United Kingdom Digital Health Market Overview

- The United Kingdom Digital Health Market is valued at USD 12.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of telehealth services, advancements in mobile health applications, and the integration of digital health systems within the National Health Service (NHS). The rising demand for remote patient monitoring, wearable devices, and healthcare analytics has further propelled the market, reflecting a shift towards more efficient, accessible, and personalized healthcare solutions. The adoption of artificial intelligence and data analytics for early diagnosis and treatment optimization is also accelerating market expansion.

- Key cities such as London, Manchester, and Birmingham dominate the market due to their robust healthcare infrastructure, high concentration of technology firms, and significant investment in health tech startups. London, in particular, serves as a hub for innovation and collaboration between healthcare providers and technology companies, fostering an environment conducive to the growth of digital health solutions.

- In 2023, the UK government implemented the Digital Health and Care Plan, which aims to enhance the digital capabilities of the NHS. This initiative includes a commitment of GBP 2.1 billion to improve digital services, ensuring that patients have access to online consultations and health records, thereby streamlining healthcare delivery and improving patient outcomes.

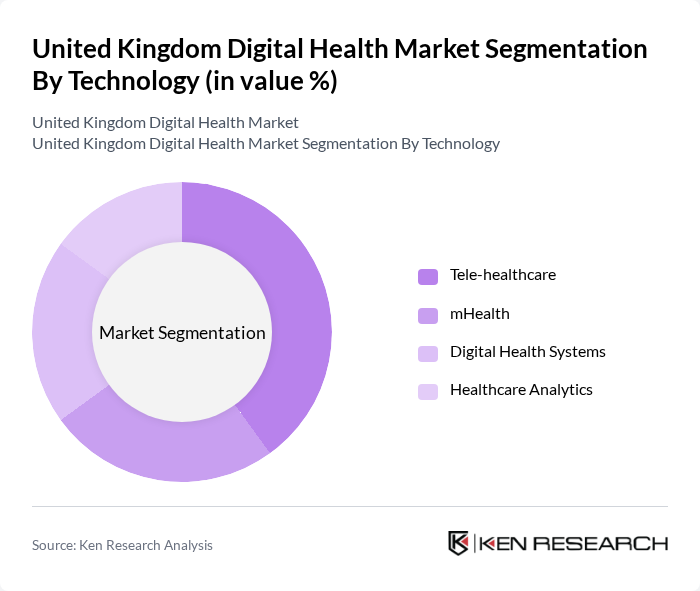

United Kingdom Digital Health Market Segmentation

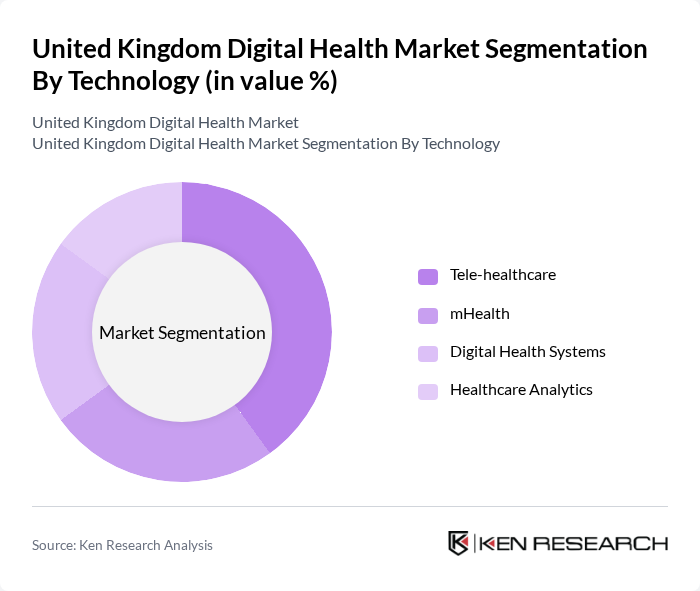

By Technology:The technology segment includes various sub-segments such as Tele-healthcare, mHealth, Digital Health Systems, and Healthcare Analytics. Tele-healthcare has gained significant traction due to the increasing demand for remote consultations and virtual care, especially during and after the pandemic. mHealth applications are widely adopted for personal health management, chronic disease monitoring, and preventive care, leveraging smartphones and wearable devices. Digital Health Systems are essential for integrating electronic health records, appointment scheduling, and care coordination across providers. Healthcare Analytics is crucial for data-driven decision-making, enabling early diagnosis, risk prediction, and resource optimization in healthcare delivery.

