Region:Asia

Author(s):Geetanshi

Product Code:KRVN3161

Pages:96

Published On:December 2025

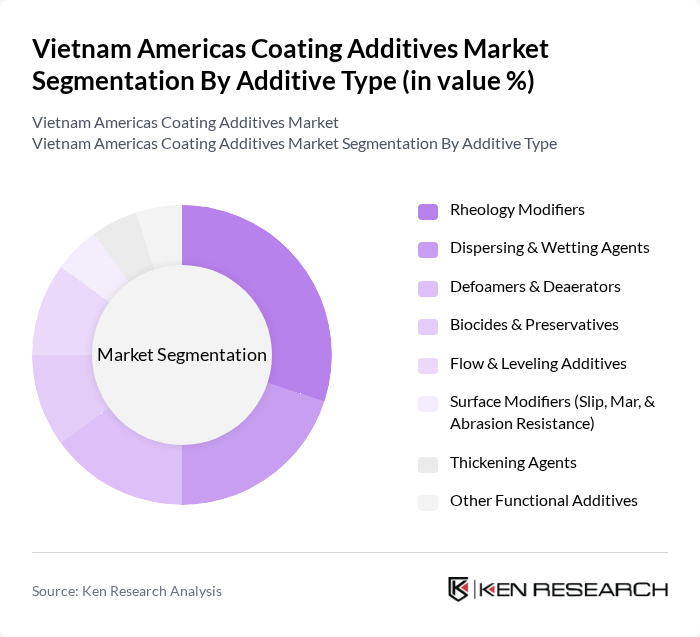

By Additive Type:The market is segmented into various additive types, including Rheology Modifiers, Dispersing & Wetting Agents, Defoamers & Deaerators, Biocides & Preservatives, Flow & Leveling Additives, Surface Modifiers (Slip, Mar, & Abrasion Resistance), Thickening Agents, and Other Functional Additives. Among these, Rheology Modifiers are widely used due to their essential role in controlling viscosity, sag resistance, and application properties in both architectural and industrial coatings, especially in water?borne and high?solids systems. The increasing demand for high-quality finishes, improved leveling, and defect-free films in interior and exterior architectural coatings, as well as protective and automotive coatings, supports strong consumption of rheology modifiers alongside dispersing and wetting agents.

By Application:The market is segmented by application into Architectural & Decorative Coatings, Industrial & Protective Coatings, Automotive OEM & Refinish Coatings, Wood & Furniture Coatings, Packaging & Printing Inks, Marine & Aerospace Coatings, and Other Specialty Coatings. The Architectural & Decorative Coatings segment is the largest, supported by Vietnam’s strong residential and commercial construction activity, rapid urban housing development, and renovation demand in major cities such as Ho Chi Minh City, Hanoi, and Da Nang. Increasing penetration of water?borne, low?VOC architectural paints and primers further raises the use of dispersants, rheology modifiers, defoamers, and biocides in this application segment.

The Vietnam Americas Coating Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Dow Inc., Arkema S.A., Huntsman Corporation, Eastman Chemical Company, Solvay S.A., Clariant AG, AkzoNobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., KCC Corporation, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Americas Coating Additives Market is poised for significant transformation, driven by the increasing emphasis on sustainability and technological innovation. As the construction sector expands, the demand for specialized coatings will rise, creating opportunities for manufacturers to develop advanced formulations. Additionally, the integration of digital technologies in production processes is expected to enhance efficiency and customization, positioning the market for robust growth in future. Companies that adapt to these trends will likely gain a competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Additive Type | Rheology Modifiers Dispersing & Wetting Agents Defoamers & Deaerators Biocides & Preservatives Flow & Leveling Additives Surface Modifiers (Slip, Mar, & Abrasion Resistance) Thickening Agents Other Functional Additives |

| By Application | Architectural & Decorative Coatings Industrial & Protective Coatings Automotive OEM & Refinish Coatings Wood & Furniture Coatings Packaging & Printing Inks Marine & Aerospace Coatings Other Specialty Coatings |

| By Formulation Technology | Water-borne Systems Solvent-borne Systems Powder Coatings Radiation-cured (UV/EB) Systems High-solids & Other Technologies |

| By End-Use Industry | Building & Construction Automotive & Transportation General Industrial & OEM Consumer Goods & Appliances Packaging Marine, Oil & Gas, and Infrastructure Others |

| By Functionality | Anti-corrosion & Protection Weatherability & UV Resistance Slip, Gloss & Aesthetic Enhancement Anti-foaming & Air-release Anti-microbial & Anti-fouling Adhesion Promotion Other Performance Enhancements |

| By Substrate | Metal Concrete & Masonry Wood Plastics & Composites Others |

| By Country (Americas Focus) | United States Canada Brazil Mexico Rest of Americas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Coating Additives | 100 | Project Managers, Procurement Specialists |

| Automotive Coating Solutions | 80 | Product Development Engineers, Quality Assurance Managers |

| Industrial Coatings Market | 70 | Operations Managers, Supply Chain Coordinators |

| Consumer Goods Coatings | 60 | Brand Managers, Marketing Directors |

| Specialty Coating Applications | 90 | Research Scientists, Technical Sales Representatives |

The Vietnam Americas Coating Additives Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increasing demand for high-performance coatings across various industries, including automotive, construction, and consumer goods.