Region:Europe

Author(s):Geetanshi

Product Code:KRAA7911

Pages:83

Published On:September 2025

By Type:The market is segmented into various types, including Boutique Hotels, Luxury Resorts, Spa Hotels, Heritage Hotels, Business Hotels, All-Inclusive Hotels, and Others. Each type caters to different consumer preferences and experiences, with Boutique Hotels focusing on personalized service and unique designs, while Luxury Resorts offer extensive amenities and leisure activities. Spa Hotels emphasize wellness and relaxation, Heritage Hotels provide historical charm, Business Hotels cater to corporate travelers, and All-Inclusive Hotels offer comprehensive packages for convenience.

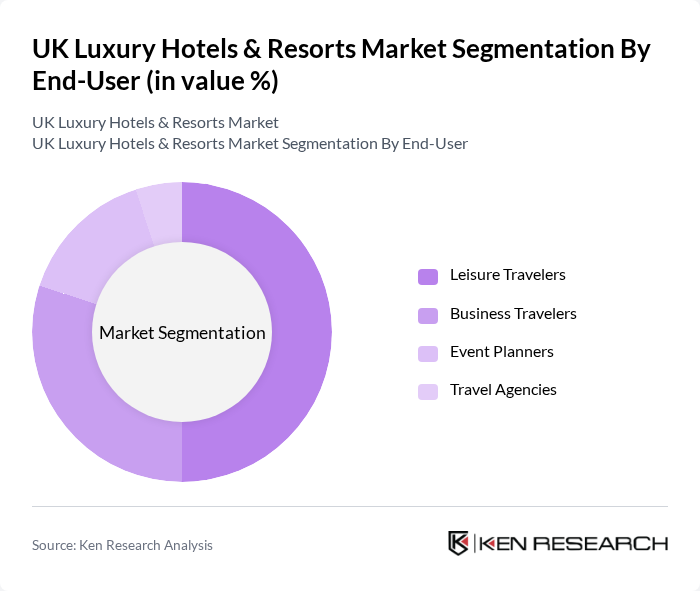

By End-User:The end-user segmentation includes Leisure Travelers, Business Travelers, Event Planners, and Travel Agencies. Leisure Travelers dominate the market as they seek luxury experiences for vacations, while Business Travelers require high-quality accommodations for work-related trips. Event Planners often choose luxury hotels for hosting corporate events and weddings, and Travel Agencies play a crucial role in promoting luxury offerings to their clients.

The UK Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Ritz London, Claridge's, The Savoy, Four Seasons Hotel London at Park Lane, The Dorchester, Mandarin Oriental Hyde Park, Shangri-La Hotel at The Shard, Rosewood London, The Langham, London, The Connaught, Chewton Glen, Gleneagles, Coworth Park, The Grove, The Lanesborough contribute to innovation, geographic expansion, and service delivery in this space.

The UK luxury hotels and resorts market is poised for growth, driven by increasing disposable income and a robust international tourism sector. As travelers seek personalized and unique experiences, luxury accommodations must innovate to meet these demands. Additionally, the integration of smart technology and sustainable practices will become essential for attracting eco-conscious consumers. By focusing on these trends, the market can navigate challenges and capitalize on emerging opportunities, ensuring a resilient and dynamic future for luxury hospitality in the UK.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts Spa Hotels Heritage Hotels Business Hotels All-Inclusive Hotels Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies |

| By Price Range | Premium Ultra-Premium Luxury Suites |

| By Location | Urban Coastal Countryside |

| By Amenities | Spa Services Fine Dining Concierge Services |

| By Booking Channel | Direct Booking Online Travel Agencies Travel Agents |

| By Customer Segment | Families Couples Solo Travelers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel General Managers | 100 | General Managers, Operations Directors |

| Frequent Luxury Travelers | 150 | Business Executives, Affluent Leisure Travelers |

| Travel Agents Specializing in Luxury | 80 | Luxury Travel Advisors, Agency Owners |

| Hospitality Industry Analysts | 60 | Market Researchers, Economic Analysts |

| Luxury Resort Management Teams | 70 | Resort Managers, Marketing Directors |

The UK Luxury Hotels & Resorts Market is valued at approximately USD 8.5 billion, reflecting a significant growth driven by increased disposable income, international tourism, and a preference for unique travel experiences among affluent consumers.