Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1034

Pages:100

Published On:October 2025

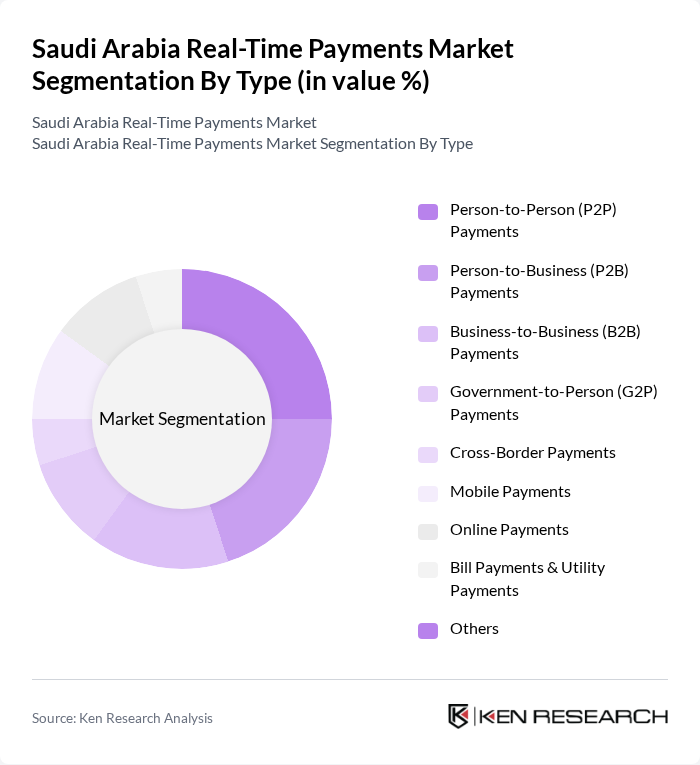

By Type:The segmentation of the market by type encompasses a diverse range of payment methods tailored to various consumer and business needs. The subsegments include Person-to-Person (P2P) Payments, Person-to-Business (P2B) Payments, Business-to-Business (B2B) Payments, Government-to-Person (G2P) Payments, Cross-Border Payments, Mobile Payments, Online Payments, Bill Payments & Utility Payments, and Others. Each subsegment is influenced by distinct trends: for example, P2P and mobile payments are driven by youth adoption and fintech innovation, while B2B and G2P payments benefit from automation and integration with government disbursement platforms .

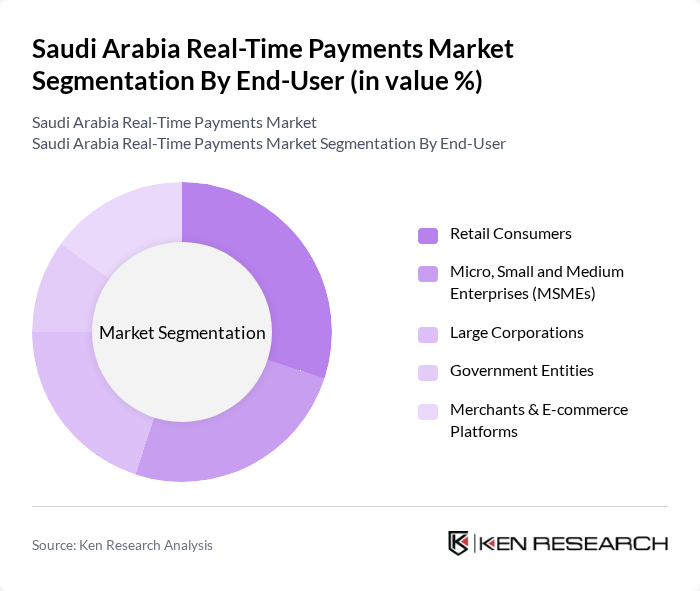

By End-User:The market segmentation by end-user includes Retail Consumers, Micro, Small and Medium Enterprises (MSMEs), Large Corporations, Government Entities, and Merchants & E-commerce Platforms. Retail consumers are increasingly adopting digital payment methods for convenience and security, while MSMEs and large corporations leverage real-time payments to streamline operations, improve cash flow, and enhance customer engagement. Government entities utilize instant payment rails for efficient disbursement of benefits and payroll, and merchants & e-commerce platforms are integrating these solutions to support seamless transactions and drive online sales .

