Region:Asia

Author(s):Geetanshi

Product Code:KRAB2791

Pages:95

Published On:October 2025

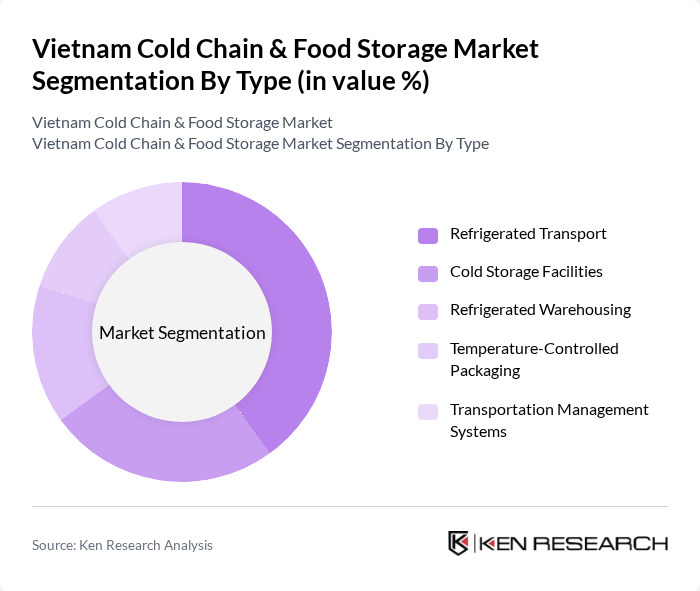

By Type:The market is segmented into Refrigerated Transport, Cold Storage Facilities, Refrigerated Warehousing, Temperature-Controlled Packaging, and Transportation Management Systems. Each segment is essential for maintaining the integrity of perishable goods throughout the supply chain. Refrigerated Transport is currently the leading sub-segment, driven by the rapid growth of e-commerce, increased demand for fresh food deliveries, and investments in temperature-controlled fleets to ensure product quality during transit.

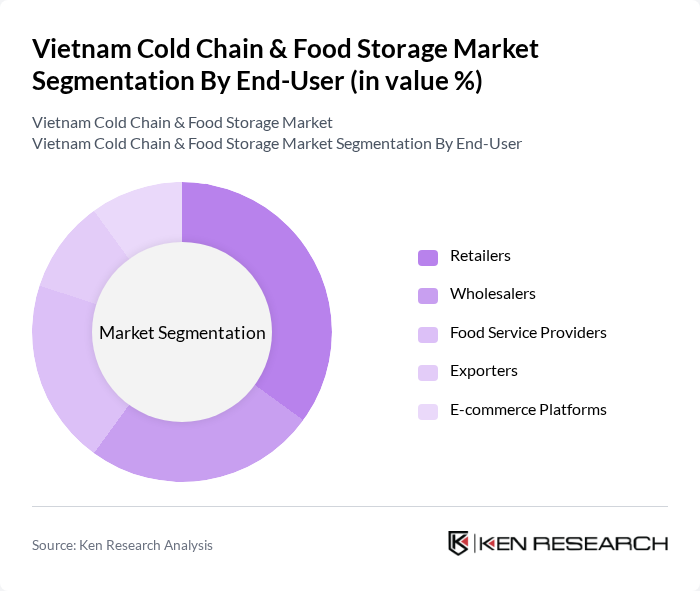

By End-User:The end-user segmentation includes Retailers, Wholesalers, Food Service Providers, Exporters, and E-commerce Platforms. Each segment has distinct requirements for cold chain logistics. Retailers are the dominant end-user segment, supported by the growing trend of fresh food consumption, expansion of supermarket chains, and the need for efficient supply chain solutions to meet consumer demands for quality and safety.

The Vietnam Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as VIETPHAT Group, Cold Storage Thang Loi, TransContinental Logistics, Vinamilk, CJ Logistics Vietnam, ABA Cooltrans, Tan Bao An Logistics, Saigon Newport Corporation, Mekong Logistics, Satra Group (Saigon Trading Group), Vinafco Joint Stock Corporation, Gemadept Corporation, Hoang Anh Gia Lai Group, Binh Minh Import-Export Company, and Green Logistics Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam cold chain and food storage market is poised for significant transformation, driven by technological advancements and increasing consumer expectations. The integration of IoT technologies is expected to enhance supply chain efficiency, while sustainable practices will gain traction as environmental concerns rise. Additionally, the government's commitment to improving food safety standards will likely create a more robust regulatory framework, fostering a competitive environment that encourages innovation and investment in cold chain solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Refrigerated Warehousing Temperature-Controlled Packaging Transportation Management Systems |

| By End-User | Retailers Wholesalers Food Service Providers Exporters E-commerce Platforms |

| By Application | Fruits Vegetables Herbs Bakery and Confectionery Dairy and Frozen Desserts Meat, Fish and Seafood Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment |

| By Sales Channel | Online Sales Offline Sales |

| By Price Range | Premium Mid-Range Budget |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facility Operations | 60 | Facility Managers, Operations Directors |

| Food Distribution Logistics | 50 | Logistics Coordinators, Supply Chain Managers |

| Agricultural Producers' Cold Chain Needs | 40 | Farm Owners, Agricultural Consultants |

| Retail Sector Cold Chain Practices | 55 | Retail Managers, Inventory Control Specialists |

| Food Safety Compliance in Cold Chain | 45 | Quality Assurance Managers, Compliance Officers |

The Vietnam Cold Chain & Food Storage Market is valued at approximately USD 1.2 billion, driven by the increasing demand for perishable goods, rising consumer awareness regarding food safety, and the growth of the e-commerce sector.