Region:Middle East

Author(s):Shubham

Product Code:KRAB7298

Pages:84

Published On:October 2025

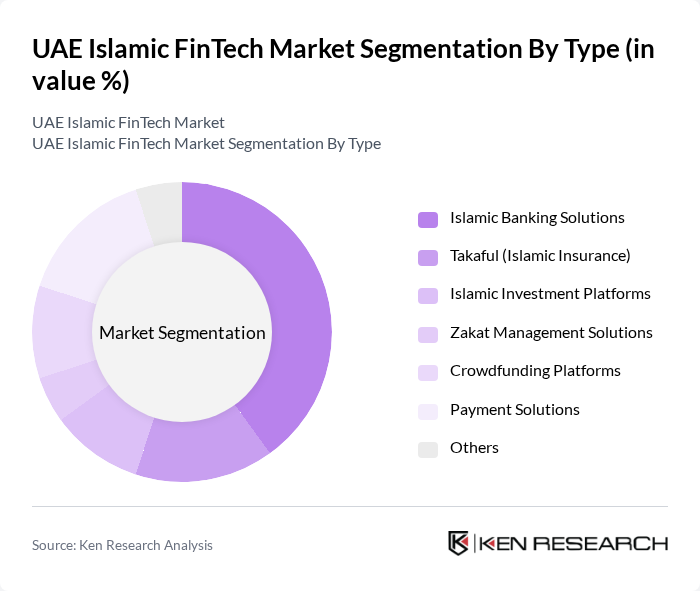

By Type:The market is segmented into various types, including Islamic Banking Solutions, Takaful (Islamic Insurance), Islamic Investment Platforms, Zakat Management Solutions, Crowdfunding Platforms, Payment Solutions, and Others. Each of these segments caters to specific consumer needs and preferences, with Islamic Banking Solutions being the most prominent due to the increasing demand for Sharia-compliant banking services.

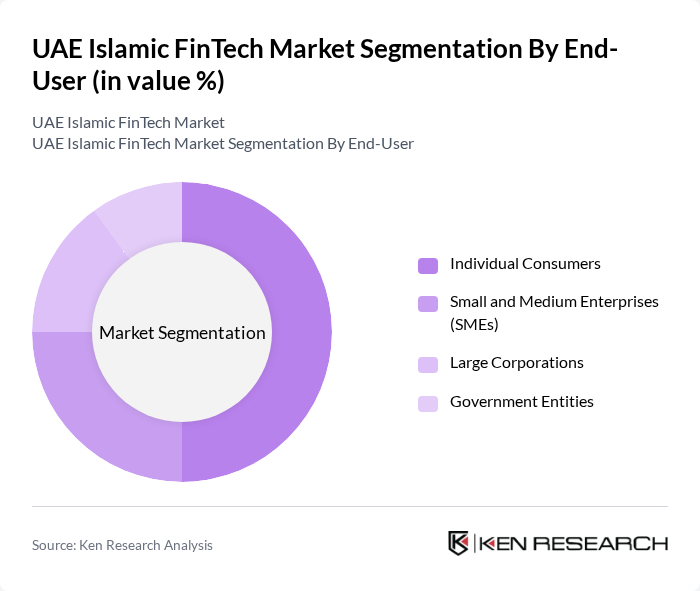

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, driven by the increasing number of tech-savvy users seeking personalized financial solutions that comply with Islamic principles.

The UAE Islamic FinTech market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Islamic Bank, Dubai Islamic Bank, Al Baraka Banking Group, Qatar Islamic Bank, Emirates Islamic Bank, Noor Bank, Abu Dhabi Investment Authority, Al Hilal Bank, Bank Al Jazira, Kuwait Finance House, Fawry for Banking Technology and Electronic Payments, PayTabs, Beehive, YAP, Sarwa contribute to innovation, geographic expansion, and service delivery in this space.

The UAE Islamic FinTech market is poised for significant growth, driven by technological advancements and increasing consumer demand for ethical financial solutions. As mobile banking and digital payment solutions become more prevalent, the integration of AI and machine learning will enhance customer experiences. Furthermore, the collaboration between Islamic FinTech firms and traditional banks is expected to create innovative products, addressing the needs of a diverse customer base. This synergy will likely lead to a more robust and competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Islamic Banking Solutions Takaful (Islamic Insurance) Islamic Investment Platforms Zakat Management Solutions Crowdfunding Platforms Payment Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Personal Finance Management Investment Management Payment Processing Risk Management |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Institutional Clients High Net-Worth Individuals |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) |

| By Regulatory Compliance Level | Fully Compliant Solutions Partially Compliant Solutions Non-Compliant Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Islamic Banking Services | 150 | Banking Executives, Product Managers |

| Islamic FinTech Startups | 100 | Founders, CTOs, Business Development Managers |

| Consumer Adoption of Islamic FinTech | 200 | End-users, Financial Service Consumers |

| Regulatory Impact on FinTech | 80 | Regulatory Officials, Compliance Officers |

| Investment Platforms in Islamic Finance | 70 | Investment Analysts, Portfolio Managers |

The UAE Islamic FinTech market is valued at approximately USD 2.5 billion, driven by the increasing adoption of digital banking solutions and a growing demand for Sharia-compliant financial products among a tech-savvy population.