The Saudi Arabia Real-Time Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Payments (mada, SARIE, AFAQ), STC Pay, Alinma Bank, SNB (Saudi National Bank, formerly NCB), Riyad Bank, Samba Financial Group (now part of SNB), Arab National Bank, Banque Saudi Fransi, Al Rajhi Bank, PayTabs, HyperPay, urpay (Al Rajhi Bank), Tamara, Tabby, Mobily Pay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia real-time payments market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security. Additionally, the growing trend towards contactless payments will likely reshape consumer behavior, making instant transactions more accessible. As the market matures, collaboration between fintech companies and traditional banks will be crucial in fostering innovation and expanding service offerings to meet diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person (P2P) Payments Person-to-Business (P2B) Payments Business-to-Business (B2B) Payments Government-to-Person (G2P) Payments Cross-Border Payments Mobile Payments Online Payments Bill Payments & Utility Payments Others |

| By End-User | Retail Consumers Micro, Small and Medium Enterprises (MSMEs) Large Corporations Government Entities Merchants & E-commerce Platforms |

| By Payment Method | Credit Cards Debit Cards Bank Transfers (SARIE, AFAQ, etc.) E-Wallets (STC Pay, urpay, Apple Pay, mada Pay, etc.) QR Code Payments Buy Now Pay Later (BNPL) Others |

| By Industry Vertical | Retail & E-commerce Healthcare Transportation & Mobility Hospitality & Tourism Utilities & Government Services Education Others |

| By Transaction Size | Micro Transactions (< SAR 100) Small Transactions (SAR 100–999) Medium Transactions (SAR 1,000–9,999) Large Transactions (? SAR 10,000) |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Policy Support | Subsidies for Digital Payment Adoption Tax Incentives for Fintech Startups Government Grants for Payment Infrastructure Regulatory Sandboxes & Open Banking Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Real-Time Payment Adoption | 60 | Bank Executives, Payment System Managers |

| Fintech Startups in Payment Solutions | 50 | Founders, Product Development Leads |

| Consumer Preferences for Digital Payments | 100 | General Consumers, Tech-Savvy Users |

| Merchant Adoption of Real-Time Payment Systems | 40 | Retail Managers, E-commerce Operators |

| Regulatory Perspectives on Payment Innovations | 40 | Regulatory Officials, Compliance Officers |

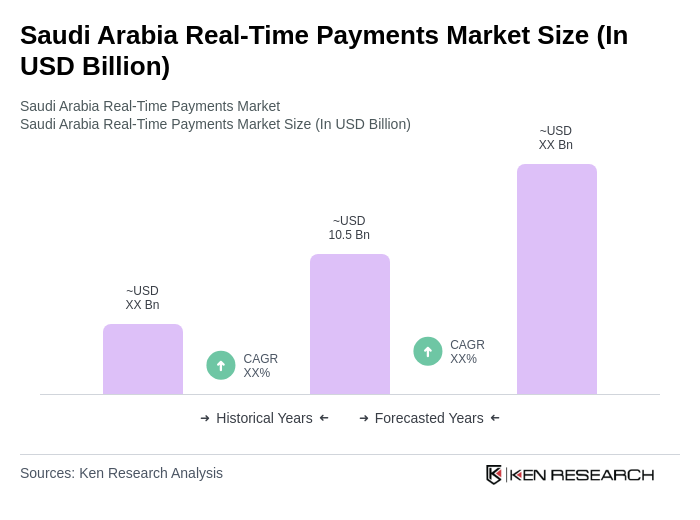

The Saudi Arabia Real-Time Payments Market is valued at approximately USD 10.5 billion, driven by the rapid adoption of digital payment solutions, increasing e-commerce activity, and government initiatives like Vision 2030 aimed at enhancing financial inclusion and digital transformation.