Region:Middle East

Author(s):Rebecca

Product Code:KRAA7065

Pages:85

Published On:January 2026

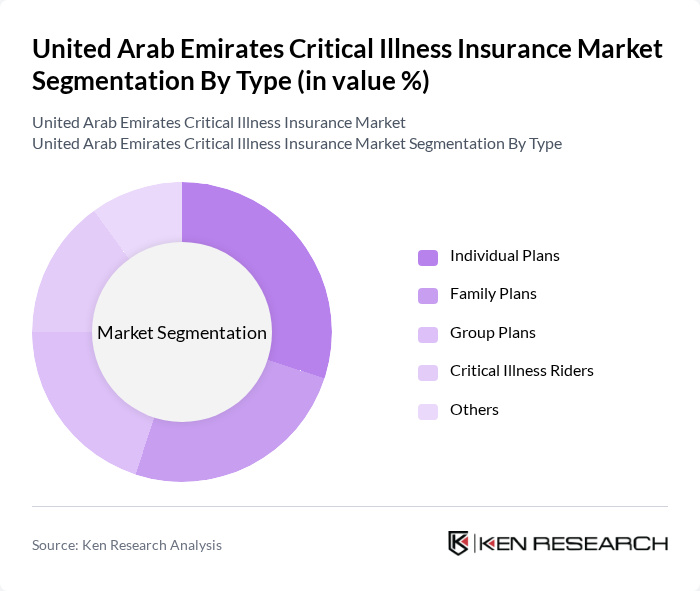

By Type:The market can be segmented into various types of plans that cater to different consumer needs. The subsegments include Individual Plans, Family Plans, Group Plans, Critical Illness Riders, and Others. Each of these plans offers unique benefits and coverage options tailored to specific demographics and financial situations.

The Individual Plans segment is currently dominating the market due to the increasing number of individuals seeking personalized health coverage. This trend is driven by a growing awareness of health risks and the need for financial security in the face of critical illnesses. Consumers are increasingly opting for plans that offer tailored benefits, leading to a rise in demand for individual coverage. Additionally, the flexibility and customization options available in individual plans make them appealing to a wide range of consumers, further solidifying their market leadership.

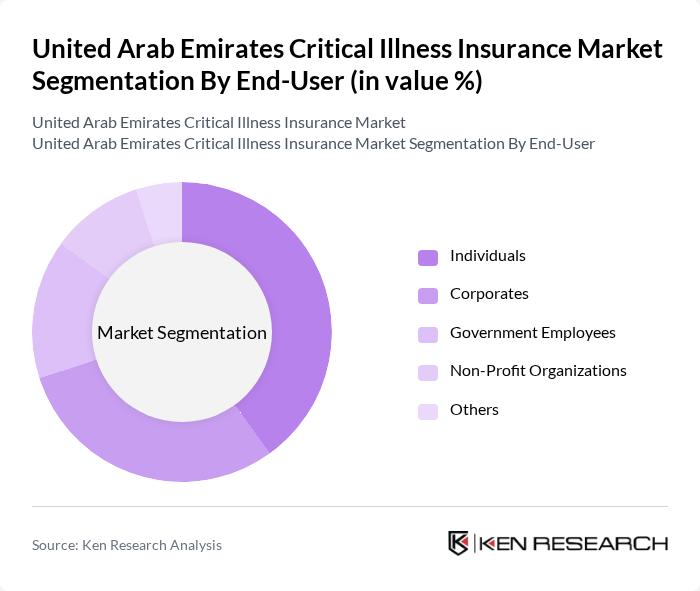

By End-User:The market can also be segmented based on the end-users of critical illness insurance. The subsegments include Individuals, Corporates, Government Employees, Non-Profit Organizations, and Others. Each end-user category has distinct needs and preferences regarding insurance coverage.

Individuals represent the largest segment of end-users in the market, driven by the increasing awareness of health risks and the importance of financial protection against critical illnesses. This demographic is actively seeking insurance solutions that provide comprehensive coverage and peace of mind. Corporates also play a significant role, as many companies are now offering critical illness insurance as part of their employee benefits packages, further boosting the market. The focus on individual needs and corporate responsibility in health coverage is shaping the landscape of critical illness insurance in the UAE.

The United Arab Emirates Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Insurance Company, Dubai Insurance Company, Oman Insurance Company, AXA Gulf, MetLife UAE, Allianz Partners, Orient Insurance, Emirates Insurance Company, National General Insurance, Daman Health Insurance, AIG Insurance, Zurich Insurance, RSA Insurance, Al Hilal Takaful, Takaful Emarat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE critical illness insurance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital platforms is expected to streamline policy purchases, making insurance more accessible. Additionally, as the population ages and chronic diseases become more prevalent, the demand for tailored insurance products will likely increase. Insurers that adapt to these trends and focus on customer-centric solutions will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Plans Family Plans Group Plans Critical Illness Riders Others |

| By End-User | Individuals Corporates Government Employees Non-Profit Organizations Others |

| By Age Group | Under 30 50 and Above Others |

| By Coverage Amount | Low Coverage Medium Coverage High Coverage Others |

| By Payment Mode | Monthly Premiums Annual Premiums One-Time Payment Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Policyholders | 120 | Individuals aged 30-60 with critical illness coverage |

| Insurance Brokers | 90 | Insurance agents and brokers specializing in health insurance |

| Healthcare Providers | 80 | Doctors and hospital administrators involved in patient care |

| Insurance Company Executives | 60 | Senior management from leading insurance firms |

| Regulatory Authorities | 40 | Officials from the UAE Insurance Authority and health ministries |

The United Arab Emirates Critical Illness Insurance Market is valued at approximately USD 9.3 billion, reflecting significant growth driven by rising healthcare costs, increased awareness of critical illnesses, and a growing population seeking financial protection against health issues.