Region:Central and South America

Author(s):Shubham

Product Code:KRAB6564

Pages:94

Published On:October 2025

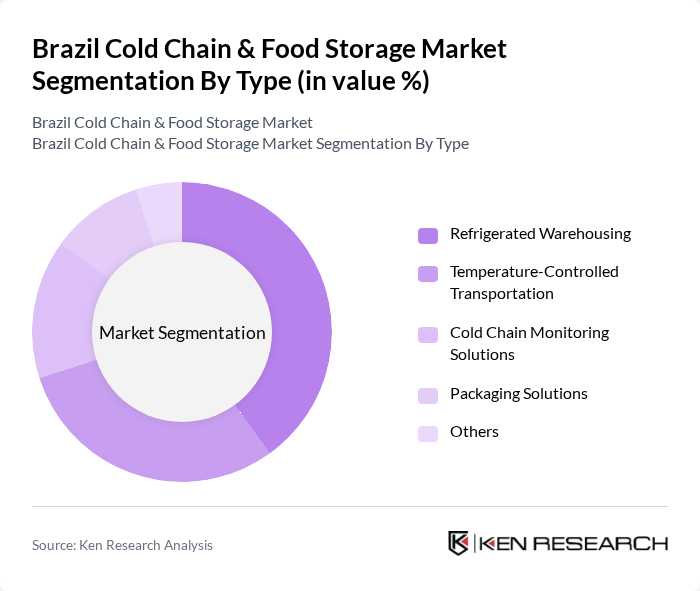

By Type:The market is segmented into various types, including Refrigerated Warehousing, Temperature-Controlled Transportation, Cold Chain Monitoring Solutions, Packaging Solutions, and Others. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain.

The Refrigerated Warehousing segment is currently dominating the market due to the increasing need for storage facilities that can maintain optimal temperatures for perishable goods. This segment benefits from the growing food and beverage industry, which requires efficient storage solutions to minimize spoilage and ensure product quality. Additionally, advancements in warehousing technology, such as automated storage and retrieval systems, are enhancing operational efficiency, further solidifying its market leadership.

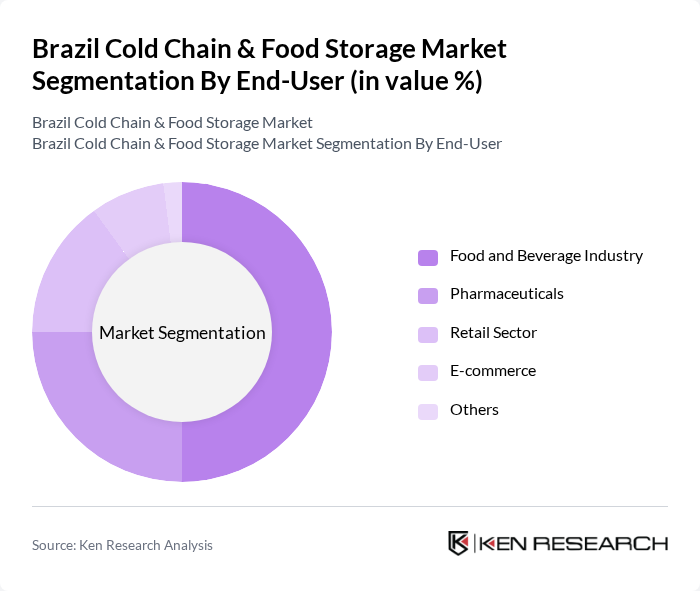

By End-User:The market is segmented by end-users, including the Food and Beverage Industry, Pharmaceuticals, Retail Sector, E-commerce, and Others. Each end-user category has unique requirements and contributes differently to the overall market dynamics.

The Food and Beverage Industry is the leading end-user segment, accounting for a significant portion of the market. This dominance is attributed to the high demand for fresh produce, dairy products, and meat, which require stringent temperature controls during storage and transportation. The increasing consumer preference for convenience foods and ready-to-eat meals is also driving the need for efficient cold chain solutions in this sector.

The Brazil Cold Chain & Food Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Martins, Friozem, Logística Frio, Cold Chain Solutions, JBS S.A., BRF S.A., Grupo Pão de Açúcar, Cargill, Sysco Corporation, DHL Supply Chain, Kuehne + Nagel, Maersk, XPO Logistics, Rhenus Logistics, TEGMA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil cold chain and food storage market appears promising, driven by technological advancements and increasing consumer expectations for food quality. As the market adapts to the growing demand for perishable goods and e-commerce, investments in cold storage facilities and IoT technologies are expected to rise. Additionally, the focus on sustainability and energy efficiency will shape operational strategies, ensuring compliance with evolving regulations while enhancing overall supply chain resilience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehousing Temperature-Controlled Transportation Cold Chain Monitoring Solutions Packaging Solutions Others |

| By End-User | Food and Beverage Industry Pharmaceuticals Retail Sector E-commerce Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics Online Platforms Others |

| By Application | Fresh Produce Dairy Products Meat and Seafood Pharmaceuticals Others |

| By Sales Channel | Wholesale Retail Online Sales Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Cold Storage Facilities Tax Incentives for Energy Efficiency Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cold Chain Operations | 150 | Supply Chain Managers, Operations Directors |

| Food Processing Facilities | 100 | Plant Managers, Quality Assurance Officers |

| Agricultural Producers | 80 | Farm Owners, Logistics Coordinators |

| Cold Storage Providers | 70 | Facility Managers, Business Development Executives |

| Food Service Industry | 90 | Restaurant Owners, Supply Chain Analysts |

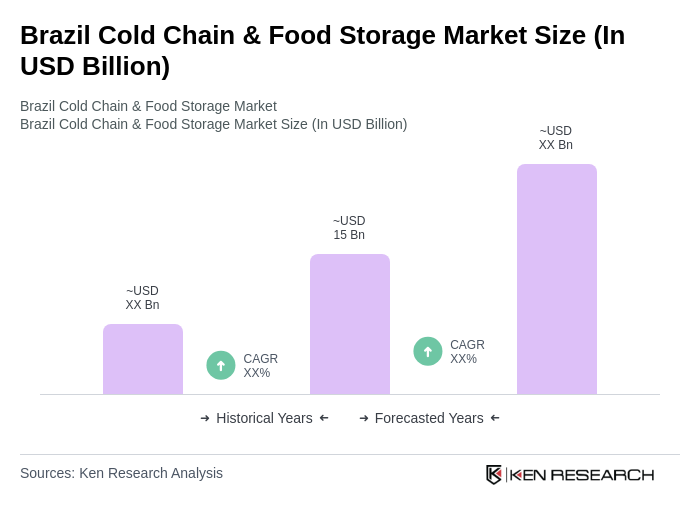

The Brazil Cold Chain & Food Storage Market is valued at approximately USD 15 billion, driven by the increasing demand for perishable goods, advancements in logistics technology, and the expansion of the food and beverage sector.