Region:Middle East

Author(s):Rebecca

Product Code:KRAB7764

Pages:92

Published On:October 2025

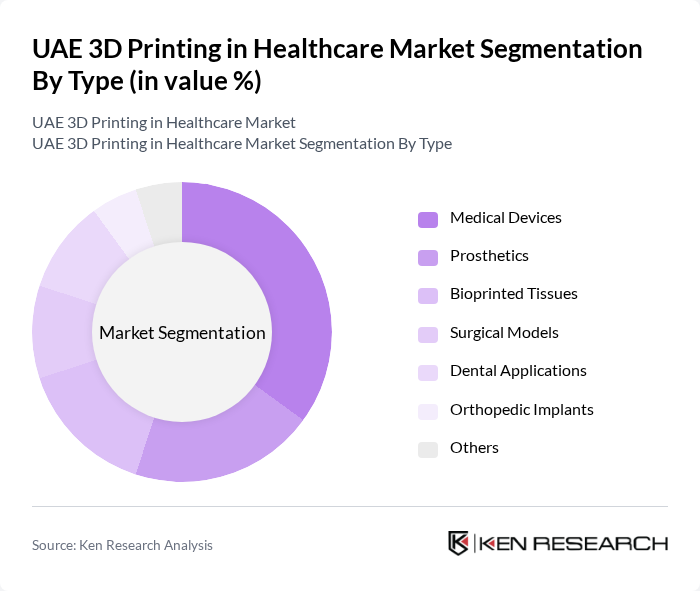

By Type:The market is segmented into various types, including Medical Devices, Prosthetics, Bioprinted Tissues, Surgical Models, Dental Applications, Orthopedic Implants, and Others. Among these, Medical Devices are leading the market due to their critical role in enhancing patient care and the growing trend of personalized medicine. The demand for customized medical solutions is driving innovation and adoption in this segment.

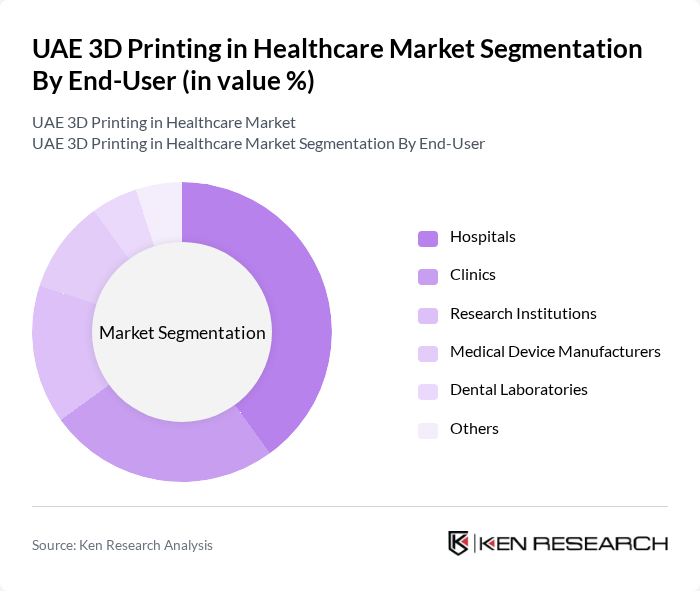

By End-User:The end-user segmentation includes Hospitals, Clinics, Research Institutions, Medical Device Manufacturers, Dental Laboratories, and Others. Hospitals are the leading end-user segment, driven by the increasing adoption of 3D printing technologies for surgical planning and patient-specific implants. The need for efficient and cost-effective healthcare solutions is propelling hospitals to integrate 3D printing into their operations.

The UAE 3D Printing in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, Materialise NV, Stryker Corporation, Siemens Healthineers, GE Healthcare, Formlabs Inc., Renishaw plc, EOS GmbH, HP Inc., Medtronic plc, EnvisionTEC, Ultimaker B.V., 3D Biotek LLC, Xilloc Medical B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE 3D printing in healthcare market appears promising, driven by technological advancements and increasing healthcare investments. By future, the integration of artificial intelligence with 3D printing is expected to enhance design capabilities and production efficiency. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly materials, aligning with global trends. As healthcare providers become more aware of the benefits, the adoption of 3D printing technologies is anticipated to accelerate, fostering innovation and improved patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Devices Prosthetics Bioprinted Tissues Surgical Models Dental Applications Orthopedic Implants Others |

| By End-User | Hospitals Clinics Research Institutions Medical Device Manufacturers Dental Laboratories Others |

| By Application | Surgical Planning Patient-Specific Implants Education and Training Prosthetic Development Bioprinting Others |

| By Material | Plastics Metals Ceramics Biomaterials Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Partnerships with Healthcare Providers Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Price Range | Low-End Products Mid-Range Products High-End Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Utilizing 3D Printing | 100 | Surgeons, Hospital Administrators |

| 3D Printing Service Providers | 80 | Business Development Managers, Technical Directors |

| Medical Device Manufacturers | 70 | Product Managers, R&D Engineers |

| Patients Receiving 3D Printed Solutions | 60 | Patients, Caregivers |

| Regulatory Bodies and Policy Makers | 50 | Regulatory Affairs Specialists, Policy Analysts |

The UAE 3D Printing in Healthcare Market is valued at approximately USD 1.2 billion, driven by technological advancements, increasing demand for personalized medical solutions, and the integration of 3D printing in surgical procedures.