New Zealand Critical Illness Insurance Market Overview

- The New Zealand Critical Illness Insurance Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of health risks, rising healthcare costs, a growing aging population that demands more comprehensive health coverage, and rising demand for income protection amid chronic disease prevalence. The market has seen a significant uptick in policy purchases as individuals seek financial security against critical illnesses.

- Auckland, Wellington, and Christchurch are the dominant cities in the New Zealand Critical Illness Insurance Market. Auckland leads due to its large population and economic activity, while Wellington benefits from being the political center, influencing insurance regulations and policies. Christchurch, recovering from past natural disasters, has seen a rise in demand for health-related insurance products as residents prioritize financial protection.

- The Health and Disability System Act 2023, issued by the New Zealand Parliament, establishes the national Public Health Agency and Te Whatu Ora | Health New Zealand to oversee health service delivery. This binding legislation requires integrated commissioning of services across primary, community, and hospital care with defined performance standards for accessibility and equity, mandating insurers to align policies with public system enhancements for critical care coverage thresholds above public entitlements.

New Zealand Critical Illness Insurance Market Segmentation

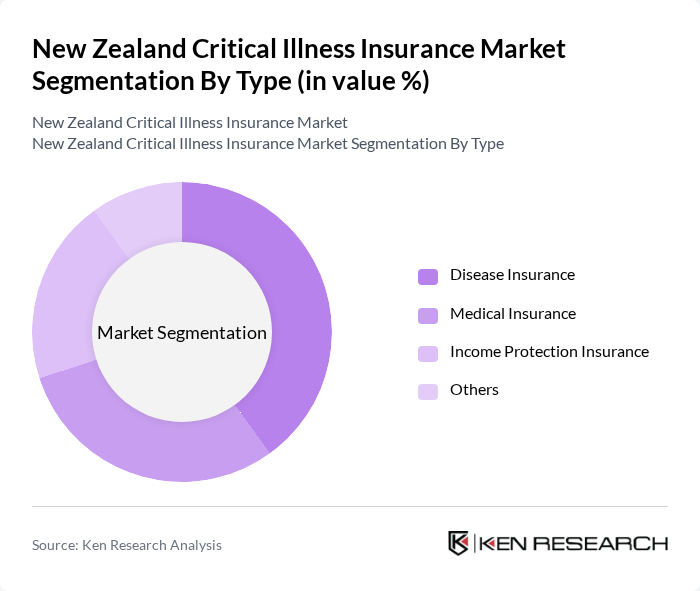

By Type:This segmentation includes various types of insurance products tailored to meet the needs of consumers. The subsegments are Disease Insurance, Medical Insurance, Income Protection Insurance, and Others. Each type serves a unique purpose, catering to different consumer preferences and financial requirements.

The Disease Insurance subsegment is currently dominating the market due to the increasing prevalence of chronic illnesses and the rising awareness among consumers about the financial implications of such diseases. This type of insurance provides coverage for specific critical illnesses, which is appealing to individuals seeking targeted protection. The growing trend of preventive healthcare and early diagnosis has also contributed to the popularity of disease-specific policies, making them a preferred choice among consumers.

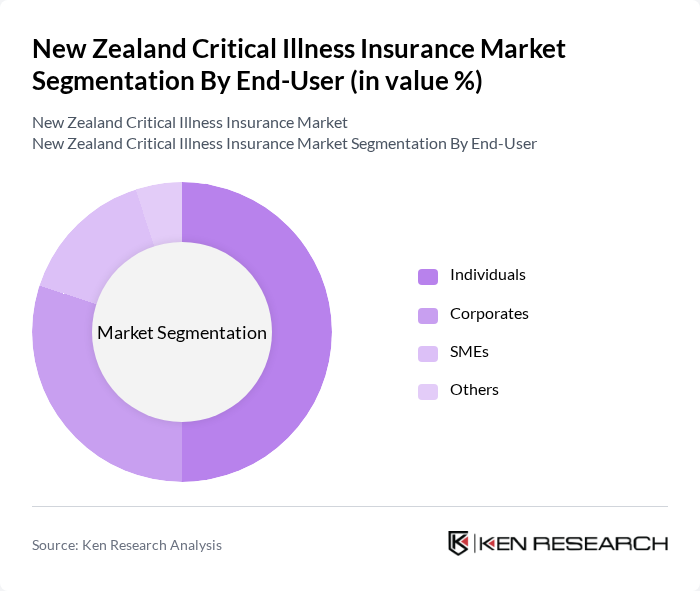

By End-User:This segmentation categorizes the market based on the type of consumers purchasing insurance. The subsegments include Individuals, Corporates, SMEs, and Others. Each end-user group has distinct needs and preferences, influencing their choice of insurance products.

