Region:Asia

Author(s):Dev

Product Code:KRAC3483

Pages:94

Published On:October 2025

The APAC Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as IQVIA Inc., Novotech, Parexel International Corporation, ICON plc, Syneos Health, LabCorp (Laboratory Corporation of America Holdings), Covance Inc. (now part of LabCorp), Charles River Laboratories, Medpace, Inc., Thermo Fisher Scientific Inc., Avance Clinical, WuXi AppTec, AbbVie, Merck Sharp & Dohme LLC, PPD, Inc. (now part of Thermo Fisher Scientific) contribute to innovation, geographic expansion, and service delivery in this space.

**Notes on Competitive Landscape Table:** - Parexel International Corporation was established in 1982, not 1983. - Syneos Health headquarters is in Morrisville, North Carolina, USA, not Morristown, New Jersey. **Sources:**

The APAC clinical trials market is poised for transformative growth, driven by technological advancements and a shift towards patient-centric approaches. As artificial intelligence and real-world evidence studies become more prevalent, they will enhance trial efficiency and patient engagement. Additionally, the rise of decentralized trials is expected to facilitate broader patient participation, particularly in remote areas, thereby improving recruitment rates and data quality. These trends indicate a dynamic future for clinical research in the region.

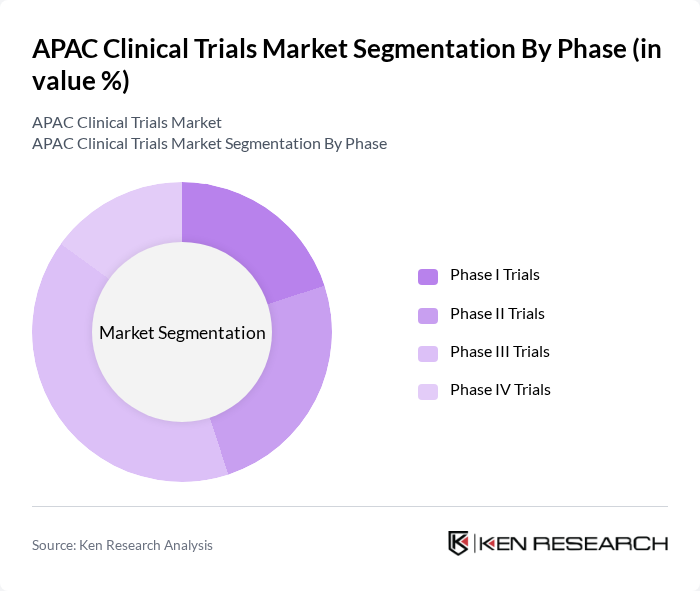

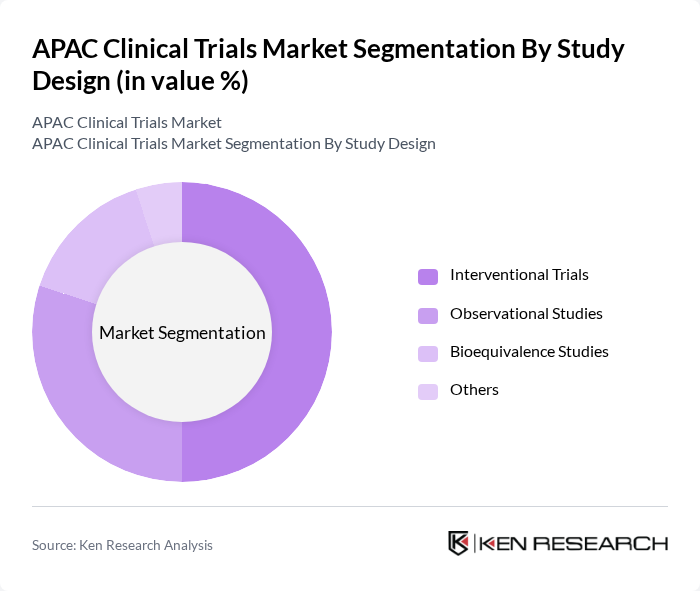

| Segment | Sub-Segments |

|---|---|

| By Phase | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials |

| By Study Design | Interventional Trials Observational Studies Bioequivalence Studies Others |

| By Sponsor | Pharmaceutical & Biopharmaceutical Companies Biotechnology Firms Academic Institutions Contract Research Organizations (CROs) |

| By Indication (Therapeutic Area) | Oncology Cardiovascular Diseases Neurology Infectious Diseases Metabolic Disorders Others |

| By Country/Region | China India Japan South Korea Australia Southeast Asia (Singapore, Malaysia, Thailand, Vietnam, Indonesia, Philippines) Rest of Asia-Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 120 | Clinical Research Coordinators, Oncologists |

| Cardiovascular Clinical Trials | 100 | Cardiologists, Clinical Trial Managers |

| Neurology Clinical Trials | 80 | Neuroscientists, Research Directors |

| Diabetes Clinical Trials | 60 | Endocrinologists, Clinical Operations Managers |

| Rare Disease Clinical Trials | 50 | Principal Investigators, Regulatory Affairs Specialists |

The APAC Clinical Trials Market is valued at approximately USD 17.5 billion, driven by factors such as the increasing prevalence of chronic diseases, rising R&D investments, and the demand for innovative therapies across the region.