Region:Middle East

Author(s):Geetanshi

Product Code:KRAB2776

Pages:91

Published On:October 2025

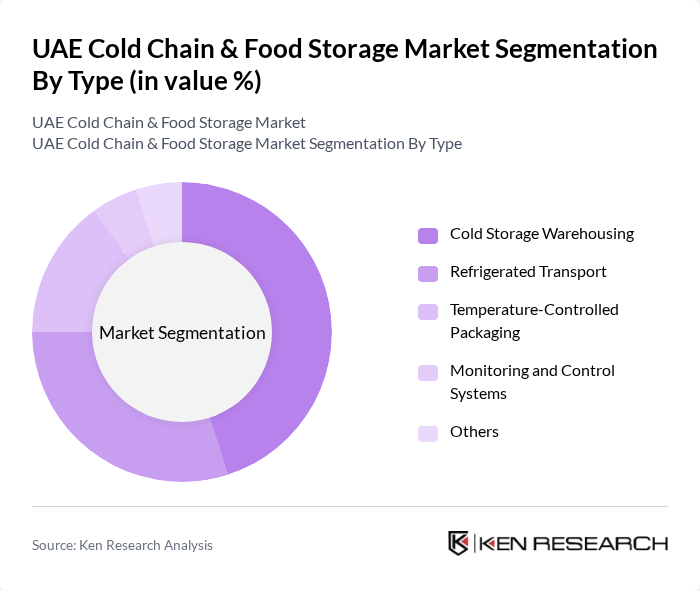

By Type:The market is segmented into various types, including Cold Storage Warehousing, Refrigerated Transport, Temperature-Controlled Packaging, Monitoring and Control Systems, and Others. Among these, Cold Storage Warehousing is the leading segment, driven by the increasing need for efficient storage solutions for perishable goods such as meat, seafood, dairy, and fresh produce. The demand for refrigerated transport is also significant, ensuring the safe and timely delivery of temperature-sensitive products across the region. Recent trends include the adoption of automated storage systems and IoT-based monitoring for real-time temperature tracking .

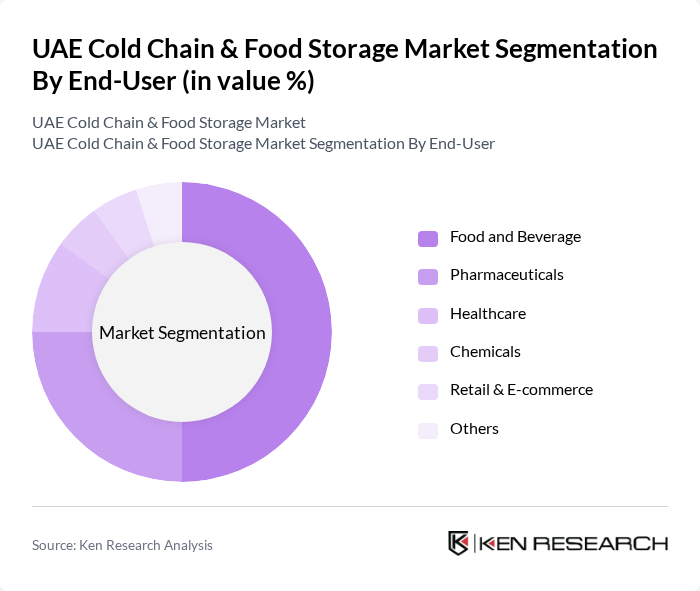

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Healthcare, Chemicals, Retail & E-commerce, and Others. The Food and Beverage sector dominates this market, driven by the increasing consumption of perishable products, rising imports of specialty foods, and the growing trend of online grocery shopping. The Pharmaceuticals segment is also significant, as it requires stringent temperature controls for the storage and transportation of sensitive medications and vaccines. Healthcare and chemicals are emerging as important segments due to regulatory requirements and the need for safe handling of temperature-sensitive materials .

The UAE Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Logistics, Agility Logistics, Emirates Logistics LLC, GWC (Gulf Warehousing Company), Almarai, Gulf Cold Storage, Al Jazeera Cold Storage, Al Mufeed Cold Storage, National Cold Storage Company, Al Watania Logistics, Emirates SkyCargo, RSA Cold Chain, Al Ain Farms, Al Ghurair Foods, Al Dahra Holding contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cold chain and food storage market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of IoT and automation is expected to enhance operational efficiency, while the shift towards sustainable practices will align with global environmental goals. Additionally, the increasing focus on food safety and security will further stimulate investments in cold storage infrastructure, ensuring that the market adapts to the growing demand for perishable goods and e-commerce services.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Storage Warehousing Refrigerated Transport Temperature-Controlled Packaging Monitoring and Control Systems Others |

| By End-User | Food and Beverage Pharmaceuticals Healthcare Chemicals Retail & E-commerce Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Online Platforms Others |

| By Application | Meat and Seafood Dairy Products Fruits and Vegetables Frozen Foods Pharmaceuticals Others |

| By Temperature Range | Ambient (Above 5°C) Chilled (0°C to 5°C) Frozen (-18°C and below) Others |

| By Service Type | Storage Services Transportation Services Packaging Services Value-Added Services (e.g., Inventory Management, Order Fulfillment) Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Food Retailers | 70 | Supply Chain Managers, Procurement Officers |

| Food Distributors | 60 | Logistics Coordinators, Sales Managers |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Food Service Providers | 50 | Operations Managers, Quality Assurance Heads |

The UAE Cold Chain & Food Storage Market is valued at approximately USD 1.4 billion, driven by the increasing demand for perishable goods and advancements in logistics technology, such as warehouse automation and real-time monitoring.