Region:Europe

Author(s):Geetanshi

Product Code:KRAB2792

Pages:84

Published On:October 2025

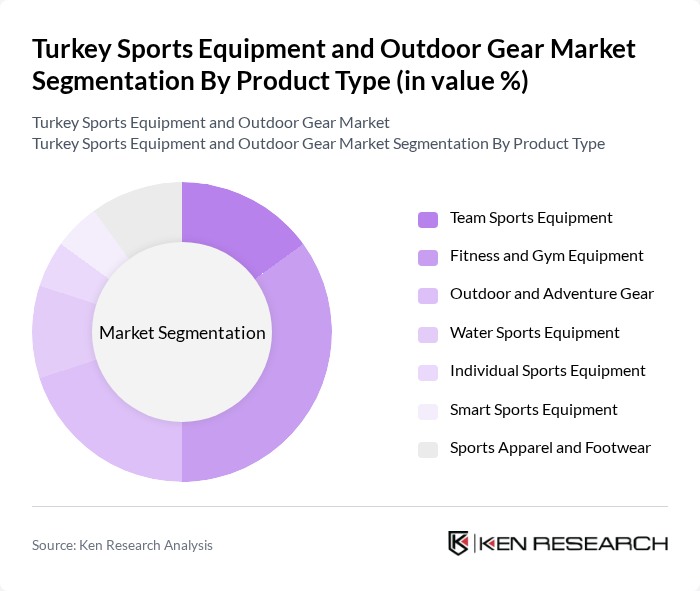

By Product Type:The product type segmentation includes various categories such as Team Sports Equipment, Fitness and Gym Equipment, Outdoor and Adventure Gear, Water Sports Equipment, Individual Sports Equipment, Smart Sports Equipment, and Sports Apparel and Footwear. Among these, Fitness and Gym Equipment is currently dominating the market due to the increasing trend of home workouts, gym memberships, and the expansion of fitness centers. The rise in health awareness, the influence of fitness influencers, and the adoption of smart fitness devices have significantly influenced consumer preferences, leading to a surge in demand for gym-related products .

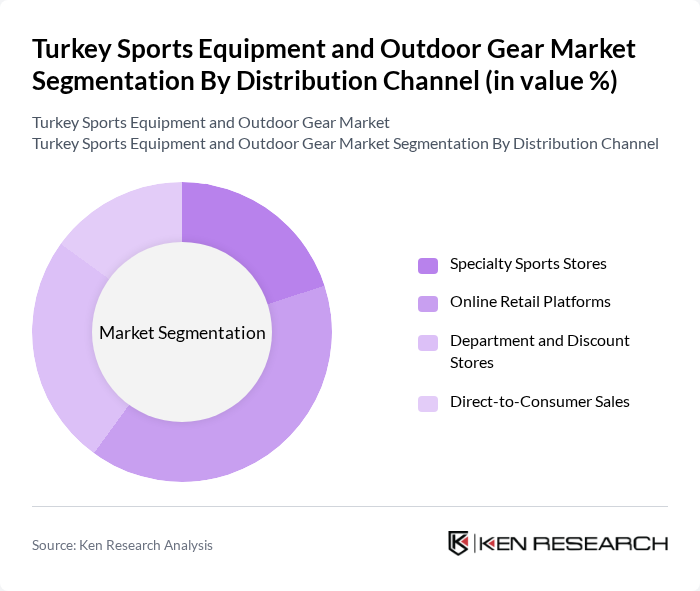

By Distribution Channel:The distribution channel segmentation includes Specialty Sports Stores, Online Retail Platforms, Department and Discount Stores, and Direct-to-Consumer Sales. Online Retail Platforms are currently leading the market, driven by the convenience of shopping, increasing penetration of e-commerce, and the expansion of digital payment options in Turkey. The COVID-19 pandemic accelerated the shift towards online shopping, and this trend continues as consumers prefer the ease of purchasing sports equipment from home. Omnichannel strategies and digital marketing have further strengthened the online segment .

The Turkey Sports Equipment and Outdoor Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Turkey, Nike Turkey, Adidas Turkey, Intersport Turkey, Sportive (FLO Ma?azac?l?k), Kinetix (Erke Spor), Lescon (Aeropostale Turkey), Hummel Turkey, Columbia Sportswear Turkey, The North Face Turkey, Salomon Turkey, Under Armour Turkey, ASICS Turkey, New Balance Turkey, Puma Turkey contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey sports equipment and outdoor gear market appears promising, driven by increasing consumer interest in health and fitness. As more individuals engage in outdoor activities, the demand for innovative and high-quality sports gear is expected to rise. Additionally, the integration of technology in sports equipment, such as smart wearables, will likely attract tech-savvy consumers, further enhancing market growth. Companies that adapt to these trends will be well-positioned for success in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Team Sports Equipment Fitness and Gym Equipment Outdoor and Adventure Gear Water Sports Equipment Individual Sports Equipment Smart Sports Equipment Sports Apparel and Footwear |

| By Distribution Channel | Specialty Sports Stores Online Retail Platforms Department and Discount Stores Direct-to-Consumer Sales |

| By Price Segment | Mass Market Mid-Priced Premium |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Professional Teams Government and Public Sector |

| By Geographic Region | Marmara Region Aegean Region Mediterranean Region Central Anatolia Other Regions |

| By Consumer Behavior | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Focused Consumers |

| By Application | Recreational Use Professional and Competitive Sports Fitness and Training |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment | 150 | Store Managers, Sales Representatives |

| Outdoor Gear Retailers | 100 | Product Managers, Marketing Executives |

| Fitness Equipment Manufacturers | 80 | Production Managers, Quality Assurance Officers |

| Consumer Insights on Sports Participation | 120 | Active Sports Participants, Outdoor Enthusiasts |

| Market Trends in E-commerce for Sports Gear | 100 | E-commerce Managers, Digital Marketing Specialists |

The Turkey Sports Equipment and Outdoor Gear Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increased health consciousness and outdoor recreational activities among consumers.