Region:North America

Author(s):Geetanshi

Product Code:KRAD0079

Pages:87

Published On:August 2025

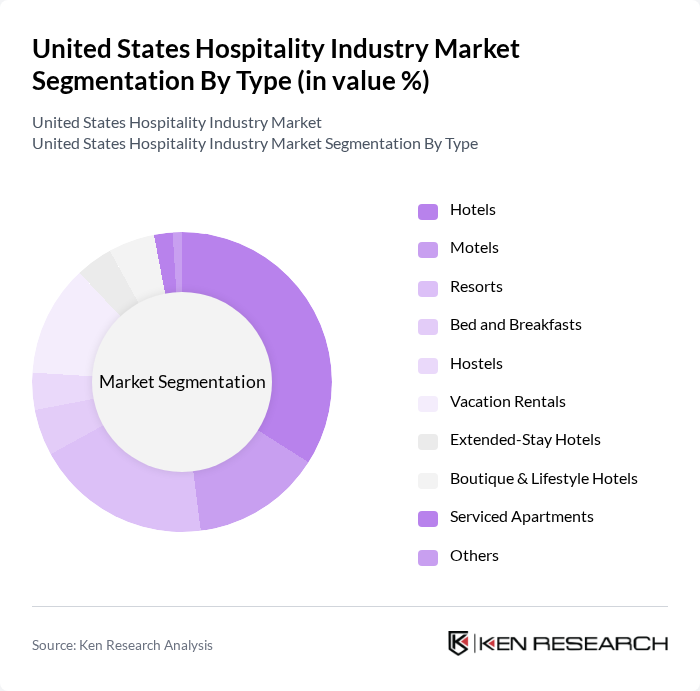

By Type:The hospitality industry can be segmented into various types, including hotels, motels, resorts, bed and breakfasts, hostels, vacation rentals, extended-stay hotels, boutique & lifestyle hotels, serviced apartments, and others. Each type caters to different consumer preferences and needs, influencing their market presence and growth potential. Hotels and resorts remain the largest segments, driven by both business and leisure travel, while vacation rentals and boutique hotels are experiencing notable growth due to changing traveler preferences and the rise of alternative accommodation platforms.

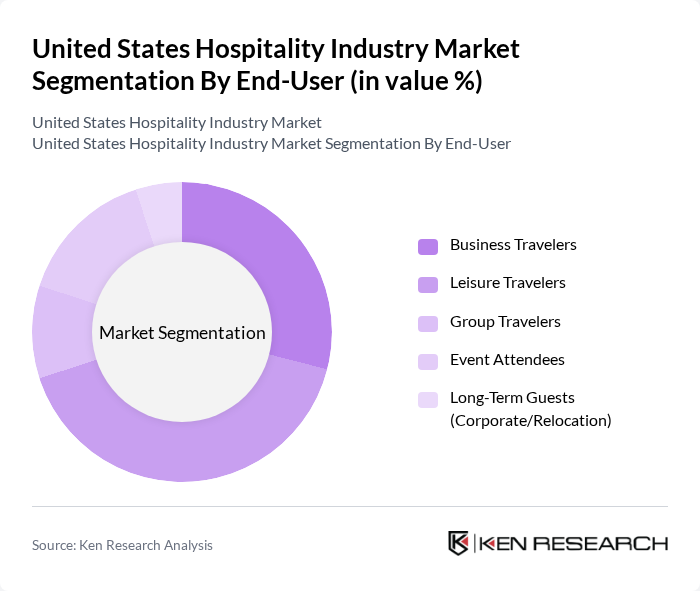

By End-User:The hospitality industry serves various end-users, including business travelers, leisure travelers, group travelers, event attendees, and long-term guests (corporate/relocation). Each segment has distinct needs and preferences, shaping the services and offerings provided by hospitality businesses. Leisure travelers constitute the largest share, reflecting the ongoing strength of domestic tourism and pent-up demand for travel experiences.

The United States Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International, Inc., Hilton Worldwide Holdings Inc., Hyatt Hotels Corporation, InterContinental Hotels Group PLC (IHG Hotels & Resorts), Wyndham Hotels & Resorts, Inc., Choice Hotels International, Inc., Best Western Hotels & Resorts, Accor S.A., Radisson Hotel Group, Extended Stay America, Inc., La Quinta by Wyndham, Omni Hotels & Resorts, Four Seasons Hotels and Resorts, The Ritz-Carlton Hotel Company, L.L.C., Kimpton Hotels & Restaurants, Drury Hotels Company, LLC, G6 Hospitality LLC (Motel 6, Studio 6), Aimbridge Hospitality, Host Hotels & Resorts, Inc., Airbnb, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. hospitality industry appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek personalized experiences, businesses must adapt by leveraging data analytics to enhance service offerings. Additionally, the integration of sustainable practices is becoming essential, as consumers prioritize eco-friendly options. The industry's ability to innovate and respond to these trends will be critical in maintaining competitiveness and ensuring long-term growth in a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hotels Motels Resorts Bed and Breakfasts Hostels Vacation Rentals Extended-Stay Hotels Boutique & Lifestyle Hotels Serviced Apartments Others |

| By End-User | Business Travelers Leisure Travelers Group Travelers Event Attendees Long-Term Guests (Corporate/Relocation) |

| By Service Type | Room Service Food and Beverage Services Event Hosting Services Concierge Services Wellness & Spa Services |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Bookings (Brand Website/App) Travel Agents Corporate Bookings Alternative Accommodation Platforms (e.g., Airbnb, Vrbo) |

| By Location | Urban Areas Suburban Areas Rural Areas Tourist Destinations Airport Hotels |

| By Price Range | Budget Mid-Range Upscale Luxury |

| By Customer Demographics | Families Couples Solo Travelers Business Professionals Seniors Gen Z & Millennials |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Segment | 100 | General Managers, Marketing Directors |

| Midscale Hotel Operations | 80 | Operations Managers, Front Desk Supervisors |

| Budget Hotel Insights | 70 | Franchise Owners, Revenue Managers |

| Food & Beverage Services | 50 | Executive Chefs, F&B Managers |

| Event Management in Hospitality | 60 | Event Coordinators, Sales Managers |

The United States Hospitality Industry Market is valued at approximately USD 780 billion, reflecting total guest spending across various sectors, including lodging, transportation, and dining. This figure indicates a steady recovery and growth following the pandemic, driven by increased travel demand.