Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4190

Pages:88

Published On:December 2025

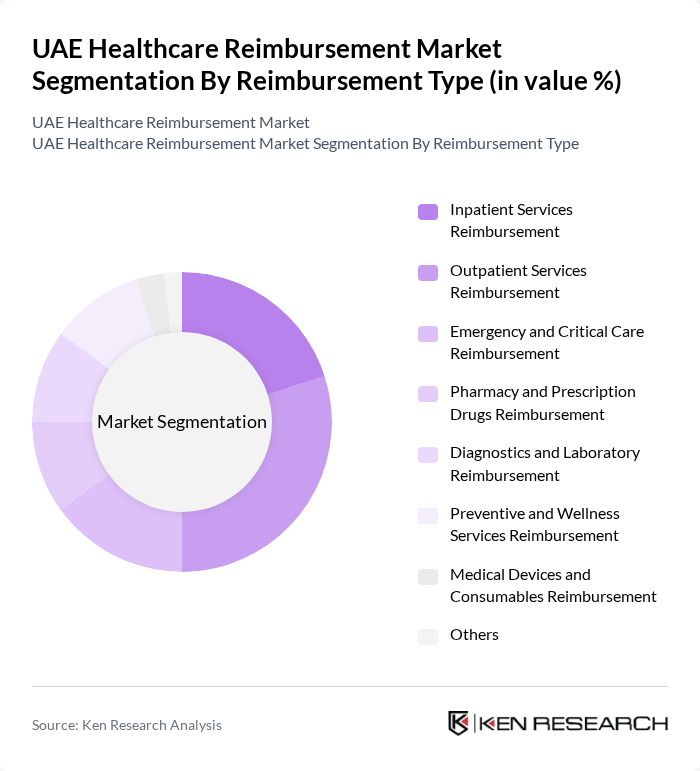

By Reimbursement Type:The reimbursement type segmentation includes various categories such as inpatient services, outpatient services, emergency and critical care, pharmacy and prescription drugs, diagnostics and laboratory services, preventive and wellness services, medical devices and consumables, and others. Among these, outpatient services reimbursement is currently dominating the market due to the increasing preference for outpatient care, which is often more cost-effective and convenient for patients. The trend towards preventive care and wellness services is also gaining traction, reflecting a shift in consumer behavior towards proactive health management.

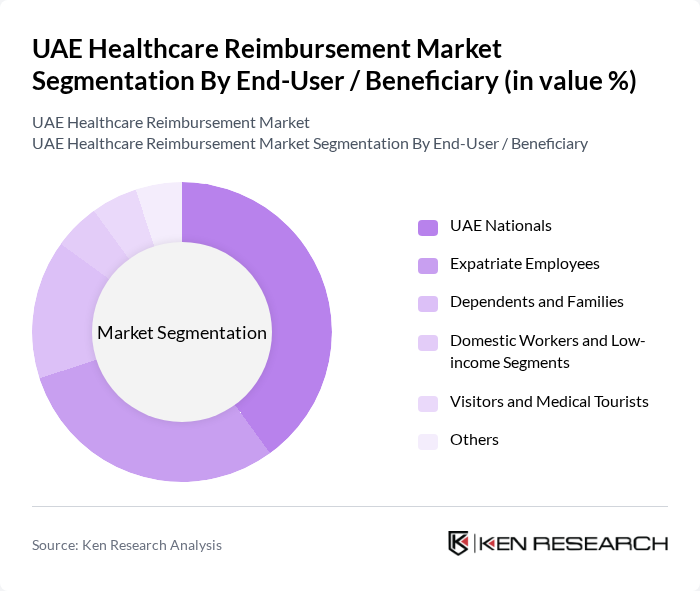

By End-User / Beneficiary:The end-user segmentation includes UAE nationals, expatriate employees, dependents and families, domestic workers and low-income segments, visitors and medical tourists, and others. UAE nationals represent the largest segment due to government support and comprehensive health insurance coverage provided through public schemes. Expatriate employees also form a significant portion of the market, driven by the large expatriate population in the UAE, which necessitates robust health insurance solutions.

The UAE Healthcare Reimbursement Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Health Insurance Company – Daman, Abu Dhabi National Insurance Company (ADNIC), Oman Insurance Company (Sukoon Insurance), Orient Insurance PJSC, AXA Cooperative Insurance (GIG Gulf), MetLife Gulf (American Life Insurance Company – ALICO), Cigna Insurance Middle East S.A.L., Allianz Partners (Allianz Care), Emirates Insurance Company PSC, Noor Takaful – Watania, Qatar Insurance Company QIC (QIC Insured), Ras Al Khaimah National Insurance Company (RAKNIC), Dubai Insurance Company PSC, RSA Insurance (Intact Insurance Specialty Solutions – UAE operations), Aetna International (Aetna Inc., a CVS Health company) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE healthcare reimbursement market is poised for significant transformation, driven by technological advancements and evolving patient expectations. The integration of digital health solutions is expected to streamline reimbursement processes, enhancing efficiency and accuracy. Additionally, the focus on value-based care models will likely reshape reimbursement strategies, emphasizing patient outcomes over service volume. As the market adapts to these trends, stakeholders must remain agile to capitalize on emerging opportunities and address ongoing challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Reimbursement Type | Inpatient Services Reimbursement Outpatient Services Reimbursement Emergency and Critical Care Reimbursement Pharmacy and Prescription Drugs Reimbursement Diagnostics and Laboratory Reimbursement Preventive and Wellness Services Reimbursement Medical Devices and Consumables Reimbursement Others |

| By End-User / Beneficiary | UAE Nationals Expatriate Employees Dependents and Families Domestic Workers and Low-income Segments Visitors and Medical Tourists Others |

| By Payer Type | Public / Government Schemes (e.g., Thiqa, SEHA, DHA Programs) Private Health Insurers Self-funded / Employer-sponsored Schemes Third-Party Administrators (TPAs) Others |

| By Service Provider Type | Public Hospitals and Health Systems Private Hospitals Polyclinics and Ambulatory Care Centers Diagnostic and Imaging Centers Pharmacies and Retail Chains Telehealth and Digital Health Providers Others |

| By Payment / Contracting Model | Fee-for-Service Capitation and Per-member-per-month (PMPM) Diagnosis-Related Groups (DRG) / Case-based Payments Pay-for-Performance and Value-based Contracts Bundled Payments and Episode-based Reimbursement Others |

| By Clinical Area | Cardiovascular and Metabolic Diseases Oncology Orthopedics and Musculoskeletal Maternal and Child Health Mental and Behavioral Health Others |

| By Geographic Distribution | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Reimbursement Processes | 100 | Hospital Administrators, Financial Officers |

| Private Insurance Provider Models | 80 | Insurance Underwriters, Claims Managers |

| Pharmaceutical Reimbursement Strategies | 70 | Pharmaceutical Sales Managers, Policy Analysts |

| Outpatient Services Reimbursement | 60 | Clinic Managers, Billing Specialists |

| Telehealth Reimbursement Trends | 40 | Telehealth Coordinators, IT Managers |

The UAE Healthcare Reimbursement Market is valued at approximately USD 8.7 billion, reflecting a significant growth driven by increasing healthcare demand, rising costs, and expanded health insurance coverage among the population.