Region:Middle East

Author(s):Geetanshi

Product Code:KRVN3160

Pages:98

Published On:December 2025

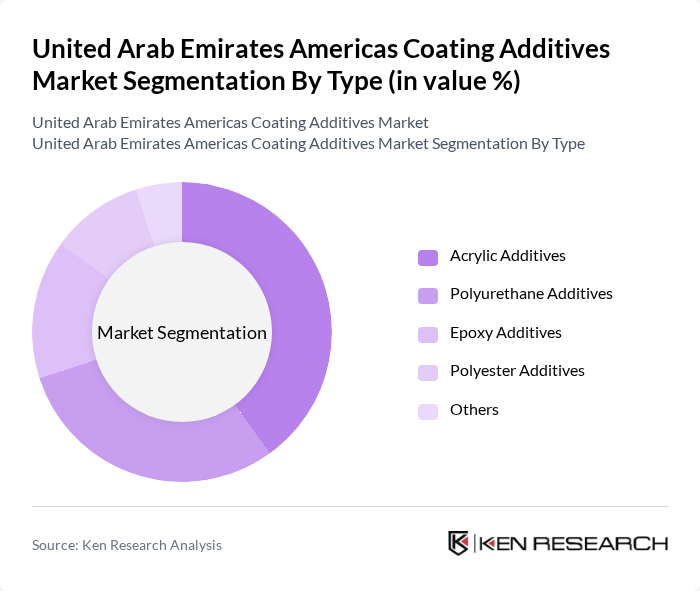

By Type:The market is segmented into various types of additives, including Acrylic Additives, Polyurethane Additives, Epoxy Additives, Polyester Additives, and Others. Among these, Acrylic Additives are leading the market due to their versatility and superior performance in various applications. They are widely used in architectural and industrial coatings, driven by their excellent weather resistance and durability. Polyurethane Additives also hold a significant share, particularly in automotive coatings, owing to their high gloss and chemical resistance properties.

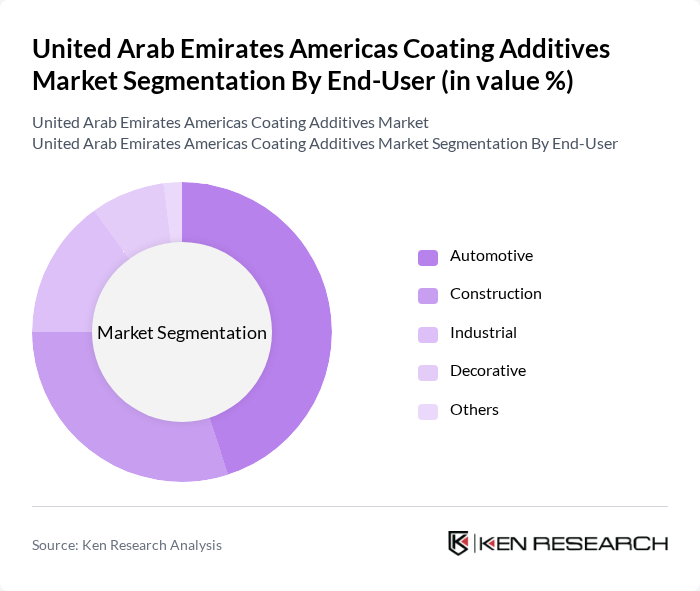

By End-User:The market is categorized into Automotive, Construction, Industrial, Decorative, and Others. The Automotive sector is the largest end-user, driven by the increasing demand for high-performance coatings that enhance vehicle aesthetics and durability. The Construction industry follows closely, fueled by ongoing infrastructure projects and a growing emphasis on sustainable building practices. Decorative coatings are also gaining traction as consumers seek innovative and visually appealing finishes for residential and commercial spaces.

The United Arab Emirates Americas Coating Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, AkzoNobel N.V., Dow Inc., Evonik Industries AG, Huntsman Corporation, Eastman Chemical Company, Clariant AG, Solvay S.A., Arkema S.A., Croda International Plc, Momentive Performance Materials Inc., Wacker Chemie AG, RPM International Inc., PPG Industries, Inc., Sherwin-Williams Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Americas coating additives market appears promising, driven by the increasing focus on sustainability and technological innovation. As the demand for eco-friendly and high-performance coatings rises, manufacturers are likely to invest in R&D to develop advanced formulations. Additionally, the ongoing expansion of the construction and automotive sectors will further stimulate market growth. Companies that adapt to regulatory changes and embrace digital technologies will be well-positioned to capitalize on emerging opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Additives Polyurethane Additives Epoxy Additives Polyester Additives Others |

| By End-User | Automotive Construction Industrial Decorative Others |

| By Application | Architectural Coatings Industrial Coatings Automotive Coatings Protective Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Product Formulation | Water-Based Coatings Solvent-Based Coatings Powder Coatings UV-Curable Coatings Others |

| By Performance Characteristics | Weather Resistance Chemical Resistance Abrasion Resistance Gloss and Finish Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Coating Additives | 100 | Project Managers, Architects, Material Suppliers |

| Automotive Coating Solutions | 80 | Production Managers, Quality Control Engineers |

| Industrial Coatings Applications | 70 | Operations Managers, Maintenance Supervisors |

| Architectural Coatings Market | 90 | Design Consultants, Retail Managers |

| Specialty Coating Additives | 60 | R&D Managers, Product Development Specialists |

The United Arab Emirates Americas Coating Additives Market is valued at approximately USD 1.3 billion, reflecting a robust growth trajectory driven by increasing demand for high-performance coatings across various industries, including automotive and construction.