Region:Middle East

Author(s):Rebecca

Product Code:KRAC1071

Pages:87

Published On:October 2025

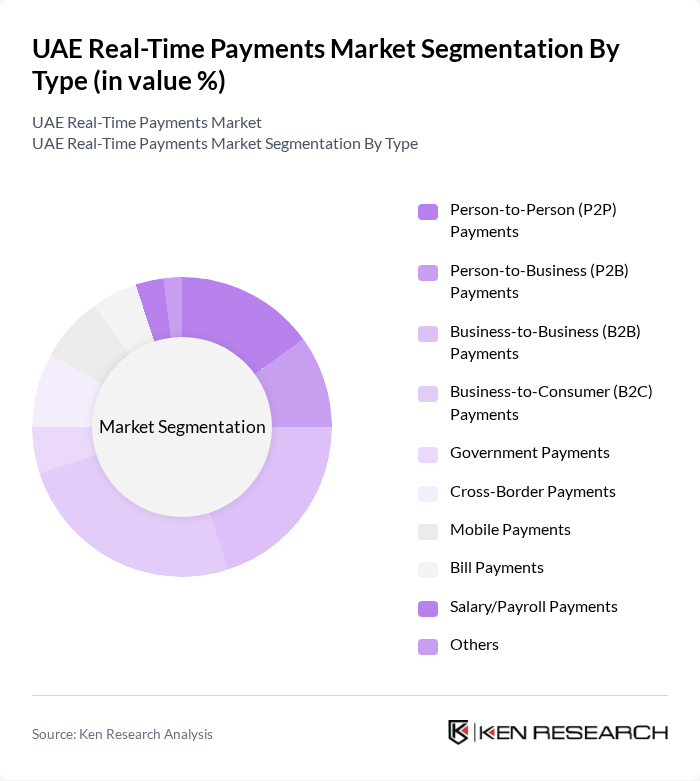

By Type:The segmentation by type includes various payment methods that cater to different transaction needs. The subsegments are Person-to-Person (P2P) Payments, Person-to-Business (P2B) Payments, Business-to-Business (B2B) Payments, Business-to-Consumer (B2C) Payments, Government Payments, Cross-Border Payments, Mobile Payments, Bill Payments, Salary/Payroll Payments, and Others. Among these, B2C Payments are currently leading the market due to the rapid growth of e-commerce and consumer preference for online shopping. Over 71% of ecommerce transactions in the UAE are made using cards or mobile wallets, reflecting the country’s shift towards instant, digital payment methods .

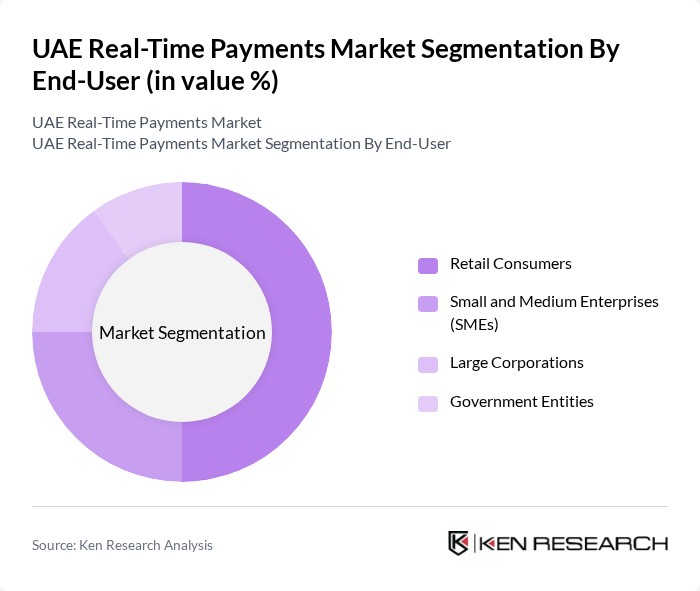

By End-User:The end-user segmentation includes Retail Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Retail Consumers dominate this segment, driven by the increasing use of mobile wallets and online shopping platforms. The convenience and speed of real-time payments have made them the preferred choice for everyday transactions. Retail and ecommerce end-users account for the largest share of real-time payment adoption, reflecting the UAE’s digital-first consumer base .

The UAE Real-Time Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Dubai Islamic Bank, Mashreq Bank, RAKBANK, Network International, PayFort (an Amazon company), Telr, Checkout.com, PayTabs, Stripe, Adyen, Wise, Denarii Cash, ACI Worldwide, Volante Technologies, Mastercard, Finastra, PayPal Holdings Inc., Alipay (Ant Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE real-time payments market appears promising, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security. Additionally, the growing trend towards contactless payments will likely reshape consumer behavior, leading to increased adoption of digital wallets. As the market evolves, collaboration between fintech companies and traditional banks will be crucial in addressing regulatory challenges and enhancing service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person (P2P) Payments Person-to-Business (P2B) Payments Business-to-Business (B2B) Payments Business-to-Consumer (B2C) Payments Government Payments Cross-Border Payments Mobile Payments Bill Payments Salary/Payroll Payments Others |

| By End-User | Retail Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers QR Code Payments Direct Account Transfers Mobile Money |

| By Industry Vertical | E-commerce Retail Hospitality Transportation Utilities Healthcare |

| By Transaction Size | Micro Transactions Small Transactions Medium Transactions Large Transactions |

| By Geographic Distribution | Urban Areas Rural Areas Free Zones |

| By Customer Segment | Individual Consumers Small Businesses Corporates Government Agencies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Insights | 60 | Chief Technology Officers, Payment Strategy Managers |

| Fintech Company Perspectives | 50 | Founders, Product Development Leads |

| Merchant Adoption Rates | 70 | Retail Managers, E-commerce Directors |

| Consumer Payment Preferences | 100 | General Consumers, Tech-Savvy Users |

| Regulatory Impact Analysis | 40 | Regulatory Affairs Specialists, Compliance Officers |

The UAE Real-Time Payments Market is valued at approximately USD 8.2 billion, reflecting significant growth driven by the adoption of digital payment solutions, e-commerce expansion, and government initiatives promoting a cashless economy.