Individuals represent the largest segment in the market, driven by a growing awareness of health risks and the need for financial security against critical illnesses. The increasing number of self-employed individuals and freelancers has also contributed to this trend, as they seek personal insurance solutions. Corporates are increasingly offering critical illness insurance as part of employee benefits, but the individual market remains the most significant due to the personal nature of health insurance decisions.

New Zealand Critical Illness Insurance Market Competitive Landscape

The New Zealand Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Southern Cross Health Society, AIA New Zealand, Partners Life, Fidelity Life, Tower Insurance, nib New Zealand, ASB Insurance, Cigna Life Insurance New Zealand, AMP Life, Vero Insurance, Sovereign Assurance Company, QBE Insurance, Zurich New Zealand, Asteron Life, Medical Insurance Group contribute to innovation, geographic expansion, and service delivery in this space.

New Zealand Critical Illness Insurance Market Industry Analysis

Growth Drivers

- Increasing Awareness of Health Risks:The New Zealand population is becoming increasingly aware of health risks, with 75% of adults acknowledging the importance of critical illness insurance. This awareness is driven by rising incidences of chronic diseases, which have increased by 18% over the past decade. As a result, more individuals are seeking financial protection against potential health crises, leading to a surge in policy purchases. This trend is supported by health campaigns and educational initiatives by the government and insurance companies.

- Rising Healthcare Costs:Healthcare expenditure in New Zealand is projected to reach NZD 22 billion, reflecting a 6% annual increase. This rise in costs is prompting consumers to seek critical illness insurance as a financial safety net. With out-of-pocket expenses for medical treatments increasing, individuals are more inclined to invest in insurance products that cover significant health events. This trend is further fueled by the government's focus on improving healthcare access and affordability, making insurance a vital consideration for many.

- Aging Population:New Zealand's population aged 65 and over is expected to grow to 1.3 million, representing a 25% increase from 2020. This demographic shift is driving demand for critical illness insurance, as older individuals are more susceptible to severe health conditions. Insurers are responding by tailoring products to meet the needs of this age group, enhancing coverage options and benefits. Consequently, the aging population is a significant growth driver for the critical illness insurance market in New Zealand.

Market Challenges

- Regulatory Compliance Issues:The New Zealand insurance market faces stringent regulatory requirements, with compliance costs estimated at NZD 600 million annually. Insurers must navigate complex regulations, including consumer protection laws and prudential standards, which can hinder operational efficiency. These compliance challenges can lead to increased premiums for consumers, potentially limiting market growth. Additionally, the evolving regulatory landscape requires continuous adaptation, placing further strain on insurance providers.

- Consumer Trust Deficit:A significant trust deficit exists in the insurance sector, with only 50% of consumers expressing confidence in insurance providers. This lack of trust is often attributed to negative experiences with claims processing and perceived lack of transparency. As a result, many potential customers hesitate to purchase critical illness insurance, fearing inadequate support during health crises. Building consumer trust is essential for market growth, necessitating improved communication and service delivery from insurers.

New Zealand Critical Illness Insurance Market Future Outlook

The future of the New Zealand critical illness insurance market appears promising, driven by technological advancements and a growing emphasis on preventive healthcare. Insurers are increasingly adopting digital platforms to streamline operations and enhance customer engagement. Additionally, the focus on preventive measures is likely to encourage more individuals to invest in insurance products that offer comprehensive coverage. As the market evolves, insurers must adapt to changing consumer preferences and leverage technology to improve service delivery and customer satisfaction.

Market Opportunities

- Customizable Insurance Plans:There is a growing demand for customizable insurance plans that cater to individual health needs. With 65% of consumers expressing interest in tailored coverage options, insurers can capitalize on this trend by offering flexible policies. This approach not only enhances customer satisfaction but also increases market penetration, as more individuals find plans that align with their specific health concerns and financial situations.

- Partnerships with Healthcare Providers:Collaborating with healthcare providers presents a significant opportunity for insurers. By forming partnerships, insurers can offer integrated services that enhance customer value. For instance, joint initiatives can provide policyholders with access to preventive health screenings and wellness programs, fostering a holistic approach to health management. This strategy can improve customer retention and attract new clients seeking comprehensive health solutions.