Region:Europe

Author(s):Geetanshi

Product Code:KRAB2815

Pages:87

Published On:October 2025

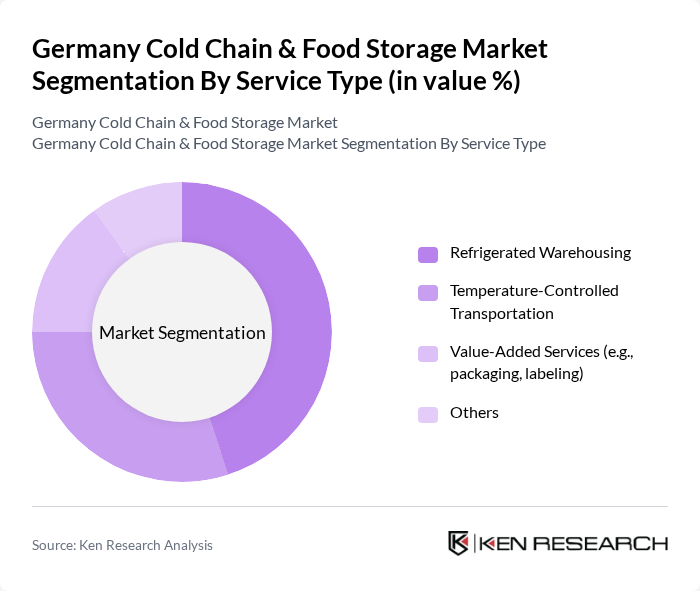

By Service Type:The service type segmentation includes Refrigerated Warehousing, Temperature-Controlled Transportation, Value-Added Services (e.g., packaging, labeling), and Others. Refrigerated Warehousing is the leading subsegment, accounting for the largest share due to the increasing need for storage solutions that maintain the quality and safety of perishable goods. The growth of e-commerce and the demand for just-in-time delivery in the food and pharmaceutical sectors further fuel the need for efficient warehousing. Temperature-Controlled Transportation is also expanding rapidly, driven by investments in EV-compatible multi-temperature truck bodies and last-mile delivery infrastructure .

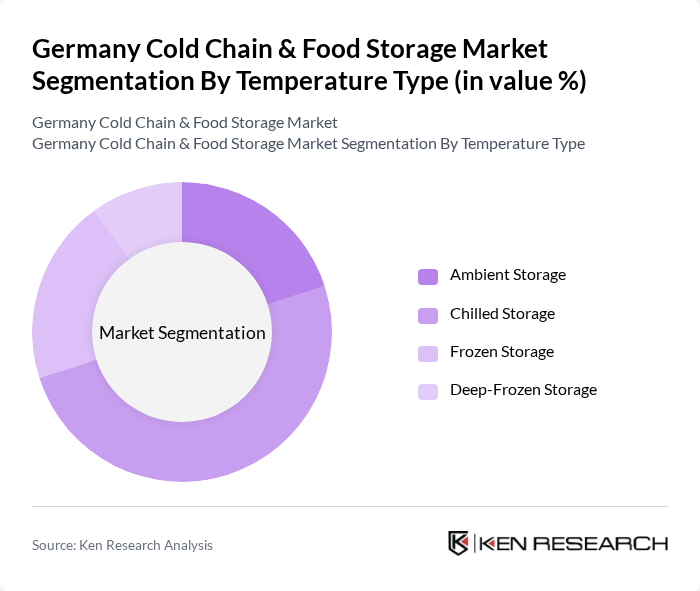

By Temperature Type:The temperature type segmentation encompasses Ambient Storage, Chilled Storage, Frozen Storage, and Deep-Frozen Storage. Chilled Storage is the dominant subsegment, primarily due to the rising consumption of fresh produce, dairy products, and pharmaceuticals that require specific temperature controls (0°C to 8°C). Investments in chilled storage facilities have surged, supported by regulatory incentives for energy-efficient retrofits and the need to maintain product freshness and quality across the supply chain .

The Germany Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Post DHL Group, Kuehne + Nagel International AG, DB Schenker, Rhenus Logistics, NewCold Advanced Logistics, Lineage Logistics, Nagel-Group, A.P. Moller-Maersk, STEF Germany GmbH, Frigo-Trans GmbH, Nordfrost GmbH & Co. KG, BLG Logistics Group AG & Co. KG, Kühne + Nagel, DSV Panalpina, Americold Realty Trust contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and food storage market in Germany appears promising, driven by technological innovations and increasing consumer awareness regarding food safety. As the demand for organic and locally sourced products rises, companies are likely to invest in advanced cold chain solutions to ensure product integrity. Additionally, the integration of smart technologies will enhance operational efficiency, enabling businesses to adapt to evolving market dynamics and consumer preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Refrigerated Warehousing Temperature-Controlled Transportation Value-Added Services (e.g., packaging, labeling) Others |

| By Temperature Type | Ambient Storage Chilled Storage Frozen Storage Deep-Frozen Storage |

| By Application | Dairy Products Meat and Seafood Fruits and Vegetables Processed Food Products Pharmaceuticals & Life Sciences Others |

| By Mode of Transportation | Road Rail Air Sea |

| By Ownership | Owned Leased Public-Private Partnership (PPP) Others |

| By End-User Industry | Food and Beverage Pharmaceuticals Retail Others |

| By Region | North South East West Central |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Food Distribution | 100 | Logistics Managers, Supply Chain Directors |

| Cold Storage Facilities | 60 | Facility Managers, Operations Supervisors |

| Pharmaceutical Cold Chain | 50 | Quality Assurance Managers, Compliance Officers |

| Food Delivery Services | 40 | Operations Managers, Delivery Coordinators |

| Logistics Technology Providers | 40 | Product Managers, Technology Officers |

The Germany Cold Chain & Food Storage Market is valued at approximately USD 12.3 billion, driven by the increasing demand for perishable goods, advancements in technology, and a focus on food safety standards.