Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7714

Pages:90

Published On:October 2025

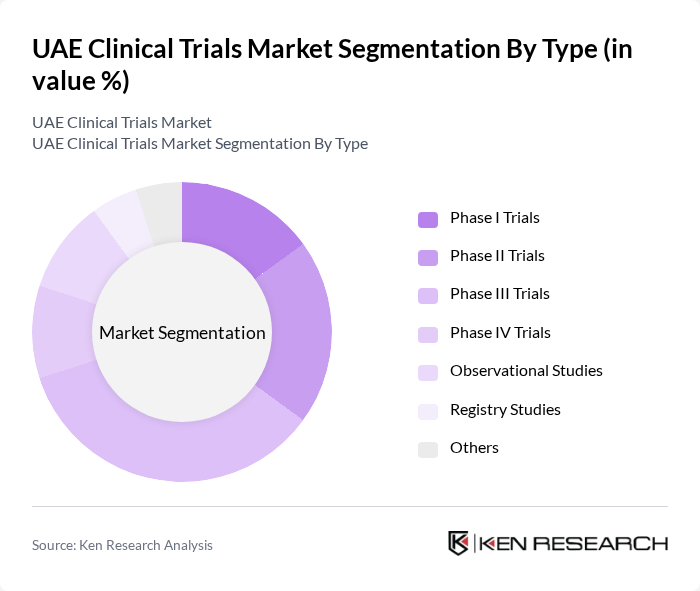

By Type:The clinical trials market is segmented into various types, including Phase I Trials, Phase II Trials, Phase III Trials, Phase IV Trials, Observational Studies, Registry Studies, and Others. Among these, Phase III Trials dominate the market due to their critical role in assessing the efficacy and safety of new treatments before they receive regulatory approval. The increasing number of innovative therapies and the demand for robust clinical evidence are driving the growth of this segment.

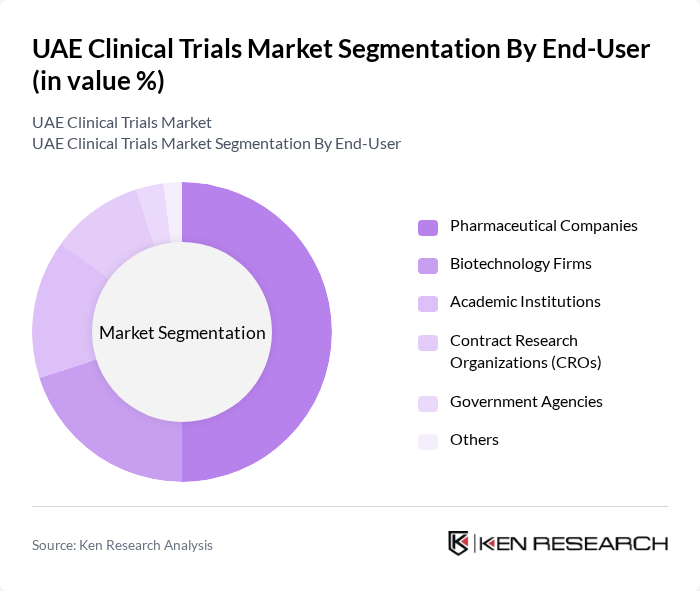

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic Institutions, Contract Research Organizations (CROs), Government Agencies, and Others. Pharmaceutical Companies are the leading end-users in the clinical trials market, driven by their need to develop new drugs and therapies. The increasing focus on personalized medicine and the growing number of clinical trials being conducted by these companies are key factors contributing to their dominance.

The UAE Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Clinical Trials Center, Dubai Health Authority, Gulf Clinical Trials, Al Ain Healthcare Group, Emirates Clinical Research Institute, Novartis Pharmaceuticals, Pfizer Inc., Roche Diagnostics, Sanofi S.A., Merck & Co., Inc., AstraZeneca PLC, Johnson & Johnson, GSK (GlaxoSmithKline), Bayer AG, Eli Lilly and Company contribute to innovation, geographic expansion, and service delivery in this space.

The UAE clinical trials market is poised for significant transformation, driven by advancements in technology and a shift towards decentralized trial models. The integration of artificial intelligence and digital health solutions is expected to streamline trial processes, enhancing efficiency and patient engagement. Furthermore, the increasing focus on personalized medicine will likely lead to more targeted therapies, fostering innovation. As regulatory frameworks evolve to accommodate these changes, the market is anticipated to attract more international collaborations and investments, positioning the UAE as a key player in clinical research.

| Segment | Sub-Segments |

|---|---|

| By Type | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials Observational Studies Registry Studies Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic Institutions Contract Research Organizations (CROs) Government Agencies Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Endocrinology Others |

| By Study Design | Randomized Controlled Trials Non-Randomized Trials Cross-Sectional Studies Longitudinal Studies Others |

| By Patient Population | Adult Population Pediatric Population Geriatric Population Others |

| By Geographic Location | Urban Areas Rural Areas Others |

| By Funding Source | Government Funding Private Funding Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 100 | Oncologists, Clinical Research Associates |

| Cardiovascular Studies | 80 | Cardiologists, Trial Coordinators |

| Diabetes Management Trials | 70 | Endocrinologists, Research Nurses |

| Neurology Clinical Trials | 60 | Neurologists, Clinical Trial Managers |

| Pediatric Clinical Research | 50 | Pediatricians, Ethics Committee Members |

The UAE Clinical Trials Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by investments in healthcare infrastructure, rising chronic disease prevalence, and a focus on pharmaceutical research and development.