strategies to meet these trends, ensuring compliance with stringent food safety regulations and addressing infrastructure challenges.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Refrigerated Warehousing Temperature-Controlled Transportation Value-Added Services (Blast Freezing, Labeling, Inventory Management, etc.) |

| By Temperature Type | Chilled Frozen |

| By Application | Dairy Products (Milk, Butter, Cheese, Ice Cream, etc.) Meat, Fish, and Seafood Fruits and Vegetables Pharmaceuticals and Life Sciences Baking and Confectionery Chemicals Other Applications |

| By End-User | Food and Beverage Industry Pharmaceuticals Agri Industry Retail Sector Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Sales Channel | Online Sales Offline Retail Wholesale Distribution Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Cold Storage Facilities Tax Incentives for Cold Chain Investments Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 60 | Facility Managers, Operations Directors |

| Food Manufacturers | 50 | Production Managers, Supply Chain Coordinators |

| Logistics Providers | 40 | Logistics Managers, Business Development Executives |

| Retail Food Outlets | 45 | Store Managers, Inventory Control Specialists |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

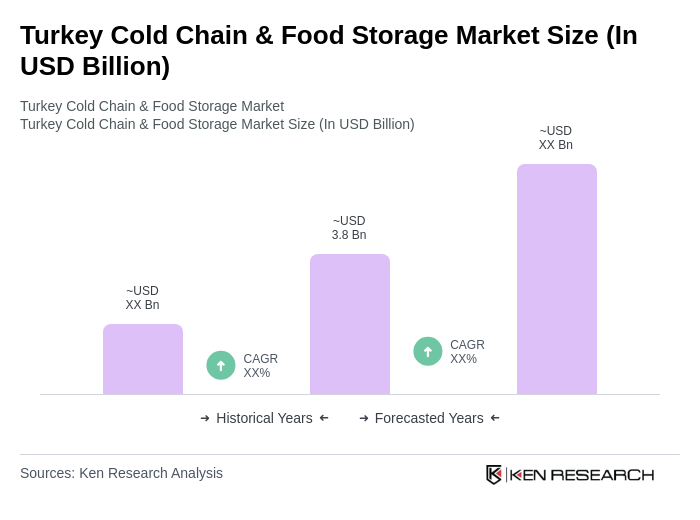

The Turkey Cold Chain & Food Storage Market is valued at approximately USD 3.8 billion, driven by the increasing demand for perishable goods and advancements in technology and logistics, enhancing operational efficiency and food safety.