Region:Asia

Author(s):Rebecca

Product Code:KRAE3241

Pages:80

Published On:February 2026

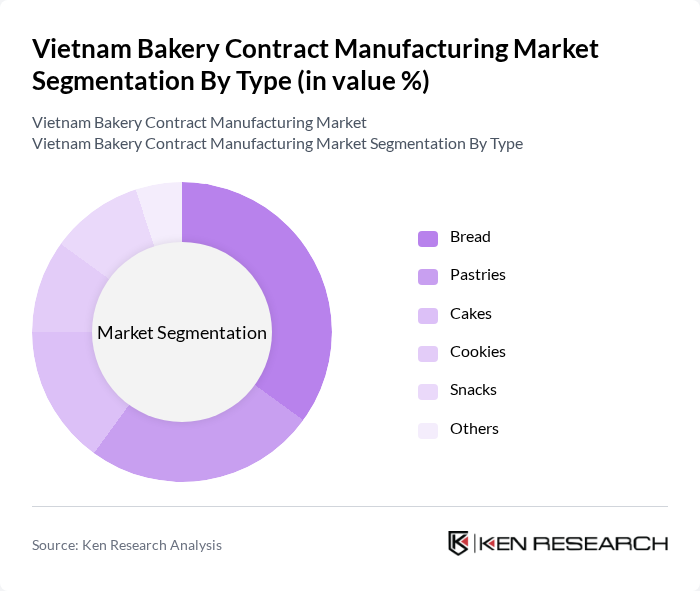

By Type:The market is segmented into various types of bakery products, including bread, pastries, cakes, cookies, snacks, and others. Among these, bread and pastries are the most popular, driven by consumer demand for fresh and convenient options. The increasing trend of snacking has also led to a rise in the production of cookies and snacks, catering to on-the-go consumers.

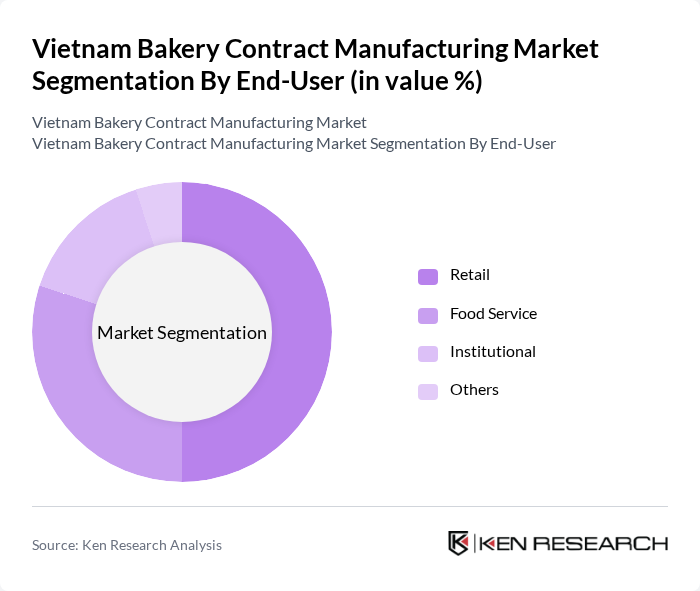

By End-User:The market is segmented based on end-users, including retail, food service, institutional, and others. The retail segment is the largest, driven by the increasing availability of bakery products in supermarkets and convenience stores. The food service sector is also growing, with more cafes and restaurants incorporating baked goods into their menus, reflecting changing consumer dining habits.

The Vietnam Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABC Bakery Co., XYZ Foods Ltd., Golden Bread Co., Viet Pastry Group, Fresh Bakes Inc., Happy Crusts Bakery, Sweet Treats Manufacturing, Viet Gourmet Bakery, Artisan Breads Co., Premium Pastries Ltd., Delightful Bakes, Urban Bakery Solutions, Traditional Breads Co., Modern Bakes Inc., Quality Confections Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam bakery contract manufacturing market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious trends continue to shape product offerings, manufacturers are likely to innovate with plant-based and gluten-free options. Additionally, the integration of smart technology in production processes will enhance efficiency and quality. These trends, coupled with a growing emphasis on sustainability, will create a dynamic landscape for the industry, fostering new growth avenues and competitive advantages.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Snacks Others |

| By End-User | Retail Food Service Institutional Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Direct Sales Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Bulk Packaging Others |

| By Ingredient Type | Wheat Flour Sugar Fats and Oils Additives Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contract Manufacturing for Bread Products | 100 | Production Managers, Quality Assurance Officers |

| Pastry and Snack Manufacturing | 80 | Product Development Managers, Sales Directors |

| Distribution Channels for Bakery Products | 70 | Logistics Coordinators, Retail Buyers |

| Consumer Preferences in Bakery Products | 90 | Market Researchers, Brand Managers |

| Regulatory Compliance in Food Manufacturing | 60 | Compliance Officers, Food Safety Inspectors |

The Vietnam Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing consumer demand for baked goods and the expansion of the food service sector.