Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2803

Pages:90

Published On:October 2025

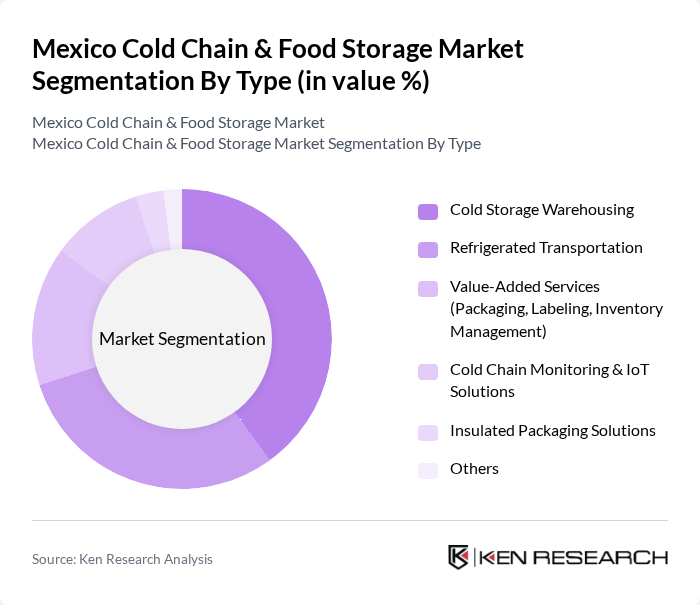

By Type:The cold chain market is segmented into various types, including Cold Storage Warehousing, Refrigerated Transportation, Value-Added Services, Cold Chain Monitoring & IoT Solutions, Insulated Packaging Solutions, and Others. Among these,Cold Storage Warehousingis the leading segment due to the increasing need for temperature-controlled storage facilities to preserve the quality of perishable goods. The demand for refrigerated transportation is also significant, driven by the growth of e-commerce and the need for timely delivery of fresh products. Recent trends highlight the adoption of advanced monitoring systems and energy-efficient refrigeration technologies to optimize operational efficiency .

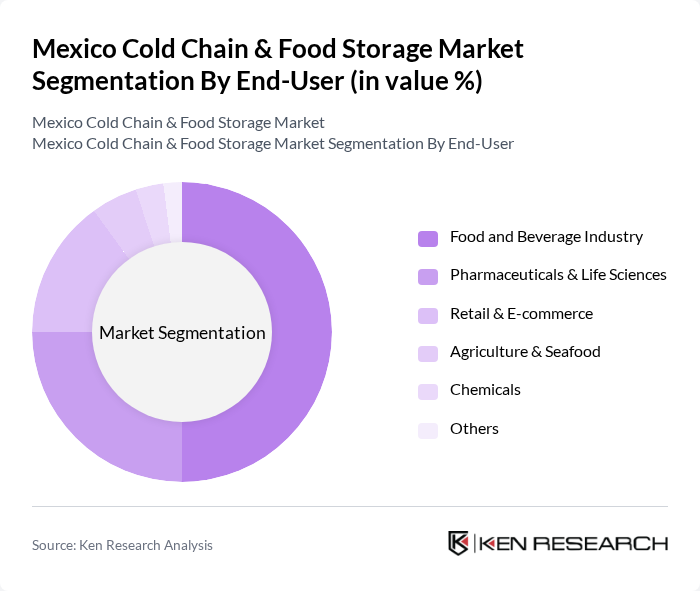

By End-User:The end-user segmentation includes the Food and Beverage Industry, Pharmaceuticals & Life Sciences, Retail & E-commerce, Agriculture & Seafood, Chemicals, and Others. TheFood and Beverage Industryis the dominant segment, driven by the increasing consumption of perishable products and the need for efficient storage and transportation solutions. The Pharmaceuticals & Life Sciences sector also plays a crucial role, as temperature-sensitive medications require stringent cold chain management. The rise of online grocery and meal delivery services is further boosting demand across end-user segments .

The Mexico Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frialsa Frigoríficos, Emergent Cold LatAm, Americold Logistics, Lineage Logistics, DHL Supply Chain Mexico, Solistica, Grupo Traxión, ARCOSA, Grupo Serbom, FrioPuerto, Transportes Castores, Grupo TMM, Logyt, Cold Chain Technologies Mexico, Grupo Marítima Sureste contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico cold chain and food storage market appears promising, driven by technological advancements and increasing consumer demand for fresh produce. The integration of IoT and smart technologies is expected to enhance operational efficiency, while government initiatives will likely focus on improving infrastructure. As e-commerce continues to expand, businesses will need to adapt their logistics strategies to meet consumer expectations for quality and safety, ensuring a robust cold chain system that supports market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Storage Warehousing Refrigerated Transportation Value-Added Services (Packaging, Labeling, Inventory Management) Cold Chain Monitoring & IoT Solutions Insulated Packaging Solutions Others |

| By End-User | Food and Beverage Industry Pharmaceuticals & Life Sciences Retail & E-commerce Agriculture & Seafood Chemicals Others |

| By Application | Dairy Products Meat, Poultry and Seafood Fruits and Vegetables Processed & Packaged Foods Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Platforms Retail Outlets Others |

| By Region | Northern Mexico (Baja California, Sonora, Chihuahua, Nuevo León) Central Mexico Southern Mexico Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (5°C to 25°C) Others |

| By Service Type | Third-Party Logistics (3PL) Integrated Logistics Services Value-Added Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Food Manufacturers | 80 | Production Managers, Supply Chain Coordinators |

| Logistics Providers | 70 | Logistics Managers, Business Development Executives |

| Retail Sector Stakeholders | 60 | Retail Operations Managers, Procurement Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

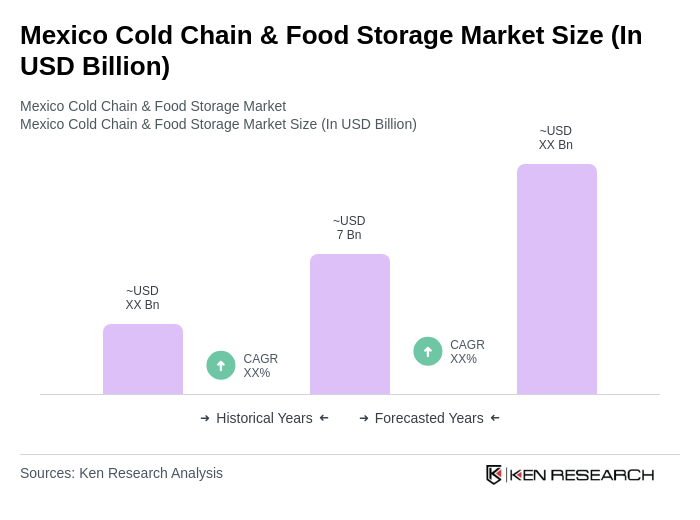

The Mexico Cold Chain & Food Storage Market is valued at approximately USD 7 billion, driven by the increasing demand for perishable goods, urbanization, and the growth of the food and beverage sector.