Region:Asia

Author(s):Geetanshi

Product Code:KRAB2842

Pages:93

Published On:October 2025

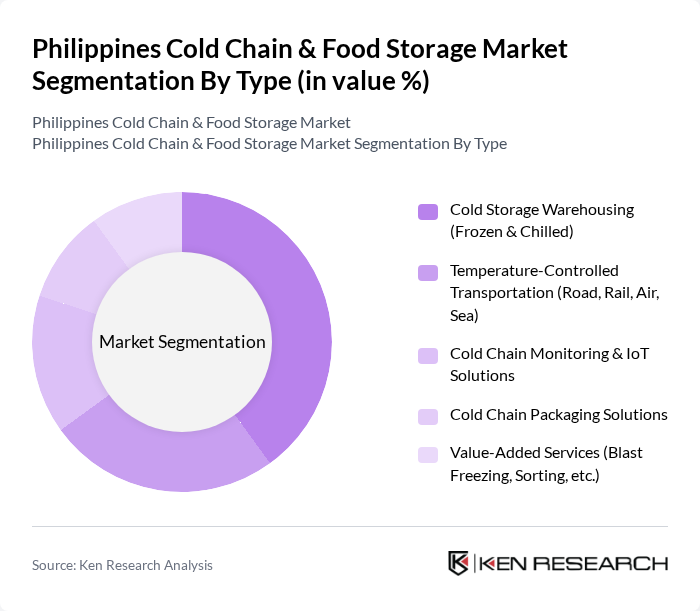

By Type:The market is segmented into various types, including Cold Storage Warehousing (Frozen & Chilled), Temperature-Controlled Transportation (Road, Rail, Air, Sea), Cold Chain Monitoring & IoT Solutions, Cold Chain Packaging Solutions, and Value-Added Services (Blast Freezing, Sorting, etc.). Among these,Cold Storage Warehousingis the leading segment due to the increasing demand for frozen and chilled products, driven by the food and beverage industry. The adoption of automation, temperature monitoring, and energy-efficient systems is transforming warehousing operations. Temperature-controlled transportation is also expanding rapidly, supported by investments in refrigerated trucks and last-mile delivery solutions for e-commerce and pharmaceuticals.

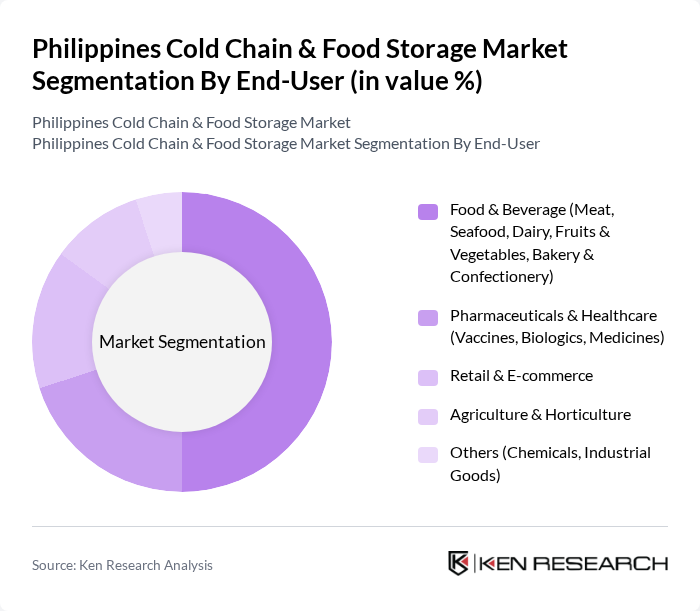

By End-User:The end-user segmentation includes Food & Beverage (Meat, Seafood, Dairy, Fruits & Vegetables, Bakery & Confectionery), Pharmaceuticals & Healthcare (Vaccines, Biologics, Medicines), Retail & E-commerce, Agriculture & Horticulture, and Others (Chemicals, Industrial Goods). TheFood & Beverage sectordominates this segment, driven by the increasing consumption of perishable goods, the shift towards convenience and frozen foods, and the growing trend of online grocery shopping. The Pharmaceuticals & Healthcare segment is expanding due to rising demand for temperature-sensitive medicines and vaccines, especially following the pandemic.

