Region:Europe

Author(s):Shubham

Product Code:KRAB1084

Pages:85

Published On:October 2025

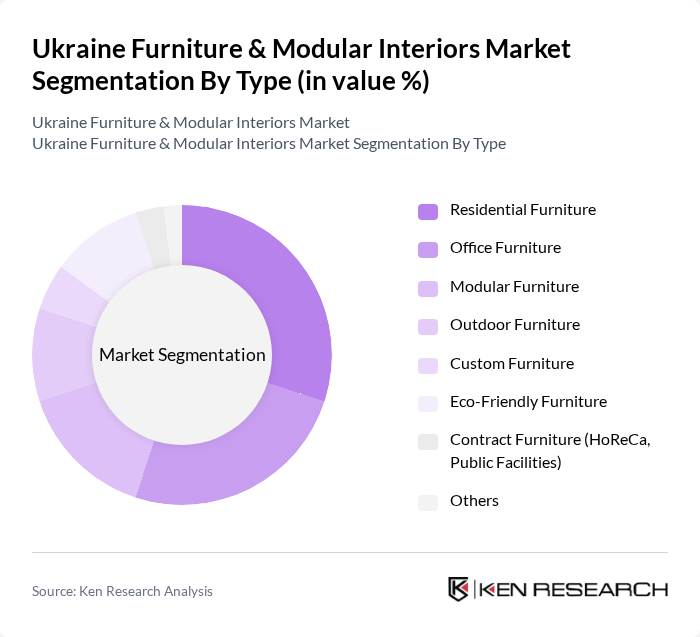

By Type:The market is segmented into various types of furniture, including residential, office, modular, outdoor, custom, eco-friendly, contract furniture, and others. Each type caters to specific consumer needs and preferences, reflecting trends in design, functionality, and sustainability. The industry has particularly focused on developing high-quality decorative panels and durable furniture solutions that meet both domestic and European export market requirements.

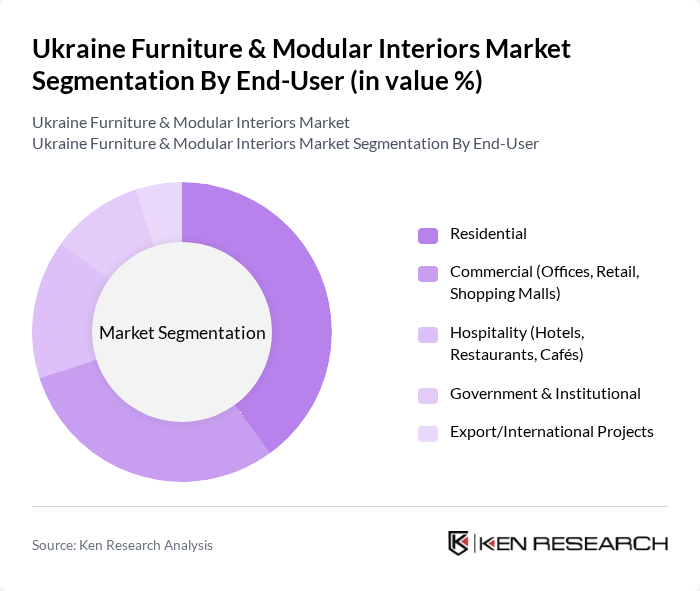

By End-User:The end-user segmentation includes residential, commercial, hospitality, government & institutional, and export/international projects. Each segment reflects the diverse applications of furniture in various settings, from homes to offices and public spaces. The export segment is experiencing significant growth, with Europe accounting for 96% of Ukrainian furniture exports and expansion plans targeting North America, Middle East, and Southeast Asia markets.

The Ukraine Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tivoli, Meblium, Woodsoft, Lamella.ua, Lviv Furniture Factory, Kvadro, Mebli Karpatski, Kolo, ArtMebli, DUB, Lviv Furniture Cluster (LFC), IKEA Ukraine, Vika, Mebli Vostok, EF Cluster contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Ukraine furniture and modular interiors market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize quality and customization, manufacturers are likely to adapt their offerings to meet these demands. Additionally, the expansion of e-commerce will facilitate greater market access, allowing businesses to reach a broader audience. However, addressing economic instability and supply chain challenges will be crucial for sustaining growth and ensuring product availability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Modular Furniture Outdoor Furniture Custom Furniture Eco-Friendly Furniture Contract Furniture (HoReCa, Public Facilities) Others |

| By End-User | Residential Commercial (Offices, Retail, Shopping Malls) Hospitality (Hotels, Restaurants, Cafés) Government & Institutional Export/International Projects |

| By Sales Channel | Online Retail & Marketplaces Brick-and-Mortar Stores Wholesale Distributors Direct Sales (B2B, Custom Projects) |

| By Material | Wood (Solid, Engineered) Metal Plastic & Composites Fabric & Upholstery Glass |

| By Design Style | Modern/Contemporary Traditional/Classical Industrial Scandinavian/Minimalist Eco/Green Design |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise/Partner Stores Export/International Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 100 | Homeowners, Interior Designers |

| Commercial Furniture Sector | 80 | Office Managers, Facility Coordinators |

| Modular Interiors Segment | 60 | Architects, Project Managers |

| Online Furniture Retail | 50 | E-commerce Managers, Digital Marketing Specialists |

| Custom Furniture Solutions | 40 | Custom Furniture Makers, Design Consultants |

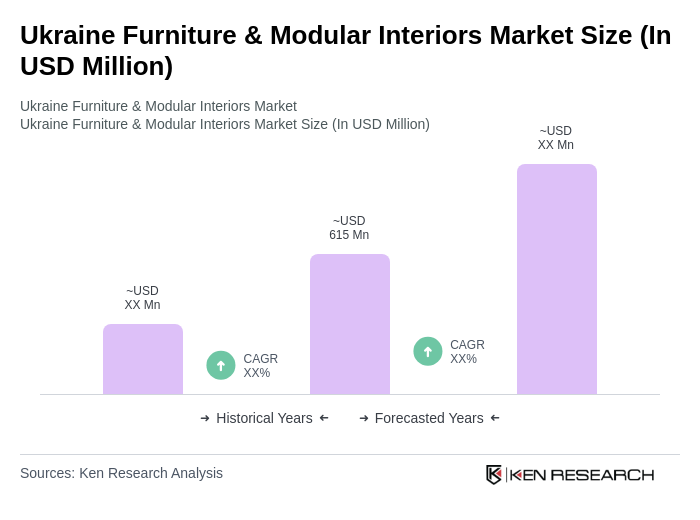

The Ukraine Furniture & Modular Interiors Market is valued at approximately USD 615 million, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a demand for modern and modular furniture solutions.