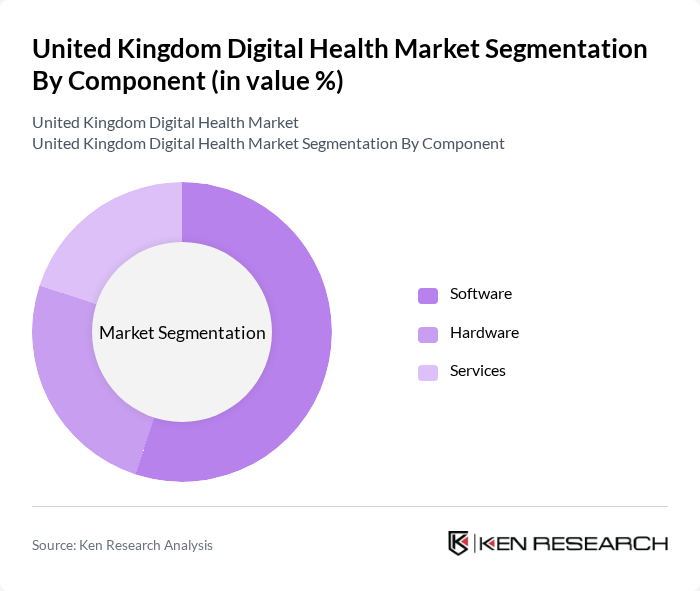

By Component:The component segment encompasses Software, Hardware, and Services. Software solutions are the backbone of digital health, providing functionalities for telehealth, electronic health records, and patient management platforms. Hardware includes devices such as wearables, remote monitoring tools, and diagnostic equipment that enable real-time health tracking and data collection. Services cover the support, maintenance, and integration of digital health systems, as well as consulting and implementation services. The software segment is currently leading due to the rapid development of applications and platforms that enhance patient engagement, care delivery, and interoperability across healthcare systems.

United Kingdom Digital Health Market Competitive Landscape

The United Kingdom Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Babylon Health, Push Doctor, Zava, Livi, Doctorlink, myGP (iPLATO Healthcare), eConsult Health, Medopad (now Huma), HealthHero, EMIS Group, TPP (The Phoenix Partnership), NHS Digital, Vision (In Practice Systems Ltd), Doccla, Neko Health contribute to innovation, geographic expansion, and service delivery in this space.

United Kingdom Digital Health Market Industry Analysis

Growth Drivers

- Increasing Demand for Telehealth Services:The United Kingdom has seen a significant rise in telehealth services, with over 40 million consultations conducted via telemedicine in future. This surge is driven by the need for accessible healthcare, especially post-pandemic. The NHS reported a 400% increase in telehealth usage, reflecting a shift in patient preferences towards remote consultations. This trend is expected to continue, supported by advancements in technology and increasing patient comfort with digital health solutions.

- Rising Adoption of Wearable Health Technologies:The wearable health technology market in the UK is projected to reach £2.8 billion in future, driven by consumer demand for health monitoring devices. Approximately 50% of adults in the UK own a wearable device, such as fitness trackers or smartwatches. This growing adoption is fueled by increased health awareness and the desire for real-time health data, enabling proactive health management and personalized care solutions.

- Government Initiatives to Promote Digital Health:The UK government has committed £2 billion to enhance digital health infrastructure in future. Initiatives like the NHS Long Term Plan aim to integrate digital health solutions into standard care practices. This funding supports the development of digital tools and platforms, ensuring that healthcare providers can deliver efficient, technology-driven services, ultimately improving patient outcomes and system efficiency.

Market Challenges

- Data Privacy and Security Concerns:Data privacy remains a significant challenge in the UK digital health market, with over 60% of consumers expressing concerns about data security. The Information Commissioner's Office (ICO) reported a 30% increase in data breach incidents in healthcare in future. These concerns hinder the adoption of digital health solutions, as patients are wary of sharing sensitive health information, necessitating robust security measures to build trust.

- Integration with Existing Healthcare Systems:The integration of digital health solutions with existing healthcare systems poses a challenge, with 75% of healthcare providers citing interoperability issues. Many legacy systems are not designed to accommodate new technologies, leading to inefficiencies and increased operational costs. Addressing these integration challenges is crucial for the seamless implementation of digital health solutions and improving overall healthcare delivery.

United Kingdom Digital Health Market Future Outlook

The future of the United Kingdom digital health market appears promising, driven by technological advancements and evolving patient expectations. The focus on preventive healthcare and personalized medicine is expected to reshape service delivery, with an emphasis on data-driven decision-making. As the market matures, partnerships between tech companies and traditional healthcare providers will likely enhance service offerings, ensuring that digital health solutions are effectively integrated into everyday healthcare practices, ultimately improving patient outcomes and system efficiency.

Market Opportunities

- Expansion of Remote Patient Monitoring:The remote patient monitoring market is anticipated to grow significantly, with an estimated 8 million patients using these services in future. This growth presents opportunities for technology providers to develop innovative solutions that enhance patient engagement and adherence to treatment plans, ultimately improving health outcomes and reducing hospital readmissions.

- Development of AI-Driven Health Solutions:The AI health technology sector is projected to reach £1.5 billion in future, driven by advancements in machine learning and data analytics. This presents opportunities for startups and established companies to create AI-driven solutions that enhance diagnostic accuracy and streamline clinical workflows, ultimately transforming patient care and operational efficiency in healthcare settings.