Region:Europe

Author(s):Geetanshi

Product Code:KRAB2737

Pages:95

Published On:October 2025

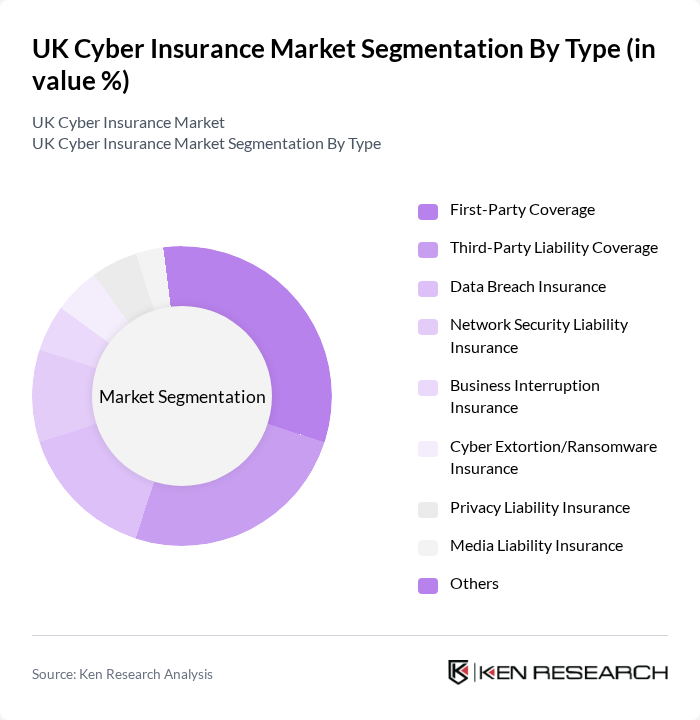

By Type:This segmentation includes various types of coverage that address specific cyber risk exposures faced by UK organizations. Recent market trends indicate increased demand for first-party coverage, business interruption, and cyber crime protection, with insurers broadening coverage to include non-IT supply chain disruptions and theft of funds resulting from cyber-attacks .

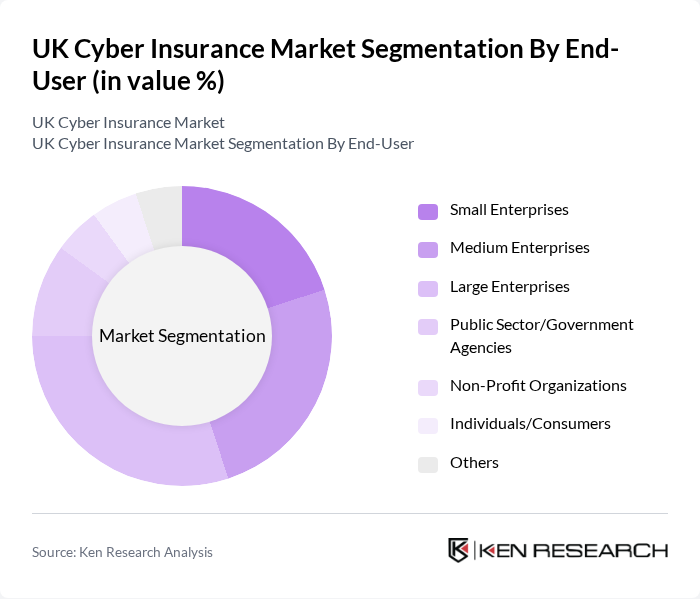

By End-User:This segmentation categorizes the market based on the type of organizations purchasing cyber insurance. The UK market is witnessing increased uptake among small and medium enterprises, driven by regulatory compliance needs and heightened risk awareness. Large enterprises and public sector agencies remain key contributors, while insurers are expanding offerings to non-profit organizations and individuals as cyber threats become more pervasive .

The UK Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIG UK Limited, Allianz Insurance plc, AXA Insurance UK plc, Chubb European Group Limited, Hiscox Ltd, Lloyd's of London, QBE Insurance Group Limited, Zurich Insurance plc, Beazley Group plc, CNA Hardy, Marsh & McLennan Companies, Inc., Lockton Companies, Gallagher, Tokio Marine HCC, Berkshire Hathaway Specialty Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The UK cyber insurance market is poised for significant evolution, driven by technological advancements and increasing regulatory pressures. As businesses continue to digitize operations, the integration of AI and machine learning in underwriting processes will enhance risk assessment accuracy. Additionally, the growing emphasis on incident response services will reshape policy offerings, ensuring that organizations are better equipped to handle cyber incidents. This dynamic environment will foster innovation and adaptability within the market, paving the way for sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Liability Coverage Data Breach Insurance Network Security Liability Insurance Business Interruption Insurance Cyber Extortion/Ransomware Insurance Privacy Liability Insurance Media Liability Insurance Others |

| By End-User | Small Enterprises Medium Enterprises Large Enterprises Public Sector/Government Agencies Non-Profit Organizations Individuals/Consumers Others |

| By Industry | Financial Services & Banking Healthcare & Life Sciences Retail & E-Commerce Technology & IT Services Manufacturing Education Utilities & Energy Media & Communications Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage Customized Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Affinity Partnerships |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Policy Limit | Low Limit Policies Medium Limit Policies High Limit Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 50 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Coverage | 40 | IT Security Directors, Operations Managers |

| Retail Industry Cyber Risk Management | 40 | Business Owners, IT Managers |

| Manufacturing Cyber Insurance Needs | 40 | Supply Chain Managers, Risk Assessment Analysts |

| SME Cyber Insurance Adoption | 50 | Small Business Owners, Financial Advisors |

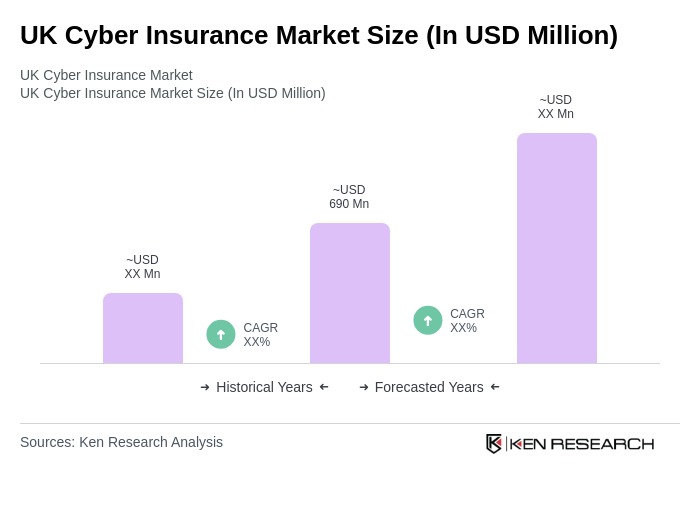

The UK Cyber Insurance Market is valued at approximately USD 690 million, reflecting significant growth driven by increasing cyber threats, rising data breach costs, and heightened awareness among businesses regarding cybersecurity risks.