The Philippines Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jentec Storage Inc., Glacier Megafridge Inc., Royal Cargo Inc., Big Blue Logistics Corporation, Mets Logistics, Inc., Cold Chain Solutions, Inc., Fast Logistics Group, Koldstor Centre Philippines, Inc., Royal Cargo Logistics, Inc., Thermo King Philippines, Cargill Philippines, Inc., San Miguel Corporation, Universal Robina Corporation, Del Monte Philippines, Inc., AgriNurture, Inc. contribute to innovation, geographic expansion, and service delivery in this space. These companies are investing in capacity expansion, value-added services, and technology integration to enhance operational efficiency and meet evolving customer requirements.

The future of the Philippines cold chain and food storage market appears promising, driven by technological advancements and increasing consumer demand for quality food products. As the government continues to invest in infrastructure improvements, the sector is expected to witness enhanced efficiency and reduced food waste. Furthermore, the integration of IoT and automation technologies will streamline operations, providing real-time monitoring and management of cold chain processes, ultimately leading to improved food safety and quality assurance.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Storage Warehousing (Frozen & Chilled) Temperature-Controlled Transportation (Road, Rail, Air, Sea) Cold Chain Monitoring & IoT Solutions Cold Chain Packaging Solutions Value-Added Services (Blast Freezing, Sorting, etc.) |

| By End-User | Food & Beverage (Meat, Seafood, Dairy, Fruits & Vegetables, Bakery & Confectionery) Pharmaceuticals & Healthcare (Vaccines, Biologics, Medicines) Retail & E-commerce Agriculture & Horticulture Others (Chemicals, Industrial Goods) |

| By Distribution Mode | Direct Distribution (Captive Logistics) Third-Party Logistics (3PL/4PL) E-commerce Fulfillment Others |

| By Application | Fresh Produce Dairy & Ice Cream Meat, Poultry & Seafood Pharmaceuticals & Vaccines Others |

| By Sales Channel | Online Sales Retail Outlets Wholesale Distributors Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 85 | Facility Managers, Operations Directors |

| Food Manufacturers | 75 | Production Managers, Supply Chain Coordinators |

| Logistics Providers | 65 | Logistics Managers, Fleet Supervisors |

| Retail Sector Cold Chain | 55 | Store Managers, Procurement Officers |

| Pharmaceutical Cold Chain | 45 | Quality Assurance Managers, Regulatory Affairs Specialists |

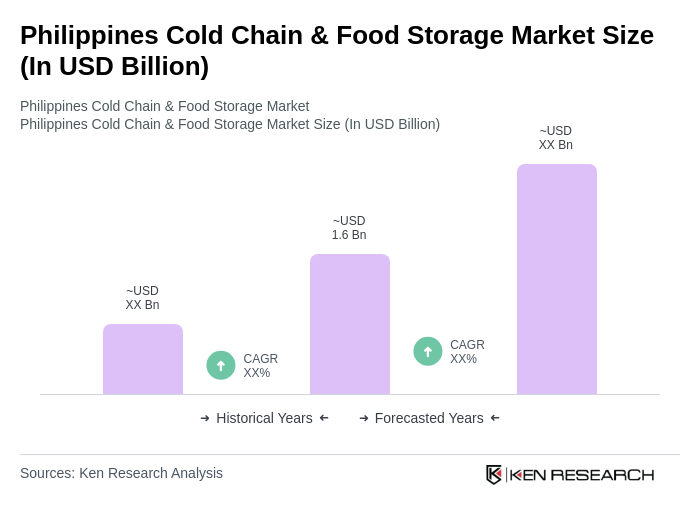

The Philippines Cold Chain & Food Storage Market is valued at approximately USD 1.6 billion, driven by the increasing demand for perishable goods, advancements in technology, and the expansion of the food and beverage sector.