Region:Middle East

Author(s):Shubham

Product Code:KRAA8842

Pages:91

Published On:November 2025

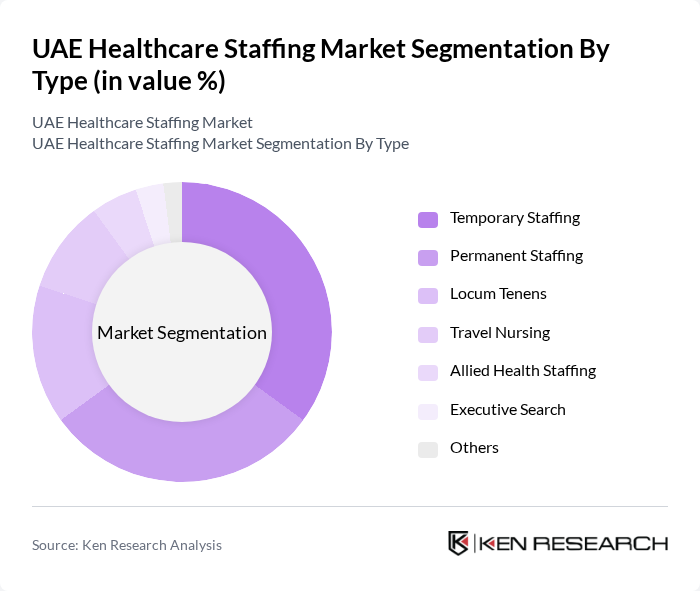

By Type:The healthcare staffing market in the UAE is segmented into Temporary Staffing, Permanent Staffing, Locum Tenens, Travel Nursing, Allied Health Staffing, Executive Search, and Others. Temporary Staffing is gaining traction due to its flexibility in addressing workforce shortages, especially during peak seasons, emergencies, and for project-based assignments. Permanent Staffing remains significant as healthcare organizations seek to build a stable workforce for continuity of care. Locum Tenens is increasingly utilized for specialist coverage and short-term needs, while Travel Nursing and Allied Health Staffing are expanding due to the rise in home healthcare and outpatient services. Executive Search is focused on leadership and senior clinical roles .

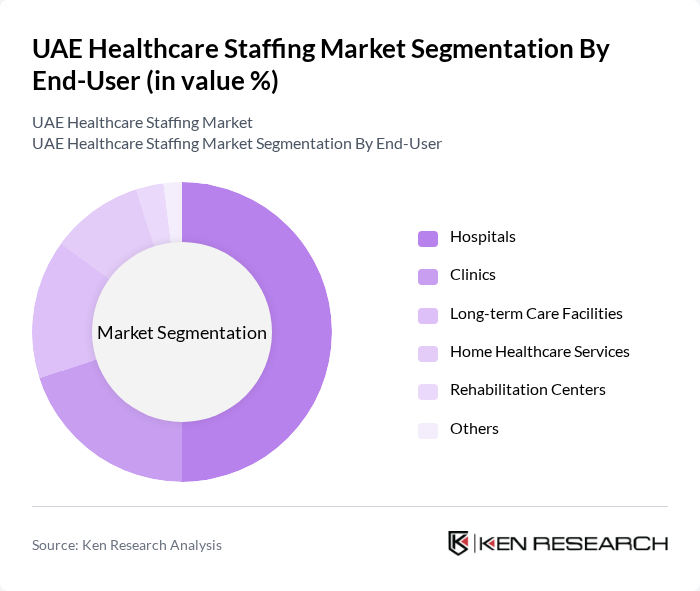

By End-User:The end-user segmentation includes Hospitals, Clinics, Long-term Care Facilities, Home Healthcare Services, Rehabilitation Centers, and Others. Hospitals are the largest end-users of healthcare staffing services, driven by the need for a diverse range of medical professionals to provide comprehensive patient care. Clinics and Home Healthcare Services are also significant, as they require specialized staff to cater to outpatient and home-based care needs. Long-term Care Facilities and Rehabilitation Centers are experiencing increased demand for allied health and nursing professionals, reflecting the UAE’s focus on chronic disease management and post-acute care .

The UAE Healthcare Staffing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medacs Healthcare, NMC Healthcare, Mediclinic Middle East, VPS Healthcare, Aster DM Healthcare, Al Zahra Hospital, United Eastern Medical Services (UEMedical), HealthPlus Network of Specialty Centers, SEHA (Abu Dhabi Health Services Company), Cleveland Clinic Abu Dhabi, Manzil Healthcare Services, Medcare Hospitals & Medical Centres, HCL Workforce Solutions, Al-Futtaim Health, NovaVita Specialised Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The UAE healthcare staffing market is poised for transformative growth, driven by technological advancements and evolving workforce dynamics. The integration of artificial intelligence in recruitment processes is expected to streamline hiring, while flexible staffing models will cater to the diverse needs of healthcare facilities. Additionally, the emphasis on diversity and inclusion will reshape hiring practices, fostering a more equitable workforce. These trends will collectively enhance the efficiency and effectiveness of healthcare staffing solutions in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Temporary Staffing Permanent Staffing Locum Tenens Travel Nursing Allied Health Staffing Executive Search Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Home Healthcare Services Rehabilitation Centers Others |

| By Specialty | Nursing Allied Health Professionals Physicians Administrative Staff Technicians & Technologists Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Al Ain Ras Al Khaimah Others |

| By Recruitment Method | Direct Recruitment Recruitment Agencies Online Job Portals Social Media Recruiting Internal Referrals Others |

| By Contract Type | Full-time Contracts Part-time Contracts Contract-to-Hire Freelance Contracts Others |

| By Service Type | Staffing Services Consulting Services Training Services Outsourcing Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Staffing Needs | 100 | HR Managers, Nursing Directors |

| Clinic Workforce Requirements | 60 | Clinic Managers, Practice Administrators |

| Long-term Care Facility Staffing | 50 | Facility Administrators, Care Coordinators |

| Healthcare Staffing Agencies | 40 | Agency Owners, Recruitment Specialists |

| Telehealth Service Providers | 40 | Telehealth Managers, IT Directors |

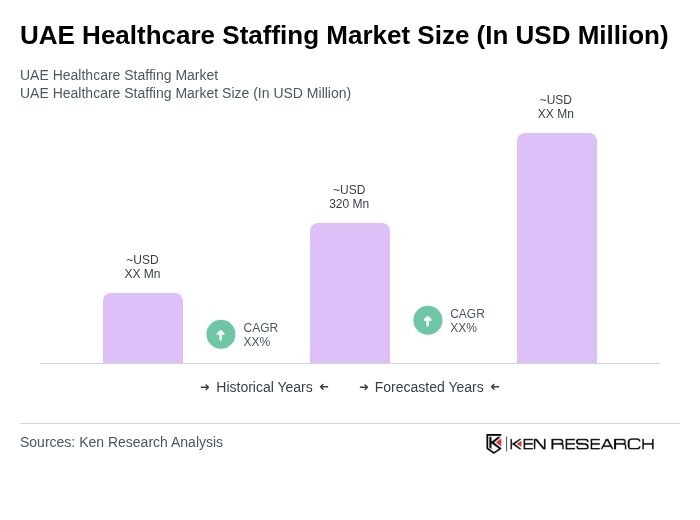

The UAE Healthcare Staffing Market is valued at approximately USD 320 million, reflecting its significant share within the broader Middle East and Africa healthcare staffing services market, which is valued at USD 743 million.